🤔 Edito 🤔

France’s private equity and venture capital markets are showing staying power in 2025, even as global investors tread carefully amid inflationary pressures and geopolitical jitters.

According to France Invest and Grant Thornton’s latest Activity Study for the First Half of 2025, the country’s investment ecosystem remains robust, if more discerning.

A Market Holding Its Nerve

The numbers tell a story of calm amid uncertainty. In the first half of 2025, €14.7 billion was invested across 1,476 companies and infrastructure projects, a modest 5% dip from the same period last year. Fundraising, too, remained sturdy at €17.4 billion, only 6% below the 2023–2024 average. The message is that investors aren’t fleeing France; they’re just becoming choosier about where their euros go.

Sophie Paturle, President of France Invest, said in the report that despite “an uncertain environment,” private equity continues to “finance thousands of French companies, contributing to innovation, job creation and the energy transition.” The country’s private markets, she warned, must nonetheless stay alert to concentration risks because capital is increasingly flowing into fewer hands and larger vehicles.

Tech Feels the Chill—Not the Freeze

For the tech ecosystem, the mood is more nuanced.

The Etude d’Activité report shows that while the digital sector remains the second-largest destination for private equity money—behind industrial goods and services—venture and growth funds are facing tougher conditions. Fundraising in these segments fell sharply, with the number of venture funds dropping to its lowest level since 2020. This is something we noted last week based on new Pitchbook data.

Yet, the latest report hints that there is resilience beneath the surface. Growth capital, though hit by longer closing times and heightened scrutiny, still attracted a few large funds that accounted for 70% of all capital raised in the segment. Tech investors, it seems, have shifted from a “growth at all costs” mindset to a more value-driven approach, prioritizing proven scalability and profitability over raw innovation.

On the deployment side, €10.1 billion was invested across 1,365 companies. Within that, the numérique (digital) and santé (healthcare) sectors held steady, confirming their long-term structural importance to the French economy. Even as ticket sizes above €100 million declined by nearly 20%, mid-cap deals (between €5 million and €100 million) maintained their momentum, accounting for the lion’s share of transactions.

Public Capital Steps Up, Global Capital Leans In

Public-sector commitments nearly doubled year-on-year, signaling the French government’s ongoing effort to prop up domestic innovation and infrastructure. Meanwhile, 35% of funds raised came from abroad, underscoring France’s continued attractiveness despite a slower global cycle.

Internationally, French funds are also flexing their muscles. About a third of total investment value in the first half of 2025 was deployed outside France—a sharp increase from 2024—showing that French capital is increasingly venturing beyond its borders.

Overall, the report described a climate of disciplined optimism. The country’s private equity industry isn’t booming like the post-COVID rebound years, but neither is it retreating.

Perplexity's Comet transforms the way you browse. Download Comet now and get a free month of Perplexity Pro included. That's $20 of value to experience AI-powered browsing with advanced features.

