👋 Welcome to our weekly recap of the big news + funding in the French tech ecosystem this week.

In this week's French Tech Wire,

☀️ Spotlight Interview: Marie Brayer, the Paris-based Partner at Fly Ventures, discusses the Berlin-based fund's approach to funding "hard tech," the closing of its new fund, and the innovation trends she's watching.

👀 Deep dive: Alice & Bob Secures €100M to Crack the Quantum Code 🧑💻The Parisian quantum powerhouse is taking on Google and IBM with its game-changing cat qubit technology. CEO Théau Peronnin tells us that with this fresh funding and record-breaking breakthroughs, the company aims to be the first to deliver a fault-tolerant quantum computer.

Subscribe to The French Tech Journal to access all the articles and archives.

Chris O'Brien + Helen O'Reilly-Durand

🚀 Tech Talk 🚀

🥩🥓🥦 A major legal victory has been secured for the plant-based food industry in France, as the Council of State officially annulled decrees and a 2020 law banning the use of meat-related names like "vegetable ham" or "plant-based bacon." The court ruled that these restrictions were contrary to European law and could never be enforced. France's traditional agricultural industry had pushed for the restrictions to protect beef and poultry producers. This marks the end of a long legal battle, primarily led by La Vie, HappyVore, and ACCRO, who had fought against what they saw as an unfair and lobby-driven attempt to hinder plant-based alternatives. La Vie CEO Nicolas Schweitzer hailed the decision as a victory for common sense, arguing that the ban unfairly targeted French producers while allowing foreign companies to use the same terms: "We have just written the end of a legal saga that will go down in history. This victory is that of common sense in the face of pressure from intensive farming lobbies. We are delighted to be able to continue to call our products by their names, without compromise or absurdity!" To celebrate, plant-based brands have launched a humorous campaign challenging the Académie Française to officially recognize plant-based alternatives in the dictionary. Bonne chance!

🐛 Once upon a time, it seemed like France was going to be the Kingdom Of Insect-Based Protein startups. Alas, those ambitions are crashing hard. French startup Ÿnsect, known for its innovative insect farming techniques, filed for bankruptcy protection last year. Now, Les Echos reports that the bankruptcy administrator overseeing the file has launched a desperate call for buyers by February 17. Otherwise, Ÿnsect is on track to run out of cash to make any payments by the end of March. Meanwhile, Agronutris, another French insect protein company, has placed its holding entity, EAP Group, into safeguarding proceedings. This decision aims to stabilize finances and negotiate debts, ensuring the continuation of its research and development activities. Notably, this measure does not affect Agronutris's industrial operations. | Les Echos

🚲 Angell, the French startup specializing in connected electric bikes and founded in 2018 by Marc Simoncini, announced its closure due to persistent manufacturing issues. These problems led to a recall of 5,000 bikes in November 2024 because of defective frames that could cause accidents. Facing refund costs estimated at €13 million, the company was forced to declare bankruptcy. Despite partnerships with major players such as the SEB Group, which assembled the bikes at its factory in Is-sur-Tille, and a €20 million fundraising round in September 2023 with investors like CMA CGM, Angell could not overcome these obstacles. As a result, Simoncini announced his intention to take legal action against the SEB Group and the engineering firm KickMaker, holding them responsible for the manufacturing defects. The SEB Group has denied these allegations, stating that it fulfilled its contractual obligations. | Maddyness, Maddyness.com, Les Echos, Les Echos

🩺 Ah, but don't despair, for not all the news is gloomy. French insurtech unicorn Alan reported impressive financial results for 2024, achieving €505 million in annual recurring revenue—a 48% increase from the previous year. The company also reduced its losses to €54 million, down from €59 million in 2023, and now covers 700,000 members across 32,000 businesses and 20,000 self-employed individuals. Alan attributes its success to the integration of AI across operations, enhancing productivity and efficiency. Looking ahead, the company aims for 40% revenue growth in 2025, targeting €700 million, and plans to reach profitability by 2026. | Sifted, Maddyness

