Inside this week's edition:

👀 Refugee women face some of the steepest barriers to employment in Europe, with 81% still jobless five years after arrival. Sistech is changing that by connecting women to tech training, mentorship, and careers to unlock talent that’s reshaping Europe’s digital future.

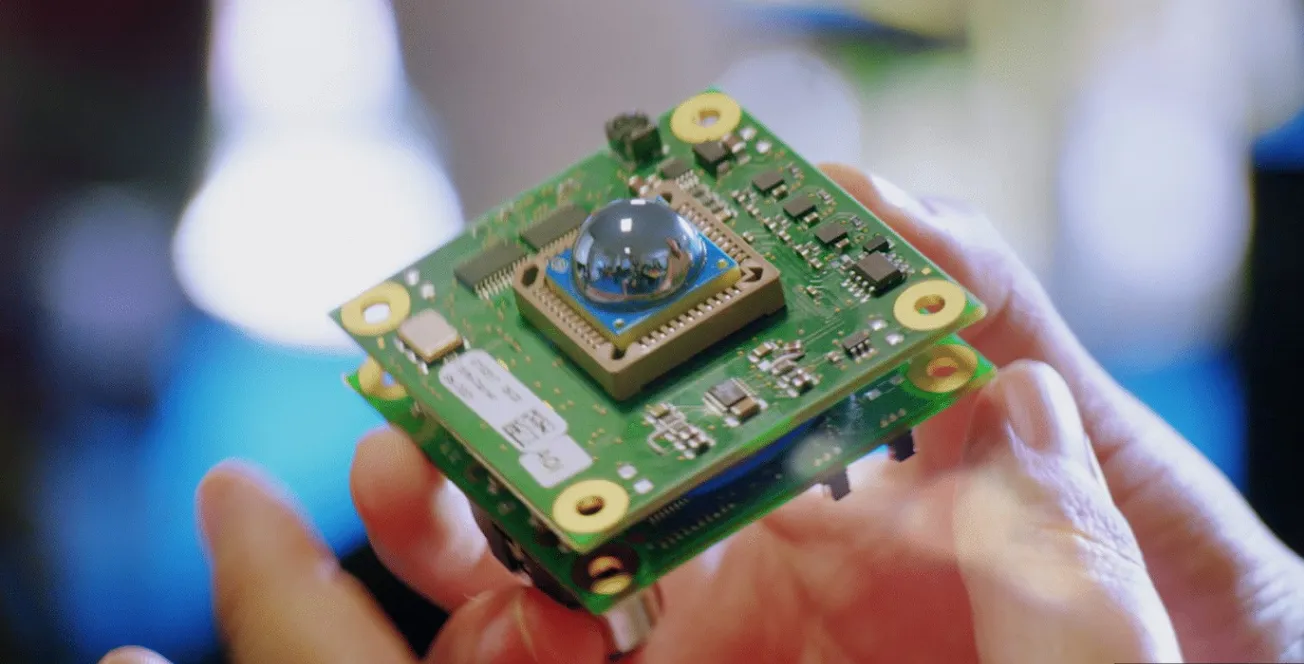

👀 Grenoble-based deeptech startup TiHive just raised €8M to scale its groundbreaking terahertz-AI technology that lets manufacturers see inside products in real time. Starting with diapers, the system replaces outdated sampling with continuous, AI-driven quality control that prevents costly defects and waste. Backed by major investors, TiHive is now eyeing global expansion and new industries from textiles to recycling. Hani Sherry, TiHive's CEO and co-founder, explains how the company got here, and where it's going.

Chris O'Brien + Helen O'Reilly-Durand

Tech Talk

If you didn't close or start raising a fund in France this week, you may have been the only one...

🤑🤖🔋Paris-based VC firm Serena has raised €200 million for its fourth flagship fund, with plans to hit €250 million by 2026. The fund will focus on early-stage startups in applied AI and the energy transition, with investments ranging from €3 million to €15 million. Serena Partners associates Sébastien Le Roy, Olivier Martret, and Paul Moriou are overseeing the fund, along with the firm's co-founders Xavier Lorphelin and Marc Fournier. Serena has already backed four companies through the vehicle, including Formality, an AI-powered contract management platform. With this new fund, Serena aims to invest in up to 20 companies, keeping reserves for follow-ons that could total up to €30 million per top startup. The firm, known for early bets on Dataiku, Malt, The Fork, and Electra, now manages over €1 billion in assets. Partners say the strategy reflects Serena’s belief that AI applications and energy infrastructure will define Europe’s next wave of tech leaders. | Sifted, Maddyness, TechEU

(Reminder: Last week, the European Investment Fund backed Jolt Capital V with €260 million for AI, chips, and cybersecurity. C4 Ventures launched a €100 million fund for European AI sovereignty. And Ventech, the pan-European fund, closed its biggest fund yet at €175 million.)