🏆 Key Highlights

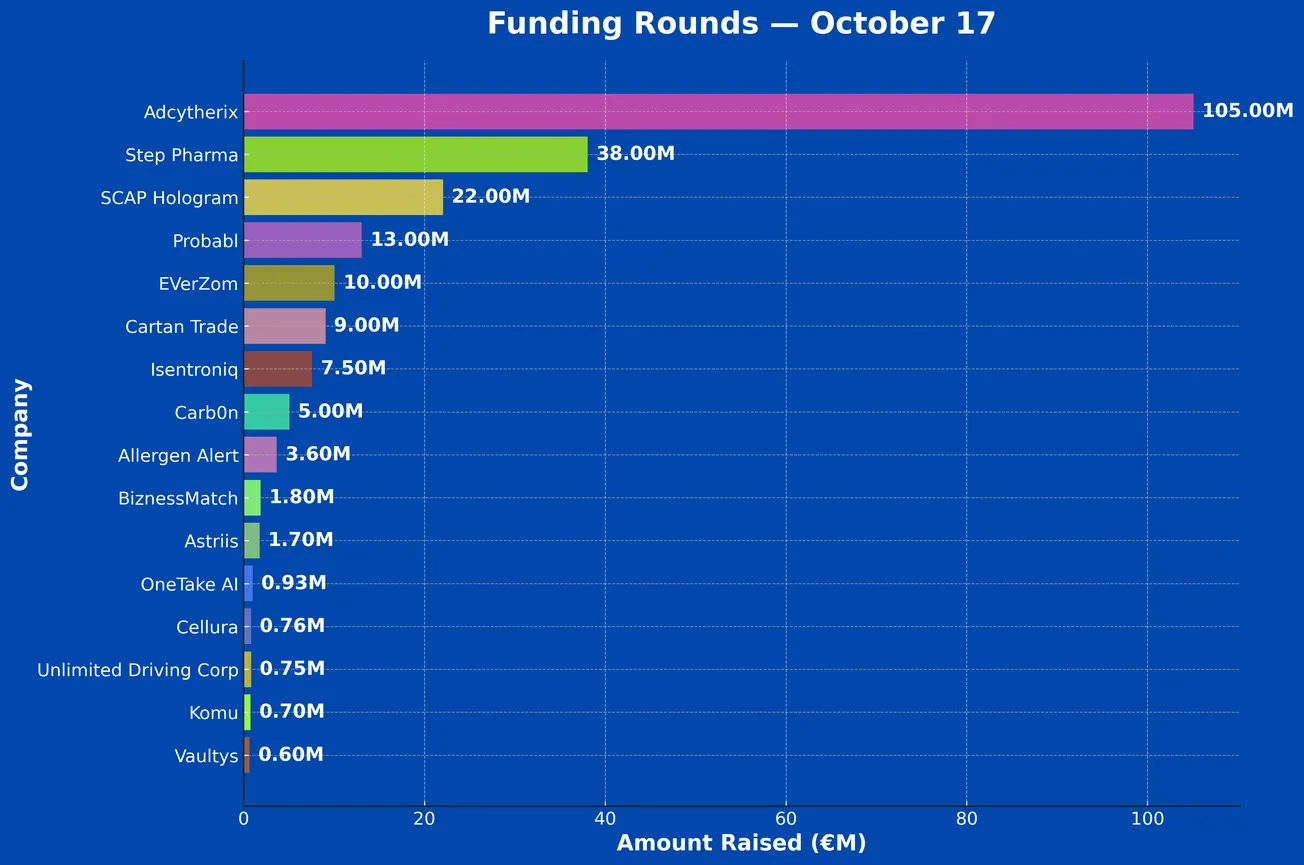

Biggest Round:

- Adcytherix (€105M) — Europe’s largest Series A in the antibody-drug conjugate (ADC) space in 2025.

- Followed by Step Pharma (€38M) and SCAP Hologram (€22M).

Total Raised: ~€225.3M across 16 companies

Average Deal Size: ~€14M

🧬 Sector Diversity

1. Biotech & Life Sciences (6 companies)

- Adcytherix (€105M) – Antibody-drug conjugates for cancer.

- Step Pharma (€38M) – Selective cancer therapies targeting CTPS1.

- EVerZom (€10M) – Exosome-based regenerative medicine therapies.

- Allergen Alert (€3.6M) – Rapid allergen detection for consumers and professionals.

- Cellura (€0.76M) – Bioreactors for cultured cells (healthcare & food).

- SCAP Hologram (€22M) – Digital surgery and medical navigation systems.

📈 Total Biotech / Medtech funding: ~€179.4M (≈80%)

🧭 France consolidates its position as a European biotech powerhouse, with Marseille, Paris, and Strasbourg emerging as leading biotech hubs.

2. Deeptech & Industrial Innovation (3 companies)

- Isentroniq (€7.5M) – Cryogenic cabling for quantum computing scalability.

- Unlimited Driving Corp (€0.75M) – Mixed-reality teleoperated racing technology.

- Astriis (€1.7M) – Predictive maintenance AI based on vibration analysis.

⚙️ Total Deeptech / Industrial: ~€9.95M (≈4%)

🔬 Highlights France’s strong pipeline in quantum hardware and industrial AI diagnostics.

3. Fintech & Insurtech (2 companies)

- Cartan Trade (€9M) – Trade credit insurance platform backed by Scor, Intact, and Bpifrance.

- BiznessMatch (€1.8M) – Phygital networking and B2B connection platform for SMBs.

💶 Total Fin/Insurtech: ~€10.8M (≈5%)

4. Climate & Sustainability Tech (2 companies)

- Carb0n (€5M) – Real estate carbon monitoring & compliance platform.

