The French Tech Journal provides analysis of France’s digital ecosystem as well as in-depth interviews with French entrepreneurs and VCs. If you like what you read, please forward the newsletter to friends or share it with your social networks.

🔥If you’d like to support independent and original reporting on the French Tech ecosystem, consider a paid subscription. That subscription gets you a code for a free session with me on Superpeer to answer all your questions about journalism and startups. Or, whatever else is on your mind. Free subscribers can request a code for a 50% discount.🔥

Send tips, comments, questions, and your ideas to our global headquarters: chris@frenchtechjournal.com.

Europe Euphoria

During a two-day summit last week, President Emmanuel Macron sought to take advantage of France's Presidency of the Council of the European Union to announce a series of proposals to help startups scale. At the same time, other European players barfed out a series of proposals to boost European stock exchanges, chip production, and digital currency.

Basically, it was a tidal wave of proposals that leaves Europe drowning in new startup programs.

Looking at this litany of plans, one might think that the European ecosystem is a patient on life support and in dire need of emergency intervention to save its life. When in reality, European startups are on fire, having minted a unicorn per week in 2021 and starting off 2022 with a rush.

While each proposal comes with its own complexities (and even possible merits!), there is a common theme here: sovereignty.

Political leaders are happy the European ecosystem has made so much progress, but they don't seem to like the way it has achieved that progress. For years, European leaders begged U.S. investors to come to their shores and give money to their startups.

The good news is that they seemed to have listened. The bad news is, well, they seemed to have listened.

Startups are now indeed raising big late-stage rounds that are primarily being led by U.S. funds. Alas, they are also still looking at IPOs on U.S. stock exchanges, and they are spending some chunk of their funding on services from cloud giants such as Amazon, Google, and Microsoft.

For the arguments on cloud and sovereignty, it's worth reading Tariq Krim, who worries the French government and enterprises could be spending 30% to 40% on U.S. cloud services, making U.S. tech giants the real beneficiaries of all this startup funding. And worse, France's digital future and culture will be subsumed by American values.

The broader underlying issue, however, is this: Are France and Europe not fully reaping the benefits of the startup explosion? Are the infrastructure spending, investment profits, and tax upside all flowing elsewhere? And if so, does that mean the true beneficiaries are just a handful of domestic entrepreneurs and venture capitalists (who have been benefiting from state and E.U. funding over the past decade)?

I've seen passionate debates on all sides of these issues. What I haven't seen is reliable data that would really allow me to decide exactly where I come down on this.

A few thoughts, though:

The financial support for startups over the past decade has made perfect sense to me. French and European ecosystems don't have access to the huge state employee pension funds that fuel so much U.S. venture capital. So the state playing the role of venture capital catalyst has always seemed like a smart strategy. I think the success of that plan is self-evident.

But, that doesn't mean that it's time to double down, either. A few years ago, founders knew they eventually had to move to the U.S. if they wanted to raise late-stage capital and go public. Based on what we have seen the past 2 years, those funds are now clearly coming to Europe, with a vengeance. Companies like Sorare and Ledger are expanding internationally while keeping their headquarters in Paris.

And yet, the Scale-Up plan wants to create 10 tech companies that are worth €100 billion or more by 2030. And to do that, it wants to create 10 to 20 venture capital funds that have at least €1 billion to invest. In an interview with TechCrunch, French Digital Minister Cedric O said Europe only has 2 such funds now: Eurazeo and EQT.

I'm pretty sure Atomico is one as well as is Index Ventures and Balderton Capital. And then there are global VCs like Accel who have a strong European presence. Yes, they are based in London, but it seems a bit arbitrary to leave them out just because of Brexit.

Still, I'm not quibbling about the larger point. Yes, the U.S. has more and bigger funds. Minister O and the Macron government want Europe to close that gap. Macron took a stab at addressing late-stage funding in France 3 years ago by bringing together private insurance companies and public investors under the Tibi initiative.