🚀🌎 Supernova Invest is firing up a new €300M late-stage fund to propel Europe’s most promising deeptech scaleups into global leadership. With tickets of around €15M, the Supernova Tech Scale II fund will back startups in AI, semiconductors, health, climate, and more—filling a crucial financing gap as U.S. and Chinese rivals accelerate. The goal: keep Europe’s deeptech champions scaling at home instead of slipping abroad. | Maddyness

🌱👼 Mathieu Tarnus, founder of digital services group Positive, has launched 404 Ventures, a new seed fund designed to professionalize his already active angel investing across 40 startups. The fund, run operationally by Julien Trucy (formerly of Euratech Ventures), will focus on deeptech, SaaS, and impact, while deliberately steering clear of marketing SaaS to avoid overlap with Tarnus’s own business. The move reflects a broader French Tech trend: entrepreneurs who once dabbled as casual angels are now formalizing their role in venture capital, bringing more structure and ambition to their investments. | Les Echos, FrenchWeb

🏃🇺🇸 Entrepreneurs First (EF), the London-based accelerator known for its “talent-first” model, is pulling out of France and Germany to double down on the US. The company is closing its Paris cohort and relocating its German hacker house to San Francisco, where founders can plug directly into Silicon Valley’s deep-pocketed investors and faster-moving customers. EF cofounder Alice Bentinck says startups landing in the US are hitting six-figure recurring revenues within months, far faster than in Europe. The pivot reflects growing founder demand for American exposure, especially as AI innovation becomes concentrated in the Bay Area. While European operations will scale back, EF plans to send more founders across the Atlantic in 2026 through larger cohorts and a new San Francisco “Bridge” residency for young entrepreneurs. The strategy underscores a broader trend: Europe may produce talent, but scaling still means crossing the ocean. Of course, a couple of years ago, we profiled EF's local chieftain about their ops in Paris. But as they say, times change, people change, hairstyles change. | Sifted, FrenchWeb

🪖✈️ Paris-based defense startup Harmattan AI is seeking a $1bn valuation in its next funding round as it ramps up production of military drones, according to a Sifted exclusive. Backed by FirstMark and Atlantic Labs, the company has already secured major contracts with the French and UK defence ministries and plans to scale manufacturing to 10,000 drones a month by 2026. The push comes amid a surge in European defence tech investment, which hit nearly €1bn in the first half of 2025. | Sifted