- Komu (€0.7M) – Community engagement SaaS for sustainable e-commerce brands.

🌍 Total Climate / GreenTech: ~€5.7M (≈3%)

♻️ Carbon management and sustainable retail remain active verticals for EU climate investors.

5. AI & Software (2 companies)

- Probabl (€13M) – Industrializing open-source machine learning (scikit-learn operator).

- OneTake AI (€0.93M) – Conversational AI for video editing.

🤖 Total AI / Software: ~€13.93M (≈6%)

🇪🇺 Probabl cements France’s reputation as a global hub for open-source AI and sovereign data science.

6. Cybersecurity (1 company)

- Vaultys (€0.6M) – Sovereign identity and post-quantum cryptography startup.

🛡️ Total Cybersecurity: ~€0.6M (≈0.3%)

What's the $17.3B Deel?

In a tech landscape where European founders still often migrate to Silicon Valley, Alex Bouaziz represents a particularly French brand of entrepreneurial success.

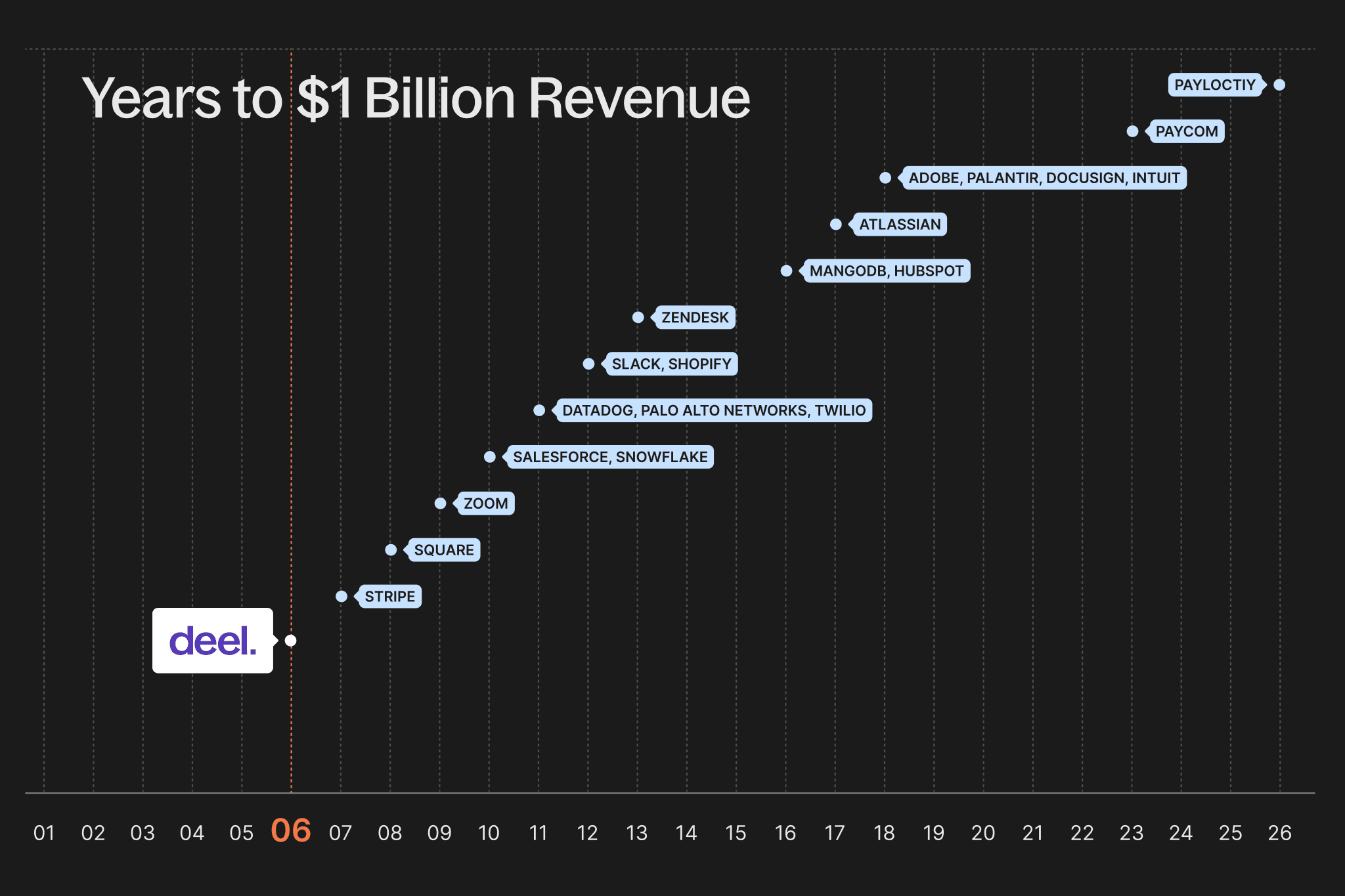

The co-founder of HR tech giant Deel has just raised a $300 million Series E funding round, catapulting the San Francisco-based company to a staggering $17.3 billion valuation, a 44% jump from its last capital raise in 2022.

While Deel's headquarters may sit firmly in California's tech capital, Bouaziz has kept his ties to France and remains one of the brightest stars in the French tech constellation. The entrepreneur, who co-founded Deel with Shuo Wang in 2019, has built what's becoming the dominant force in global payroll and HR solutions.

"We've been profitable for three years and surpassed $1 billion in annualized revenue in the first quarter," Bouaziz told Les Echos, noting the company generates between 15-17% EBITDA margins. According to sources, the founders still retain an impressive 25-30% stake in their creation, a rarity in the dilution-heavy world of Silicon Valley unicorns.

The funding round, led by new investor Ribbit Capital alongside longtime partners Andreessen Horowitz and Coatue Management, comes at a pivotal moment for the company. Processing $22 billion in payroll annually across 150 countries, Deel has positioned itself as the solution to a fundamentally broken system.