Now he wants to bring this campaign across Europe. Already, 18 European countries have signed pledges to participate in some fashion. As Minister O told TechCrunch:

“In order to structure a strong European ecosystem, financing is key. We still want to attract investments from the whole world. But we also want to enable European venture capital with European funds, European knowledge and European teams...

“We think we’re at a tipping point in Europe. And part of the question is: Who is going to take advantage of that shift? Will it be American companies or European companies? We want to do everything we can so that it’s European companies."

There are a couple of shortcomings to this strategy. First, it's likely too little, too late. The investors who are really transforming late-stage investment are private equity and hedge funds. These are funds that have assets under management approaching $100 billion. They can write a €500 million check to a late-stage startup and it's basically a rounding error on their balance sheet. A few European funds with €1 billion funds would basically be cuddly little co-investors to them. I mean, €1 billion is the size of a late-stage round at this point.

Second, founders raising these big rounds are looking for partners outside of Europe who can help them scale internationally. There are some great European-focused businesses being built (Doctolib, Malt), but many more are geared toward international expansion. Having investors who know the U.S. market especially is critical, no matter the size of the check.

And finally, I'm not convinced that the location of the funds is going to fundamentally alter where these companies decide to go public. Minister O is hoping that more European funds will keep more European startups in Europe so they will go public here. With more of the funding and investments and profits in Europe, hopefully, that will create more resources for supporting big IPOs. Or so the thinking goes.

Euronext, which operates many of the major European stock exchanges, announced its own set of initiatives to boost the visibility of tech IPOs while also putting in place more liquidity structures to support their public offerings. The company brags that across these exchanges that it has "763 listed Tech companies, representing an aggregated market capitalization of €1.8 trillion."

FYI, Apple has a market cap of $2.7 trillion. So, that is a mighty big hole to climb out of.

To be sure, obstacles for European startups remain. There are a few fundamental problems that startups face when it comes to scaling up in Europe. First, while the old continent managed to remove any physical barriers for goods and services, Europe ironically remains a house divided when it comes to digital and financial stuff.

Any entrepreneur who has tried to scale across the market will tell you horror stories about opening branches in other countries and trying to navigate the different administrative, financial, and labor rules. That startups do so is a testament to entrepreneurial tenacity rather than any reforms instituted by governments.

Some of the secondary Scale-Up programs, like creating a talent portal for comparing national tech visas, and launching an EIC Scale Up 100 of companies that could get special administrative help could make a difference at the margins.

But while there may be a lot of good intentions here, it also feels a bit like someone re-arranging the deck chairs (though not on the Titanic!). Or at the very least, fighting yesterday's battles. Unifying financial rules, particularly around compensation, and work rules across borders might have a far greater impact than the name on the check.

Unfortunately, at a time when European integration feels fragile, convincing countries to harmonize even more of their rules might be impossible.

Facebook Freakout

Never underestimate people's ability to lose their minds over nothing. Exhibit A: Meta, the company formerly known as Facebook before it engaged in a nauseating rebranding exercise, filed its annual report with the U.S. Securities and Exchange Commission. Such documents require standard disclosures of risks, and in this case, MetaBook wrote that the company may "be unable to offer a number of our most significant products and services, including Facebook and Instagram, in Europe” due to privacy and data rules.

The entire journo-blogosphere then churned out alarmist stories saying OMG FACEBOOK THREATENS TO LEAVE EUROPE. In the face of this non-threat threat, politicians naturally felt compelled to respond with some Euro-snark.

J’entends que #Facebook pourrait retirer ses services de l’Union européenne à cause des règles de protection des données 🇪🇺.

— Cédric O (@cedric_o) February 8, 2022

Et alors ? pic.twitter.com/SsBk9Y9LpX

Of course, Facebook tried to explain that it was simply making a standard risk disclosure related to negotiations over data transfer negotiations. In a blog post, Meta Europe public policy VP Markus Reinisch wrote:

"Meta is not wanting or 'threatening' to leave Europe and any reporting that implies we do is simply not true. Much like 70 other EU and US companies, we are identifying a business risk resulting from uncertainty around international data transfers."

