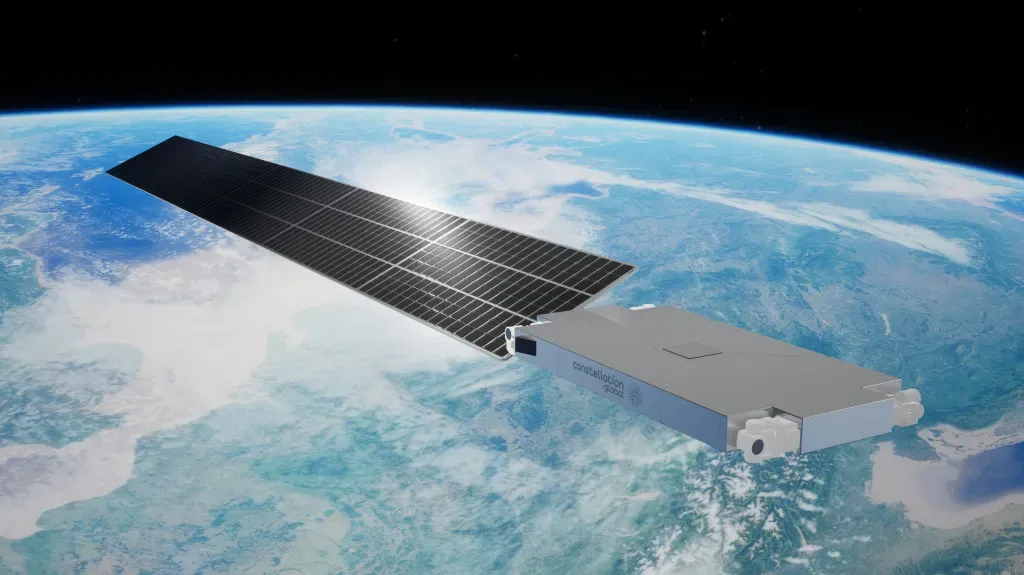

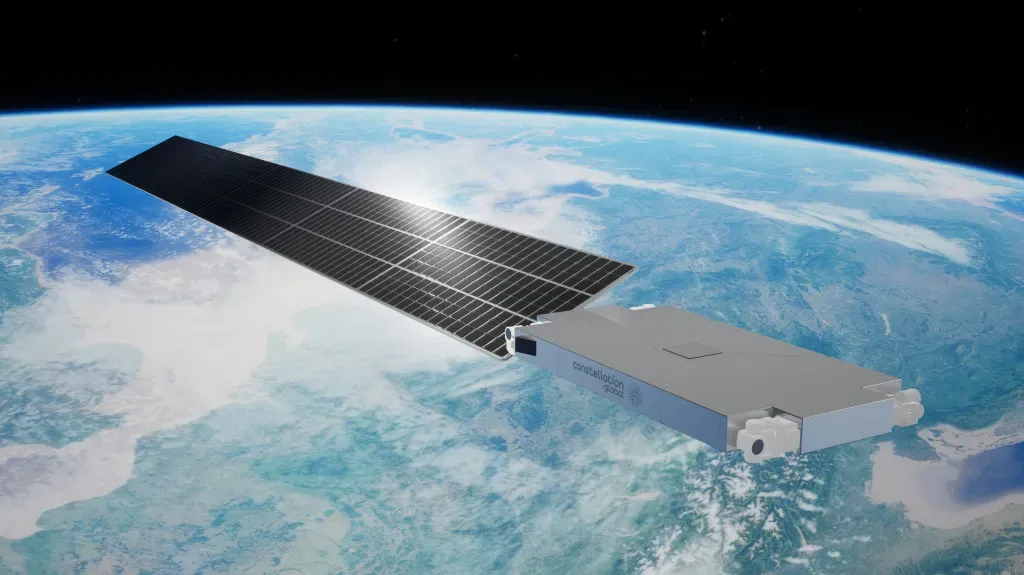

How Constellation Will Challenge Starlink In The Communication Space Race

Constellation Technologies wants to partner with operators to offer space-based internet to help them compete with the SpaceX service.

Constellation Technologies wants to partner with operators to offer space-based internet to help them compete with the SpaceX service.