Other headlines

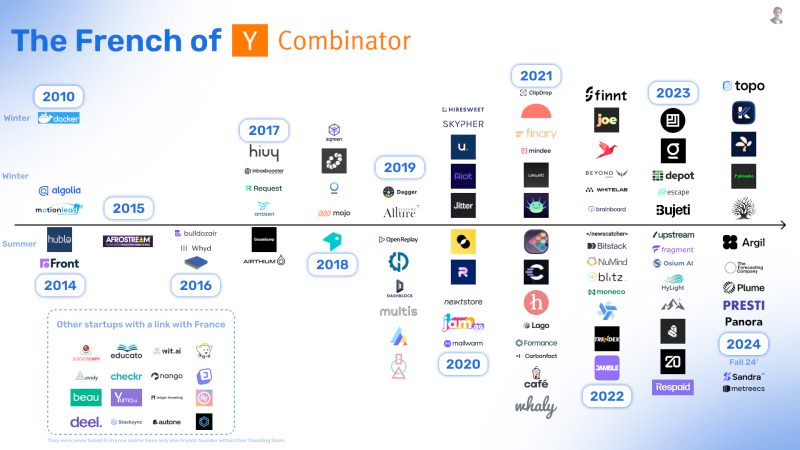

🗞️ The Frenchies of Y Combinator | Erwan Gardelle and Louis Durance analyzed the 91 French startups that have gone through the famed US-based accelerator. | Read the breakdown here

Spotlight Interview:

Fly Ventures' Marie Brayer

Fly Ventures' Marie Brayer

In December 2024, Berlin-based Fly Ventures announced the closing of its third fund at €80 million, marking another milestone for the firm that has established itself as a key early-stage investor in Europe's deep tech ecosystem. The oversubscribed fund demonstrates growing confidence in Fly's thesis of backing technical founders solving complex problems, particularly in artificial intelligence, industrial tech, and developer tools.

With offices in Berlin, London, Paris, and Zurich, Fly operates through an equal partnership model led by Matt Wichrowski, Marie Brayer, Fredrik Bergenlid, and Gabriel Matuschka. The firm typically invests €1-4 million in rounds of €2-8 million at the inception stage, often engaging with founders 6-9 months before they officially start their companies. Its top four investment markets are the UK, US, Germany, and France. The French portfolio includes GitGuardian and Thynk.

I talked recently with Brayer, the Paris-based Partner at Fly Ventures, to discuss the firm's investment strategy and her views on the European tech ecosystem. The conversation has been edited for length and clarity.