"The payroll and HR market is often single-country focused," Bouaziz explained, highlighting Deel's differentiating factor. From day one, the company built a truly global infrastructure, now employing 7,000 people across 120 countries. This global-first approach has attracted major French clients, including Air France-KLM, Alan, and Spendesk, though Bouaziz diplomatically declines to specify France's exact contribution to Deel's revenues beyond calling it "an important market that's close to my heart."

The new capital will fuel an aggressive acquisition strategy, with $500 million allocated for M&A over the next three years. Having already completed 13 acquisitions, including recent purchases of German SIRH startup Zavvy and South African payroll company PaySpace (for over $100 million according to TechCrunch), Bouaziz characterized Deel as "aggressive" but "opportunistic" in its approach.

Not everything is smooth sailing. The company faces ongoing litigation with its main rival, Rippling, valued at $16.8 billion after its own $450 million raise this year. The legal drama includes allegations of corporate espionage worthy of a Netflix series, with claims that a Rippling employee acted as a spy for Deel—charges the company refuses to comment on.

Still, these challenges haven't slowed Deel's momentum. The company hit a milestone in $100 million revenue per month in September and is rapidly expanding its AI capabilities, launching dedicated AI agents for HR needs, including recruitment, payroll, and compliance.

With Europe contributing roughly 30% of revenues and the US accounting for half, Deel has its sights on serving 100 million employees worldwide and achieving native payroll processing in over 100 countries by 2029.

"We’ve come a long way - but in many ways, it still feels like day one," the company wrote in a blog post announcing the funding. "Every milestone, every new customer, and every country we enter reminds us how much there’s left to build. We’ll keep listening, and building products that help our customers work smarter, faster, and more seamlessly across borders."

Meanwhile, closer to the homefront...

🔥🔥🔥🔥

📇 Company: Adcytherix

🔍 Description: Marseille-based biopharmaceutical company developing next-generation antibody-drug conjugates (ADCs) using novel payload classes to overcome resistance and expand the reach of ADC therapies to poorly responsive tumors. Its lead candidate, ADCX-020, targets high unmet need diseases such as cancer.

