Intro: Each month, the Digital Diplomats cut through the clichés about the Silicon Valley and French approach to innovation to bring a clear analysis of a major tech story or trend that reveals the relative strengths and weaknesses of each ecosystem. Our goal is to give entrepreneurs the perspective they need to succeed in both markets.

Marjolaine Catil, an Investment Director at Newfund, a VC firm based in Paris and Silicon Valley. She leads Newfund’s “Road to the USA” initiative for French entrepreneurs considering U.S. expansion.*

Chris O’Brien, a Silicon Valley veteran journalist who is the founder and editor of The French Tech Journal newsletter.

Chris: Y Combinator recently put out a call for more "full-stack AI companies." It feels like a significant shift in the world of AI.

Marjolaine: It's certainly generating attention in the market, and YC's emphasis suggests they see significant potential in this approach. It’s fundamentally different from what we've traditionally seen with AI software startups.

Chris: Okay, but "full-stack AI company," what does that mean?

Marjolaine: YC Partner Jared Friedman explains it like this: A traditional AI company might build a cool AI tool or software and sell it to an existing business, but a full-stack AI company becomes a more productive version of this existing business. Take Operand, for example. They don’t sell to consulting companies; they are building their own consulting company and want to compete directly with traditional firms. Or “kill” them, as they claim. They use AI as the absolute core operational foundation to rethink an entirely new business that owns the whole value chain, or at least aims to.