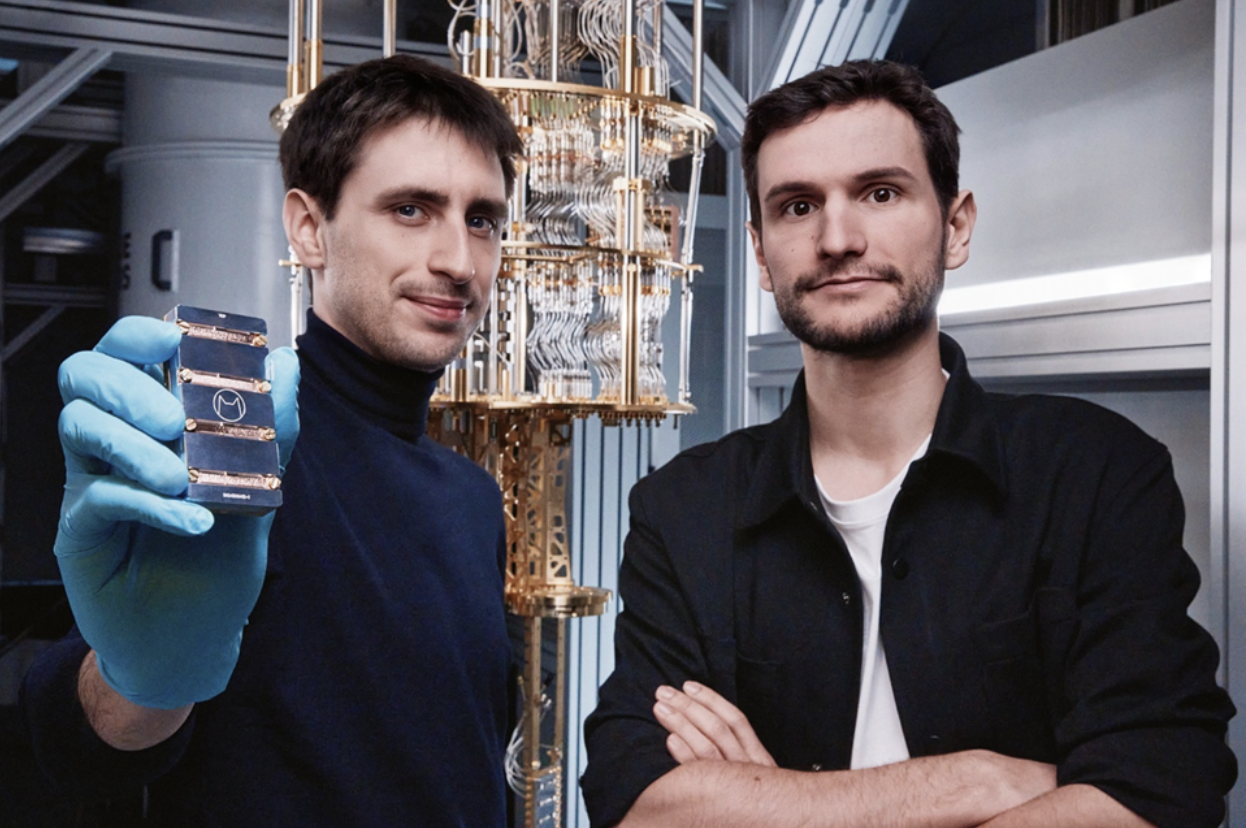

Deep Dive: Alice & Bob Secures €100M Series B to Build the World’s First Fault-Tolerant Quantum Computer

It’s been a few years since I last caught up with Alice & Bob, the Paris-based startup pushing the boundaries of quantum computing. Back in 2022, the circa-40-person team had just raised a €27M Series A, giving them the means to move from academic labs to their own research and development center in the south of Paris.

Fast forward to 2025, and Alice & Bob has just closed a game-changing €100M Series B, led by Future French Champions (FFC), AVP (AXA Venture Partners), and Bpifrance, to supercharge progress toward what the entire quantum world has been waiting for: the first useful, fault-tolerant quantum computer.

Quantum computers have the potential to revolutionize industries by solving complex problems exponentially faster than today’s best supercomputers. However, building a fully functional quantum machine has been an uphill battle, largely due to persistent computational errors.

Alice & Bob, known for pioneering error-reducing “cat qubits,” has quickly gone from a promising newcomer to a serious contender on the global stage. Their technology, which drastically cuts down the number of qubits required to build a reliable quantum machine, has come on in leaps and bounds threatening to leapfrog the competition—even heavyweights like Google and IBM.

Funding

📇 Company: Alice & Bob

🔍 Description: Developer of self-correcting Schrödinger cat qubits to build fault-tolerant quantum computers.

💻 Website: http://alice-bob.com

📍 HQ City: Paris

🧗 Round: Series B

💰 Amount Raised: €100M

🏦 Investors: Elaia Partners; Bpifrance; AXA Venture Partners; European Innovation Council; Supernova Invest; Future French Champions; Breega

👨👩 Founders: Théau Peronnin; Raphaël Lescanne

🗞️ News: Sifted

📇 Company: Swan

🔍 Description: Fintech specializes in embedded banking solutions.

💻 Website: https://www.swan.io/

📍 HQ City: Paris

🧗 Round: Series B

💰 Amount Raised: €42M

🏦 Investors: Accel; Creandum; Eight Roads Ventures; Lakestar; Bpifrance; Hexa Capital

👨👩 Founders: Nicolas Saison; Nicolas Benady; Mathieu Breton

🗞️ News: EU Startups

📇 Company: Naboo

🔍 Description: Platform enabling teams to meet when and where they need.

💻 Website: https://naboo.app

📍 HQ City: Paris

🧗 Round: Series A

💰 Amount Raised: €20M

🏦 Investors: ISAI Ventures; Notion Capital; Ternel

👨👩 Founders: Antoine Servant

🗞️ News: TechCrunch

📇 Company: Formance

🔍 Description: Open-source platform enabling fintechs and marketplaces to build and operate strategic money flows.

💻 Website: https://www.formance.com

📍 HQ City: Paris

🧗 Round: Series A

💰 Amount Raised: €19.09M

🏦 Investors: Hoxton Ventures; Y Combinator; Portage; Axeleo Capital; PayPal Ventures

👨👩 Founders: Anne-Sybille Pradelles; Clément Salaün

🗞️ News: Paypers

👋🏻 If you’re enjoying The French Tech Journal, support the project by forwarding it to friends and sharing it on your social networks. You can also comment on this post. And if you have ideas for stories, tips, or just want to harass us, shoot us an email: chris@frenchtechjournal.com / helen@frenchtechjournal.com 👋🏻