💻 Website: https://www.adcytherix.com/

📍 HQ City: Marseille, France

🧗 Round: Series A

💰 Amount Raised: €105M

🏦 Investors: Andera Partners (lead, via BioDiscovery 7), Angelini Ventures, Bpifrance (Large Venture & InnoBio), Kurma Partners, Surveyor Capital (Citadel), aMoon, Pontifax, Dawn Biopharma (KKR), Pureos Bioventures, RA Capital

👨💼👩💼 Founders: Jack Elands (CEO, ex-Emergence Therapeutics), Xavier Preville, Carsten Dehning, and Pontifax Venture Capital

🗞️ News: The largest ADC-focused Series A in Europe in 2025 will accelerate the clinical development of Adcytherix’s lead candidate ADCX-020, with IND and CTA filings expected by the end of 2025. The company will also expand its pipeline of proprietary ADCs by leveraging novel payloads. This round highlights growing investor momentum in Europe’s bioconjugate and targeted oncology sectors, alongside recent raises from Tubulis (€308M, Munich) and Ciloa (€6.5M, Montpellier). | EU-Startups

📇 Company: Step Pharma

🔍 Description: French biotech developing next-generation targeted therapies that selectively destroy cancer cells while sparing healthy ones. Its lead programs focus on inhibiting CTPS1, a key enzyme required for DNA synthesis in cancer cells, with promising results across hematologic cancers, solid tumors, and autoimmune diseases.

💻 Website: https://www.step-ph.com

📍 HQ City: Saint-Genis-Pouilly (Ain, France)

🧗 Round: Series C

💰 Amount Raised: €38M

🏦 Investors: V-Bio Ventures (lead), Kurma Partners, Pontifax, Bpifrance, Hadean Ventures, Sunstone Life Sciences Ventures, Inserm Transfert Initiative

👨💼👩💼 Founders: Prof. Alain Fischer and Dr. Sylvain Latour; company co-founded by Kurma Partners, Institut Imagine, and Sygnature Discovery

🗞️ News: Funds will expand Step Pharma’s clinical data, complete ongoing Phase 1 trials, and advance into Phase 2 for its CTPS1 inhibitor programs targeting cancer and autoimmune diseases. | Maddyness

📇 Company: Probabl

🔍 Description: French AI startup spun out from Inria and official operator of scikit-learn — the world’s most-used open-source machine learning library (2.5B+ downloads). Probabl develops industrial-grade, sovereign, and transparent data science solutions to help enterprises move from fragmented, artisanal ML practices to scalable, traceable, and responsible AI operations.

💻 Website: https://probabl.ai

📍 HQ City: Paris / Saclay / Sophia Antipolis / Berlin

🧗 Round: Seed

💰 Amount Raised: €13M (total funding €18.5M)

🏦 Investors: Serena, Capital Fund Management (CFM), Mozilla Ventures, French Tech Souveraineté (Bpifrance – France 2030)

👨💼👩💼 Founders: Yann Lechelle (CEO, ex-Scaleway), Gaël Varoquaux (Scientific Advisor, Inria), and 12 co-founders from the scikit-learn community

🗞️ News: Largest commercial open-source software (COSS) seed round in Europe to date. The funding will accelerate Probabl’s mission to industrialize open-source AI, expand internationally, and build enterprise-grade tools around scikit-learn. The company positions itself as Europe’s flagship for sovereign, open, and transparent AI — championing the philosophy that “open always wins.” | Maddyness, La Tribune, FrenchWeb

📇 Company: SCAP Hologram

🔍 Description: Medtech building disruptive real-time navigation for shoulder surgery (shoulder arthroplasty), removing barriers to intraoperative guidance adoption. Core platform integrates technologies from MinMaxMedical to deliver precise, minimally invasive surgical navigation.

💻 Website: LinkedIn

📍 HQ City: Saint-Martin-d’Hères (Grenoble area), France

🧗 Round: Undisclosed (since-inception financing; milestone-based commitments)

💰 Amount Raised: €22M raised to date (up to €30M upon milestones)

🏦 Investors: Founders Stéphane Lavallée (via Fullstim) & Delphine Henry; Haventure; MinMaxMedical; eCential Robotics; Surosh (private investor group); undisclosed strategic investor. Additional financing: Bpifrance; Caisse d’Épargne Rhône-Alpes Auvergne; BNP Paribas.

👨💼👩💼 Founders: Stéphane Lavallée (Co-founder), Delphine Henry (Co-founder & CEO)

🗞️ News: Funding accelerates tech and regulatory development of SCAP Hologram’s shoulder surgery navigation platform, deepens partnership with MinMaxMedical, and highlights Grenoble’s Digital Surgery & Robotics ecosystem (ECCAMI). | LinkedIn

Want to reach an audience of more than 30,000 readers each month? The French Tech Journal is the leading English-language media platform covering France's dynamic tech ecosystem. With 31,000 + engaged readers across key global markets and consistently high engagement rates, our sponsorships provide unparalleled access to decision-makers in French tech.