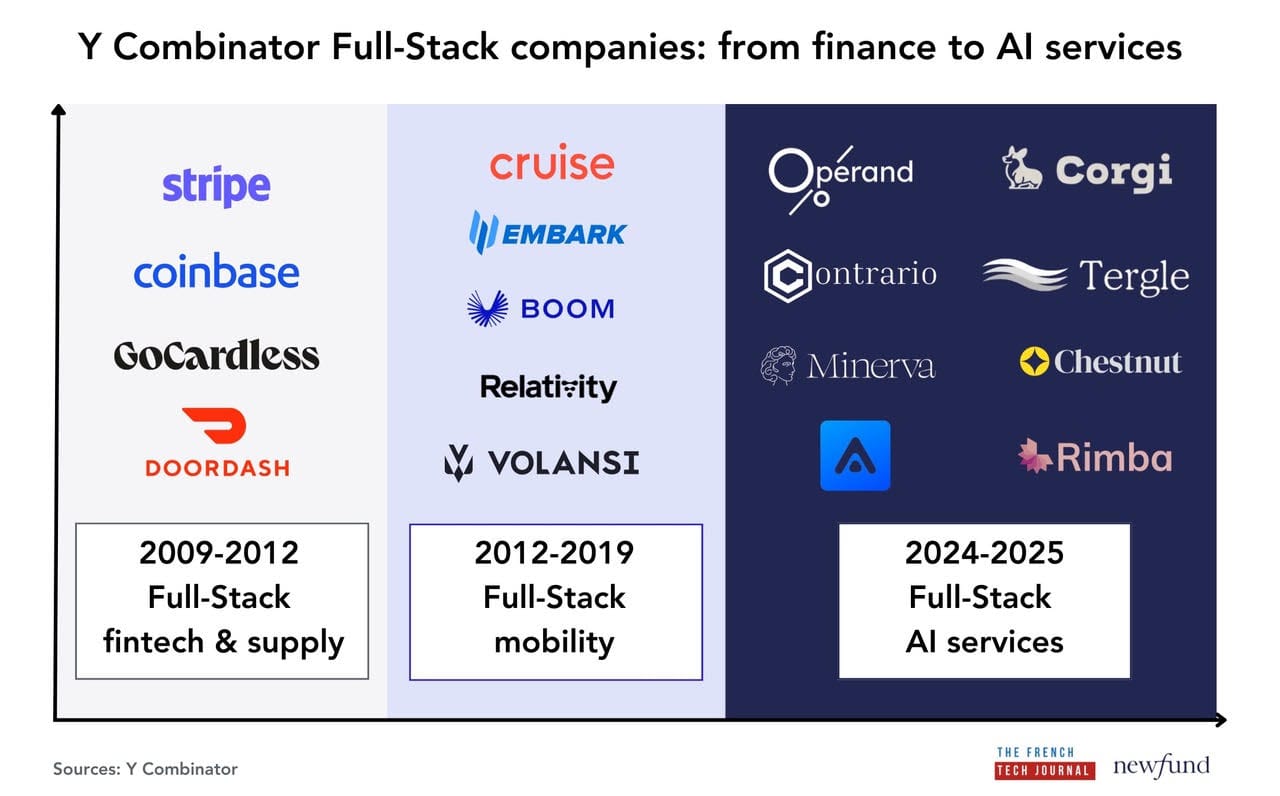

When we analyzed YC's portfolio of over 5,000 companies from the past 15 years, full-stack companies have historically been the exception rather than the rule. We identified only about a dozen true full-stack ventures, primarily fintech startups in the early 2010s, followed by autonomous mobility hardware companies between 2012 and 2019. What's notable is the apparent shift in 2024, with at least 9 startups explicitly positioning themselves as full-stack AI companies across sectors like insurance, consulting, HR services, accounting, mortgage lending, and healthcare. These are all industries characterized by high labor costs and significant manual processes. This represents a marked departure from YC's traditional software-first approach and suggests they're betting that AI has reached a maturity level that makes these capital-intensive, operationally complex models viable at scale.

Chris: I would think that, from an investor perspective, a truly full-stack AI company offers compelling economics. These companies can potentially achieve much better margins and iterate faster than selling tools to incumbents. And because they own the full stack, they capture the entire value created by their AI, instead of just getting licensing fees. It would create a structural advantage, especially in industries where the established players are slow to adopt new tech.

Marjolaine: Exactly. We can understand YC's enthusiasm for this model. Instead of selling a $50,000 annual software license, you're potentially capturing millions in industry revenue per customer. The total addressable market isn't just the software budget; it's the entire industry. Once you've built the regulatory moats, operational expertise, and customer relationships, which is easier said than done, you've created something incredibly hard to replicate.

New Paradigm Thanks To AI Workforce?

Chris: So, full-stack AI companies are not just making the existing players more efficient; they're trying to replace them. Like, mastering the whole customer experience, end-to-end, but powered by AI, which could create a huge market, as you suggested. Estimates vary, but the full-stack AI market is already valued in the tens of billions, around $26.8 billion or $32.4 billion this year. And projections for growth are massive, potentially reaching over $175 billion by 2030 or over $200 billion by 2033. But are they really reinventing the wheel?

Marjolaine: The concept of full-stack isn't completely new. We saw it with companies like Tesla, Stripe, or DoorDash 10 years ago. But there is, of course, a downside. While the model presents compelling economics on paper, it also carries significantly higher execution risk than traditional SaaS approaches. These older full-stack models required a huge number of employees and massive capital investment to manage so much complexity. Doordash hired 19,000 employees and spent $2b of capital before generating positive net income in 2024. Stripe raised $11b and hired 12,000 people before also reporting profitability in 2024. Only a few founders and funds risked themselves in sectors with massive human and operational entry barriers.

Chris: That distinction makes sense because the economics weren’t there. But neither was the tech. Justin Kan started a hybrid legal software and law firm called Atrium back in 2017 and raised more than $75 million. But ultimately, he shut it down a few years later because it couldn’t operate more efficiently than a traditional law firm. Now, YC is saying that maybe AI wasn't ready then, but it is now.

Marjolaine: AI has brought a new level of productivity that's fundamentally changing the economics. As NFX explains in their analysis "The AI Workforce is Here," we're witnessing a fusion of labor and software markets, where US businesses spend $5 trillion on knowledge workforces versus only $230 billion on B2B SaaS. AI now enables software to both organize AND execute tasks. Service margins (below 30%) are converging toward SaaS margins (above 80%) through AI automation. Take customer service, for example. A human agent costs hundreds of dollars per interaction, while an AI Agent can handle thousands of queries 24/7 for a fraction of the cost, all while offering personalization impossible to achieve manually.

Chris: In the past, you’d need a super-talented technical team to pull this off because a full-stack company would have to master so many operational fields. We discussed previously how AI was enabling new productivity because it can handle so many functions, allowing startups to reach $100M ARR with a few employees. This same dynamic potentially creates a foundation for full-stack AI companies.