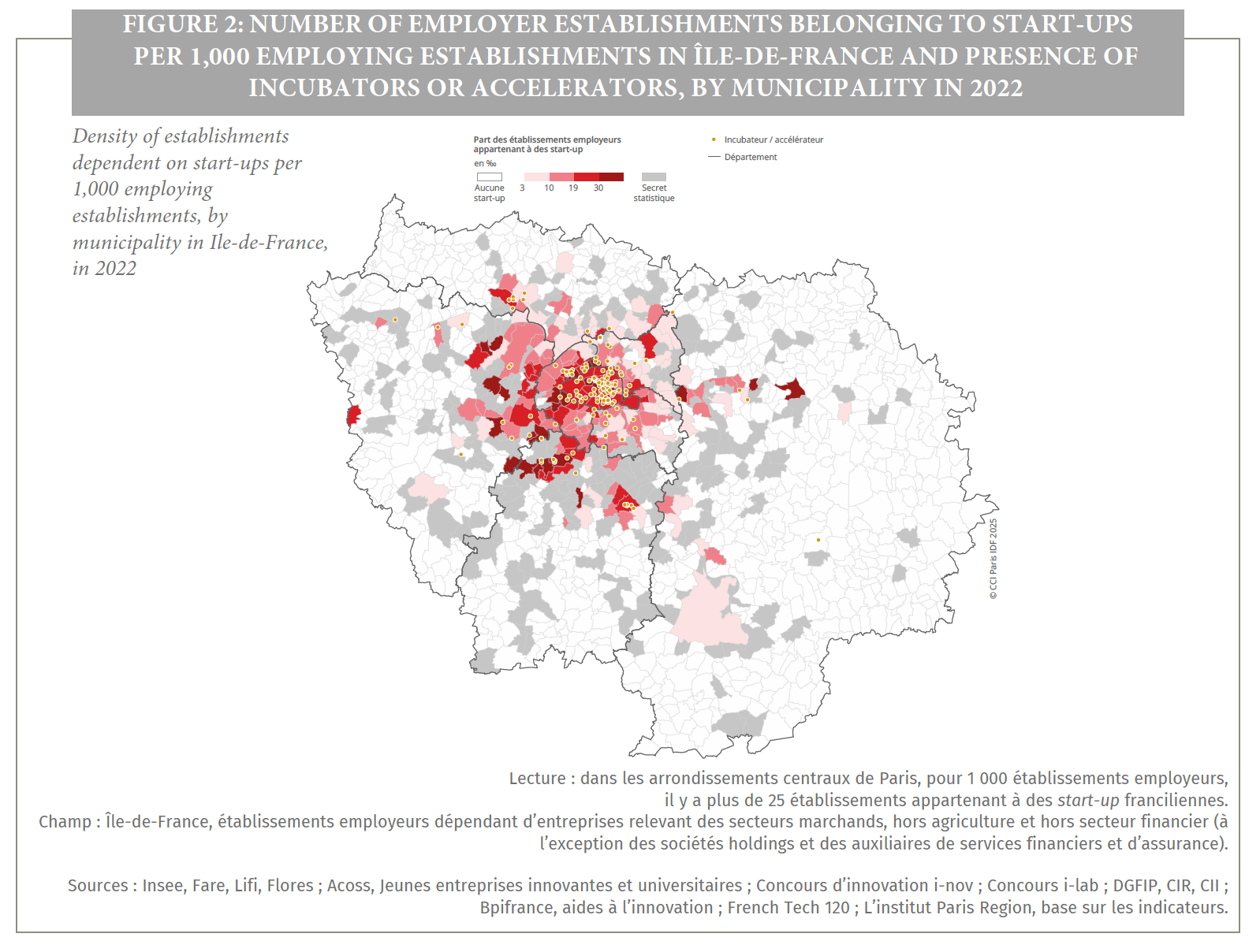

📍 Where the startups are. Île-de-France, the region that is home to Paris, has cemented its status as France’s start-up powerhouse, hosting more than a third of the nation’s young firms, according to a new report by INSEE and Paris Île-de-France Regional Chamber of Commerce and Industry (CCI). In 2022, some 8,790 start-ups were active in the region, with Paris alone home to more than half of them. Tech dominates the landscape: 37% work in information and communication, far above the national average. Financially, Francilian (the nickname for the IDF region) start-ups are thriving — with average revenues of €1.7 million and added value 38% higher than elsewhere in France. They’re also more international, with 18% of their turnover coming from exports. But the picture isn’t all rosy: while “gazelles” post stellar growth, many fund-raising or innovation-heavy ventures remain unprofitable. Still, the Paris region’s mix of talent, capital, and ambition makes it the undisputed heart of French start-up dynamism. | INSEE

🛒 Fresh off a €25 million fundraising round, Paris-based fintech Finary has snapped up Affluent, a young wealth management platform founded by former Qonto executives Thomas Vuchot and Thomas Brach. Affluent’s cutting-edge financial planning tech will be folded into Finary, supercharging its AI-powered investment tools. The move strengthens Finary’s mission to democratize investing and help more than half a million French users take control of their money. As part of the deal, Affluent’s app will shut down, but its best features will live on inside Finary’s fast-growing platform.

Want to reach an audience of more than 30,000 readers each month? The French Tech Journal is the leading English-language media platform covering France's dynamic tech ecosystem. With 31,000 + engaged readers across key global markets and consistently high engagement rates, our sponsorships provide unparalleled access to decision-makers in French tech.

Inside TiHive:

How a French Deeptech Startup Is Revolutionizing Quality Control, One Diaper at a Time

How a French Deeptech Startup Is Revolutionizing Quality Control, One Diaper at a Time

There's an uncomfortable truth about the baby products industry that most parents never consider: the quality control systems ensuring their infant's diaper won't leak are, in many cases, woefully inadequate.

For decades, manufacturers have relied on sampling: pulling a product off the line every few hours, destroying it in a lab, and hoping that a single data point represents the millions of products made in between.

It's this antiquated approach that TiHive, an eight-year-old deeptech startup based in Grenoble, set out to disrupt. After years of development, commercial validation, and measured growth, the company just closed an €8 million funding round from Karista, Wind, and the EIC Fund to accelerate its global expansion.