📇 Company: EVerZom

🔍 Description: French biotechnology company pioneering exosome-based biotherapies for regenerative medicine and inflammatory diseases. EVerZom is developing first-in-class therapeutics leveraging mesenchymal stem cell-derived exosomes, combined with biomaterials, to treat complex diseases with high unmet medical need.

💻 Website: https://everzom.com

📍 HQ City: Strasbourg

🧗 Round: Growth Round (Series A extension)

💰 Amount Raised: €10 million

🏦 Investors: Capital Grand Est, European Innovation Council (EIC) Fund, Sorbonne Venture by Audacia, Aloe Private Equity, Paris Business Angels, Capital Cell, and several family offices

👨💼👩💼 Founders: Jeanne Volatron (CEO, ex-Sorbonne Université), Adrien Mebarki (CTO)

🗞️ News: The funding will finance the first clinical trial of EVerGel™ in 2026—an exosome-based therapy targeting complex perianal fistulas in Crohn’s disease—and expand EVerZom’s exosome biomanufacturing platform to new indications in hepatology and dermatology. The company also secured a €3M France 2030 grant to industrialize its GMP exosome production technology up to 50L scale, marking a key step toward clinical and commercial readiness. | Benzinga

📇 Company: Cartan Trade

🔍 Description: French insurtech specializing in trade credit insurance, offering tailored risk management solutions that protect businesses against customer defaults. The company provides flexible, tech-driven coverage adapted to SMEs and large corporations, combining underwriting expertise with digital underwriting tools.

💻 Website: https://www.cartantrade.com

📍 HQ City: Paris, France

🧗 Round: Growth / Capital reorganization

💰 Amount Raised: €9 million

🏦 Investors: Scor (via SV One SAS), Intact Financial Corporation, Bpifrance (Large Venture)

👨💼👩💼 Founders: Sébastien Guidoni, CEO

🗞️ News: Cartan Trade raised €9 million and restructured its shareholding, marking a new strategic phase with Scor and Intact as cornerstone investors. Bpifrance joined the round via its Large Venture fund. The funding will fuel technological innovation and international expansion into the UK, Benelux, Italy, Spain, and Northern Europe. The company targets 30% growth in premiums in 2025, reaching €40 million, supported by 400 active contracts and €12 billion in coverage.| PR

📇 Company: Isentroniq

🔍 Description: French deeptech startup developing ultra-low-heat, high-density cryogenic cabling systems designed to dramatically improve the scalability of superconducting quantum computers. Its technology aims to reduce cryogenic needs by a factor of 1,000, removing one of the final barriers to building viable quantum machines.

💻 Website: https://www.isentroniq.com

📍 HQ City: Paris-Saclay, France

🧗 Round: Seed

💰 Amount Raised: €7.5M

🏦 Investors: Heartcore (lead), Ovni Capital, iXcore, Kima Ventures, Better Angle

👨💼 Founders: Paul Magnard (PhD in Physics, ex-Alice & Bob) and Théodore Amar, a former Bain & Company consultant and ex-head of marketing at Hilti.

🗞️ News: The funding will enable Isentroniq to advance the development of its cryogenic cabling technology and conduct its first in-situ tests in 2026. Positioned as a “pickaxe seller” in the quantum gold rush, the startup operates on a fabless model and targets clients including superconducting quantum leaders such as Google, IBM, Amazon, Rigetti, IQM, and Alice & Bob. | EE Times

📇 Company: Carb0n

🔍 Description: French climate-tech startup helping decarbonize commercial real estate by assessing and optimizing buildings’ carbon trajectories. Carb0n provides digital solutions enabling landlords and tenants to monitor, forecast, and reduce energy consumption in compliance with national energy efficiency regulations.

💻 Website: https://carbon.green/

📍 HQ City: Paris, France

🧗 Round: Seed

💰 Amount Raised: €5 million

🏦 Investors: Batipart Europe

👨💼👩💼 Founders: Hadrien Flon, Stanislas de Gabrielli

🗞️ News: Carb0n raised €5 million from Batipart Europe to accelerate the deployment of its carbon management platform for commercial real estate. The funding supports the company’s mission to help building owners and operators comply with France’s strict energy reduction targets (−40% by 2030) and the 2027 mandate for smart building automation (GTB).