Marjolaine: In a sense, yes. It opens more fields and verticals to a potential full-stack solution. At the same time, it creates a different challenge. The replacement of the human workforce by AI requires deep technical integration across data, models, deployment, and user interfaces. You need what people are calling "full-stack AI teams." That means expertise in both deep AI and traditional software development. Mastering that technical complexity, integrating across all layers, and handling things like regulation, security, data privacy, and algorithmic bias are massive undertakings.

Chris: Speaking of regulation, I wonder how that looks different between the US and Europe. In the US, for example, insurance and banking are regulated by the states, but there are also federal rules. I remember that more than two decades ago, it took PayPal years to obtain all the banking licences it needed from each state. It’s the same for insurance, with state licensing boards. Those are long and costly administrative hurdles that AI can’t magically fix. Plus, depending on the services, the companies have to maintain certain assets as guarantees. And that doesn’t even get into different data rules in places like California or evolving AI regulations.

Marjolaine: That's an important point, particularly for any company looking to operate internationally. Europe has moved forward with the AI Act, a comprehensive, risk-based framework. The US approach is less centralized at the federal level, relying more on existing agency rules and court cases. For full-stack companies, especially in regulated industries, compliance isn't just an add-on; it has to be baked into the core of their operations from day one. They need strong regulatory expertise to navigate these different requirements depending on where they build or expand.

Full Stack Companies: Build or Buy?

Chris: I’m somewhat skeptical about the number of users or professions that are ready to embrace a fully AI solution. In France, even when it comes to SaaS or cloud computing, a lot of traditional enterprise software companies still dominate because customers want to deal with a human, at least to some degree, at the end of the day.

Marjolaine: Absolutely, and it’s not just France. In many businesses, you still need to overcome barriers that AI can't eliminate: regulatory capital requirements for banks or insurance companies, professional certifications, and compliance frameworks. These create substantial moats but also high entry costs. We’ve been talking about full-stack companies being built from the ground up. But there is another way to pursue this. YC is looking for AI native full stack companies, but I think most of the value from AI will come from “AI-transformed full-stack companies.” These are traditional companies that are rethinking their way of operating and still benefiting from their knowledge and long-term distribution with their customers.

Chris: Maybe, but as you know. It’s incredibly difficult for traditional companies to lead on digital transformation, no matter how big or small. How would you imagine this happening?

Marjolaine: I think there is an opportunity for technical leaders or AI entrepreneurs to design their concept and then take over traditional companies in that sector. So, they would effectively rethink the full-stack business model and then expand. It is not an easy journey as you need both an understanding of more local and traditional businesses, and at the same time, the ability to transform them. But there will be a growing market because there will be plenty of these small firms to acquire in the coming years as the Baby Boomers retire. In France, one out of four owners of small and medium businesses will be over the age of 60 by 2033. Bpifrance estimates that one out of two SMEs will need to find a buyer by 2033.

Chris: Bringing it back to France, what should French entrepreneurs building AI companies be thinking about based on this trend?

Marjolaine: For French founders, this represents both a massive opportunity and a strategic crossroads. Every business, not just startups, needs to integrate AI productivity or risk being disrupted by massive American competition.

If you want to build a full-stack AI company from scratch, you should consider going to the US, where the market size and risk appetite can support that ambition. But there's another compelling option for Europe: instead of creating new AI products that may be disrupted by the mega US players, consider acquiring traditional full-stack companies and transforming them with AI.

The core of technological evolution today isn't only about finding new business ideas, but understanding how to rethink existing value chains with technological tools. Local companies have great assets: data, customer relationships, and technological infrastructure. AI combined with startup methodologies can amplify the productivity leverage.

However, this transformation requires bold leaders with a tech mindset and financial partners who understand both the technological risks and the potential of AI-driven business model transformation. Newfund is already involved in these transformation projects, because we're ready to take the technological risks that traditional financing often won't support.

Chris: This is another example of how AI could fundamentally rewire how entire industries operate. But it will take a new breed of entrepreneurs and investors who have the vision and execution capability to pull it off.