This was portrayed as Meta "backing down from its threats" or "walking them back." The fact that no real threats were ever made was beside the point. Meta had not properly apologized for something it hadn't done, and left just enough wriggle room in its response to allow one to imagine that it just might do a thing which it really had no intention of ever doing. (With usage slipping, there is ZERO chance MetaFace pulls the plug on Europe. Ever.)

And that, kiddos, is how journalism works in 2022.

Non-Fungible Fungi

In a corner of France where prized mushrooms are dubbed “black diamonds,” one truffle hunter hoped that an unusual NFT auction will help him turn a surprising gastronomic discovery into a publicity bonanza for the Dordogne region.

Bernard Planche, who lives in Sarlat of the Dordogne region, has been a “trufficulteur” (truffle grower) for more than 30 years. Between December and March each year, the Dordogne Valley in the Southwest of France comes alive with special markets dedicated to the delicacy. Gourmands come from around the globe to dig through the soil in search of this gastronomic delight.

Recently, with truffle hunting season in full swing Planche dug up a "tuber melanosporum" that weighed 2.78 pounds (1.265kg).

Bernard Planche holds his prized truffle.

Courtesy of Bernard PlancheHe showed off this discovery at the Sarlat market on February 5 where its authenticity was confirmed. But beyond enjoying the accolades of the locals, he saw an opportunity to use the unusually large truffle to shine a light on his beloved region and profession.

So mixing tradition with one of the most buzz-worthy technologies, Planche decided to auction off the virtual rights to the truffle using a “non-fungible token” or NFT.

An NFT is kind of a digital certificate that works on blockchain networks to provide a unique identifier for virtual objects. Over the past year, NFTs have exploded into the public view as artists have used them to sell the digital rights to their works for millions of dollars. In France, NFT startup Sorare raised a $680 million round of venture capital last September for its platform that uses the technology to enable fantasy sports leagues.

In the case of Planche, he partnered with Venture Makers, a consultancy studio that focuses on so-called “web 3.0”, which includes things like NFTs, blockchain, cryptocurrencies, and other decentralized technologies.

The auction was held on the NFT bidding platform OpenSea. Participants can bid in regular currency or cryptocurrency.

The winning bid: 3.41 WETH ($10,650.36).

The certificate of authenticity for Planche's truffle.

Courtesy of Bernard PlancheIn addition to the digital rights for the truffle, the winning bidder will be invited to Planche’s estate in Saint-Cirq-Madelon near Périgord. They will get to participate in a truffle hunt with the assistance of truffle-sniffing dogs and pics. And then they will experience a special meal prepared at the end of the day.