📇 Company: Allergen Alert

🔍 Description: French deeptech startup developing a portable, rapid, and reliable device for detecting food allergens and gluten in just minutes — designed for individuals with allergies and professionals in the food industry. The solution leverages licensed bioMérieux diagnostic technology miniaturized for real-time allergen testing via a smartphone-connected instrument.

💻 Website: https://www.allergen-alert.com

📍 HQ City: Lyon, France

🧗 Round: Seed

💰 Amount Raised: €3.6M

🏦 Investors: Demeter (via the Fonds d’Amorçage Industriel Métropolitain – FAIM Lyon/Saint-Étienne), bioMérieux, Bpifrance, and private banks

👨💼👩💼 Founders: Bénédicte Astier (Founder & CEO; former Quality Manager at bioMérieux).

🗞️ News: The funding will accelerate industrialization, technical development, and pre-sales of Allergen Alert’s handheld allergen detection device. Born from bioMérieux’s InVENTURE intrapreneurship program, the startup converts diagnostic lab tech into a consumer health solution, addressing a growing public health challenge that affects 6% of Europeans and 9% of North Americans. The company aims to expand its device to detect the nine most common allergens within three years.

📇 Company: BiznessMatch

🔍 Description: French 'phygital' networking startup reinventing professional matchmaking for SMB leaders. BiznessMatch connects entrepreneurs directly through an AI-powered platform and a network of international business clubs—offering an alternative to LinkedIn by matching companies based on needs, competencies, and location rather than profiles or SEO visibility. The platform enables instant RFPs and quotations, complemented by physical meetings that strengthen real business relationships.

💻 Website: https://biznessmatch.com

📍 HQ City: Paris

🧗 Round: Seed

💰 Amount Raised: €1.8M

🏦 Investors: Undisclosed (private investors)

👨💼👩💼 Founders: Dimitri Pontif (Founder & CEO, ex-professional athlete and real estate entrepreneur)

🗞️ News: The funds will fuel AI development (natural language processing, multilingual translation, and data scraping optimization) and support international expansion with new BiznessMatch clubs planned in La Rochelle, Bordeaux, Nantes, Toulouse, the U.S., and China. The company positions itself as a “business-first” alternative to LinkedIn, blending digital efficiency with real-world connections. | Maddyness

📇 Company: Astriis

🔍 Description: French industrial deeptech startup developing predictive maintenance software that uses vibration analysis and AI to anticipate mechanical failures up to 18 months in advance. Its technology, built on 30 years of CNRS research, analyzes the vibrational “signature” of rotating machines (wind turbines, hydraulic turbines, etc.) to detect anomalies and prevent costly breakdowns.

💻 Website: https://www.astriis.com

📍 HQ City: Chambéry, France

🧗 Round: Seed

💰 Amount Raised: €1.7M (€700K equity + €1M loans)

🏦 Investors: Crédit Agricole, Grenoble Angels, Investessor, Samba (Savoie Mont Blanc), Amba (Arts et Métiers Business Angels), BNP Paribas, Bpifrance

👨💼👩💼 Founder: Nicolas Saubin (President & Founder)

🗞️ News: The funding will support Astriis’s commercial expansion, including three new hires. Its AI-driven platform, protected by nine patents, is already used by TotalEnergies and EDF, and is expanding internationally in wind, hydro, and industrial sectors. | Les Echos

📇 Company: OneTake AI

🔍 Description: French AI startup building a conversational video editing platform that allows users to edit, enhance, and professionalize videos simply by speaking in natural language. Its agentic AI automates cuts, removes silences, generates subtitles, and formats content for social platforms—offering entrepreneurs and creators a fast, intuitive way to produce professional-grade videos.

💻 Website: https://onetake.ai

📍 HQ City: Paris

🧗 Round: Seed

💰 Amount Raised: $1M

🏦 Investors: 33 entrepreneur-users (community-led round, avg. ticket $30K)

👨💼👩💼 Founders: Sébastien Night (CEO, Centrale Nantes engineer; founder of Le Mouvement des Entrepreneurs Libres), Vladimir Rill (Co-founder)

🗞️ News: Funds will support the launch of OneTake 7, a breakthrough version integrating natural language understanding for conversational AI video editing, multi-format publishing, and patent filings. The round highlights OneTake AI’s strong community-driven model, with investors drawn from its own power users.