"Sampling just simply doesn't work. It's really old school," said Hani Sherry, TiHive's CEO and co-founder. What TiHive brings to the table, he explained, is "really 100% quality and process control using a deep tech technology."

From Refugee to Tech Talent:

How Sistech Helps Women Build Careers in Europe’s Digital Economy

How Sistech Helps Women Build Careers in Europe’s Digital Economy

Across borders and cultures, refugee women often face challenges to regain their professional identities. At the same time, technology is rapidly shaping the future of society and yet there is still room to invest further in diversifying this field.

Sistech’s mission is to bridge this divide. Founded in 2017 by Joséphine Goube, Sistech is a European non-profit supporting displaced women through access to professional opportunities in the tech and digital field. Despite the barriers refugee women may face, they bring a variety of skills and ambition to build the future of technology.

The association targets the tech industry because 44% of tech companies state that employee turnover limits growth targets. The focus on refugee women stems from the fact that 81% of refugee women are still unemployed 5 years after arriving in their host country; this statistic is two times more than refugee men.

Since the start of the organization, 71% of Fellows have had a successful outcome. This includes 41% signing full time jobs, internships, or apprenticeships, and 30% entering a complementary tech training.

Sistech offers more than just career training programs. Its goal is systemic change through sisterhood. Sistech comes from “Sisters in Technology.” The organization aims to amplify the voices of displaced women with a pathway to rebuild their careers.

“We don’t just train women for tech jobs, we create a community where they feel seen, supported, and empowered to belong and lead,” said Sistech’s Partnership Officer in France Helay Rahim.

💸 Top Funding Deals 💸

📇 Company: Vibe

🔍 Description: French adtech platform enabling brands to easily launch, target, and optimize streaming TV ads, with AI-powered creative tools and partnerships with 500+ apps and channels (Disney+, Roku, Paramount+).

💻 Website: www.vibe.co

📍 HQ City: Paris

🧗 Round: Series B

💰 Amount Raised: $50M (€42M)

🏦 Investors: Hedosophia (lead), Elaia, Singular, QuantumLight (Nikolay Storonsky, Revolut), Illusian (Supercell founder), other historical investors

👨💼👩💼 Founders: Franck Tetzlaff (ex-Doctolib, Frichti), Arthur Querou (ex-Appinest, MotionLead, Adikteev)

🗞️ News: Funding will fuel U.S. expansion, accelerate AI integration in ad creation and performance optimization, and scale revenues beyond $1B by 2028. Company expects >$100M revenue in 2025 and to be profitable by year-end. | EU-Startups, FrenchWeb, Maddyness, Sifted

📇 Company: Edflex

🔍 Description: SaaS platform for corporate digital training, aggregating and curating learning content from over 10,000 publishers across 300+ topics. Serves 300+ corporate clients and 1.5M users worldwide.

💻 Website: edflex.com

📍 HQ City: Paris

🧗 Round: Series C

💰 Amount Raised: $18M

🏦 Investors: Bpifrance (Digital Venture fund), Educapital, Ternel, Wille Finance

👨💼👩💼 Founders: Clément Meslin, Philippe Riveron, Raphaël Droissart, Rémi Lesaint

🗞️ News: Edflex will use the funding to strengthen its AI-powered smart learning content (conversational features, real-life simulations, personalization, automated skills assessment), expand internationally (new languages, local teams in Europe and North America, structured go-to-market partnerships), and pursue its ambition to become a global leader in corporate learning. | Edflex Blog

📇 Company: RDS

🔍 Description: French medtech company developing MultiSense®, a CE-marked, connected patch for continuous remote patient monitoring in hospitals and at home.

💻 Website: rdsdiag.com

📍 HQ City: Strasbourg, France

🧗 Round: Series A

💰 Amount Raised: €14 million ($16.6M)

🏦 Investors: SPI Fund (Bpifrance, lead), Critical Path Ventures, MACSF, Capital Grand Est, other historical investors

👨💼👩💼 Founders: Elie Lobel (CEO)

🗞️ News: The funds will accelerate industrialization and market launch of MultiSense® in Europe, with plans to expand in France, Germany, and across the EU. RDS will ramp up production in France, strengthen its salesforce, and launch complementary clinical trials to support reimbursement applications. The company also plans to begin FDA registration, targeting a US launch in 2028. Several hundred new jobs are expected to be created by 2035.

👋🏻 If you’re enjoying The French Tech Journal, support the project by forwarding it to friends and sharing it on your social networks. You can also comment on this post. And if you have ideas for stories, tips, or just want to harass us, shoot us an email: [email protected] / [email protected] 👋🏻