Seed Of The Week: JOIN

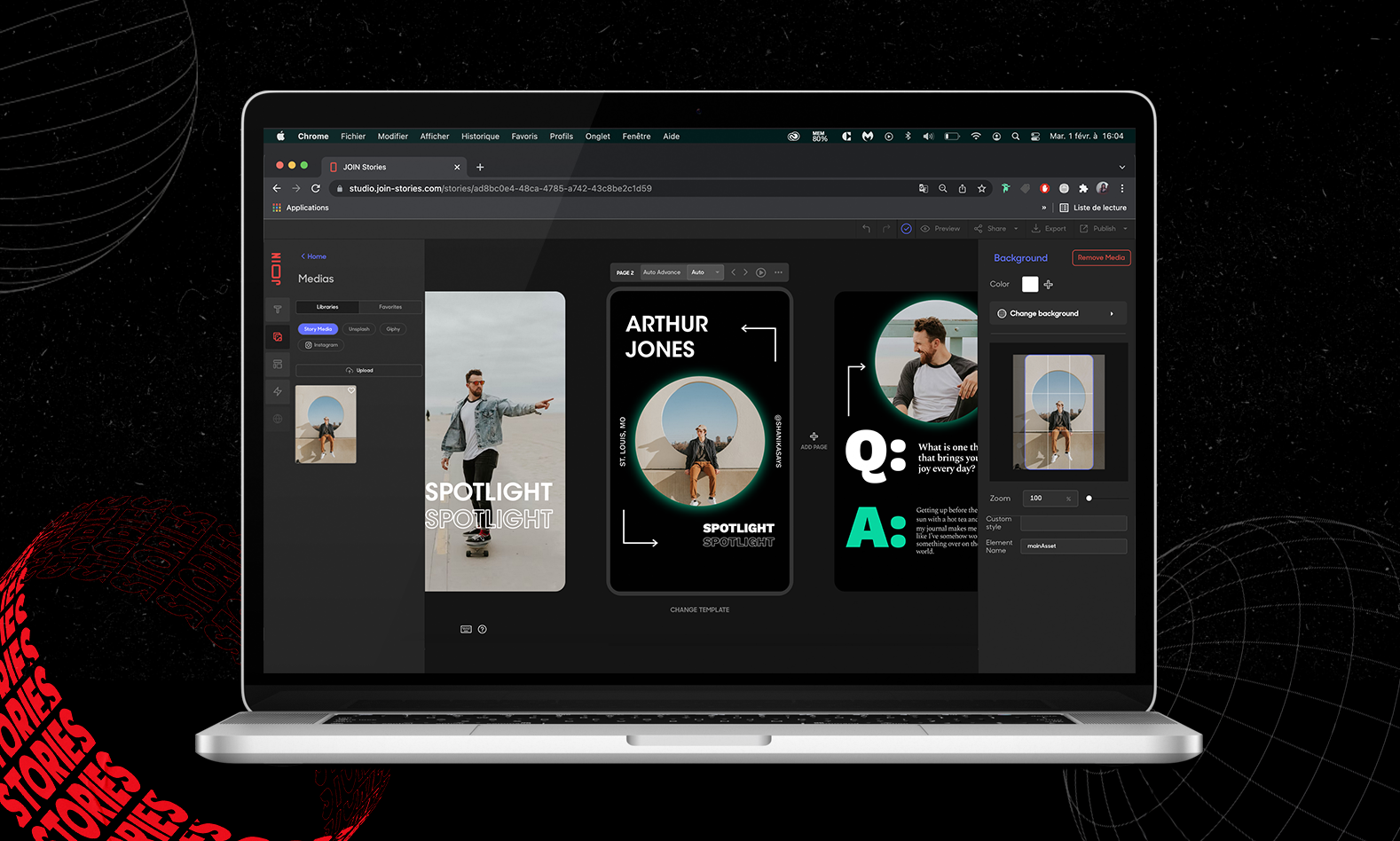

What: JOIN has developed software to help brands and content creators produce stories that can be published across all channels, from websites to social media platforms to e-mail. The idea is to facilitate content that will help build engagement by automating parts of the production process while optimizing it for different viewing experiences. JOIN's platform uses templates to facilitate the creative flow and then adapts each story for the particular platform.

Why: Creating engaging content has become essential for brands as they seek to attract interest from customers. It's critical to be present on all of these channels because that's increasingly how users search, discover, and shop. According to JOIN, 100,000 "web stories" are published every day. But the proliferation of different platforms, including social and mobile, has made the production process timely and expensive. And tracking the results and engagement can be difficult and time-consuming.

Who: Co-founders Jonathan Szwarc and Nicolas Goudemant.

Seed Round: €4.5 million

Investors: XAnge (Alban Oudin), Seedcamp, multiple business angels including Station F's Roxanne Varza and founders of Voodoo, Zenly, Jellysmack, Bergamotte, Prestashop, and AB Tasty.

Next: JOIN will use the money to continue product development while also expanding sales and marketing. While the company already has clients in the U.S., Brazil, and Switzerland, it is planning to enter new markets in the coming year. The company is also hiring.

👋🏻 If you’re enjoying The French Tech Journal, support the project by forwarding it to friends and sharing it on your social networks. You can also comment on this post. And if you have ideas for stories, tips, or just want to harass me, send me an email: chris@frenchtechjournal.com. 👋🏻