📇 Company: Cellura (formerly SoftCell Therapeutics)

🔍 Description: French deeptech startup developing SoftXS, the world’s first “geo-inspired” bioreactor designed for the large-scale production of fragile living cells used in healthcare, regenerative medicine, and cultured food. By replicating Earth-like rotational motion, Cellura’s bioreactor enables gentle, high-yield cell growth without mechanical stress, significantly lowering costs and expanding industrial applications.

💻 Website: http://www.cellura.io/

📍 HQ City: Marseille, France

🧗 Round: Pre-seed

💰 Amount Raised: €760,000

🏦 Investors: Seed for Good, Thierry Letartre (family office, founder of Laboratoires Anios), Angels’Bay Invest

👨💼👩💼 Founders:

🗞️ News: Cellura, supported by Marseille Innovation, raised €760K to accelerate the development and industrialization of SoftXS, a next-generation bioreactor enabling mass production of delicate cells for health and food applications. The funding will be used to finalize prototypes and prepare for pilot-scale deployment.

📇 Company: Unlimited Driving Corporation (UDC)

🔍 Description: Marseille-based deeptech startup creating a hybrid experience between real-world racing and e-sport. UDC’s flagship product, The Ring, combines physical race circuits, teleoperated electric cars, and immersive driving simulators to deliver a new form of mixed-reality racing. The technology leverages haptic feedback and ultra-low latency teleoperation — innovations that can extend beyond gaming to applications in logistics, urban mobility, and defense.

💻 Website:

📍 HQ City: Marseille, France

🧗 Round: Seed

💰 Amount Raised: €750,000

🏦 Investors: Multiple business angel groups and investment funds (undisclosed); previous support from Bpifrance (Deeptech label), École des Mines de Saint-Étienne, and CNRS

👨💼👩💼 Founders: Thibault Satto, Yusuke Tomita Huuskonen

🗞️ News: UDC raised €750K in seed funding to protect its teleoperation IP and commercialize The Ring, its hybrid racing and e-sport experience. After two years of R&D and €250K in self-financing and public support, the startup now aims to deploy its turnkey kits (simulators, cars, and circuits) with arcade operators and karting venues. UDC targets €1M in revenue by 2026 and plans to open its own The Ring venue and expand internationally through franchises by 2027. | Journal des Enterprises

📇 Company: Vaultys

🔍 Description: French cybersecurity startup specializing in sovereign digital identity and post-quantum cryptography. Vaultys develops a decentralized, peer-to-peer suite of identity and access management (IAM) solutions — including VaultysID, SmartLink, and Console Shadow IT — designed to ensure full data sovereignty and protection against AI- and quantum-enabled cyber threats.

💻 Website: https://vaultys.com

📍 HQ City: Strasbourg, France

🧗 Round: Seed

💰 Amount Raised: €600,000

🏦 Investors: Alsace Business Angels (ABA), private investors (including Marie-Hélène Fagard / Fagard Associates), and Bpifrance

👨💼👩💼 Founders: Jean Williamson, François-Xavier Thoorens

🗞️ News: Vaultys closed its first fundraising round of €600,000 to accelerate the deployment of its sovereign IAM suite and announced a strategic partnership with the CEA-List institute for the development of decentralized cryptographic technologies. The company aims to bring military-grade security to enterprises and public institutions, ensuring full independence from foreign infrastructures.

📇 Company: Komu (ex-Contestio)

🔍 Description: French SaaS startup reimagining customer engagement in e-commerce through community building. Komu enables brands to transform their customers into engaged communities via interactive spaces, challenges, and co-creation features embedded directly in online stores. Its AI-powered platform boosts loyalty, basket size, and customer lifetime value.

💻 Website: https://www.komu.eu/

📍 HQ City: Paris, France

🧗 Round: Pre-seed

💰 Amount Raised: €700,000

🏦 Investors: Undisclosed

👨💼👩💼 Founders: Killian Olivier, Rémi Labatut

🗞️ News: Komu, incubated at HEC Paris, raised €700K to accelerate growth and expand its AI-powered community platform for e-commerce. Integrated with Shopify and Magento, Komu helps brands double purchase frequency, increase basket size by 30%, and boost lifetime value by 150%. The company aims to become Europe’s standard community layer for online retail. | LinkedIn