Follow Us

The news that French GenAI startup LightOn filed to go public caused a sizable buzz. That's not surprising given how rare French tech IPOs are, and the fact that the company operates in the planet's hottest sector.

Last Friday, the company officially began the process of selling stock, confirming that it's set to debut on the Paris Euronext exchange later this month. It hopes to raise between €10.4 million and €13.5 million. Given the magic combination of "GenAI" and "IPO," it's drawing plenty of attention.

All of this hype got me curious, so I dug into the company's 225-page filing to see what it revealed. Certainly, there is nothing scandalous here. That's hardly surprising because the prospectus has been reviewed by France's financial regulatory agency and given the okay.

Still, the filing gives us an unusually detailed view into the 10-year odyssey of LightOn as it evolved from an advanced AI research project to a startup hoping to ride the GenAI wave.

For those who don't want the whole IPO colonoscopy, here's the TL;DR:

- LightOn is the earliest of earliest stage companies despite being founded almost a decade ago. Its prospectus reads more like a startup taking its first baby steps at Station F than a juggernaut barrelling toward the public market.

- For most of its history, the company was a research project developing an optical processing appliance for supercomputers, a line of hardware business it has now abandoned.

- The company has received substantial public support from France and the EU in the form of grants, re-payable advances, and tax credits.

- Its other main benefactor is Huawei, which owns 11.3% of the company.

- LightOn began building LLMs to demonstrate the potential of its optical technology. This led to a bespoke business building LLMs for customers. Almost all revenue for that business came from a single customer.

- LightOn has developed a SaaS subscription platform that it only began to commercialize earlier this year and has been adopted by 4 customers – mostly in a proof-of-concept phase.

Context

The real unicorns in France's tech scene aren't the startups that reach billion-euro valuations. It's the startups that IPO.

Dealroom lists just a handful over the past few years. The rare bright spot was the €1.9Bn IPO by Believe in 2021, which eventually sputtered and resulted in the company being taken private earlier this year. In general, French tech IPOs tend to be teensy weensy by the standards of Silicon Valley.

LightOn falls into this bucket. The company is going public on the Euronext Growth Paris exchange, a market specifically for small and medium-sized enterprises (SMEs) "at earlier stages of development" to list their shares and raise financing. It is an unregulated market, which means companies listed there don't face the same disclosure obligations.

In The Beginning

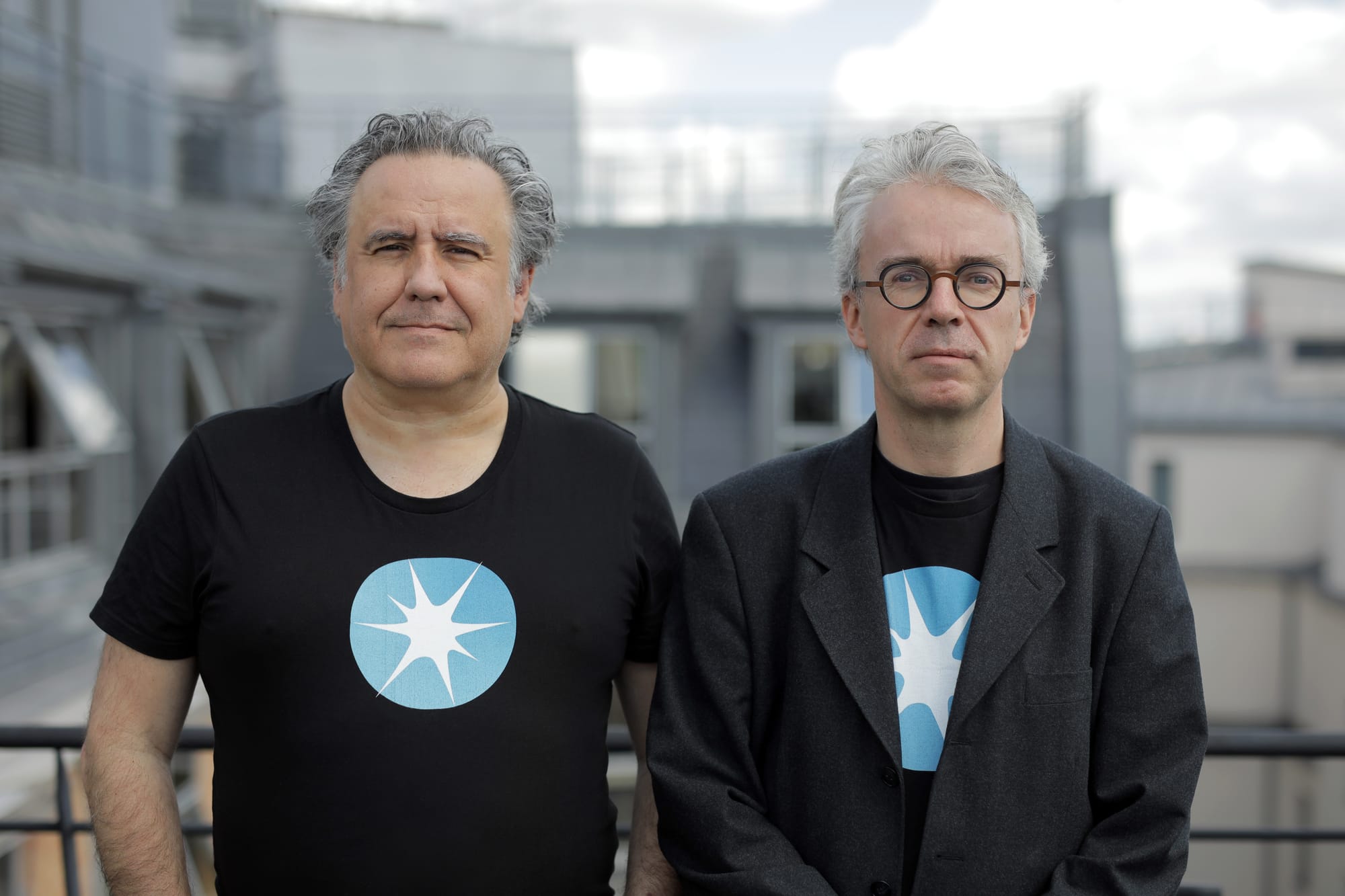

The company was founded in June 2016 by AI scientists and entrepreneurs Igor Carron, Laurent Daudet, Sylvain Gigan, and Florent Krzakala.

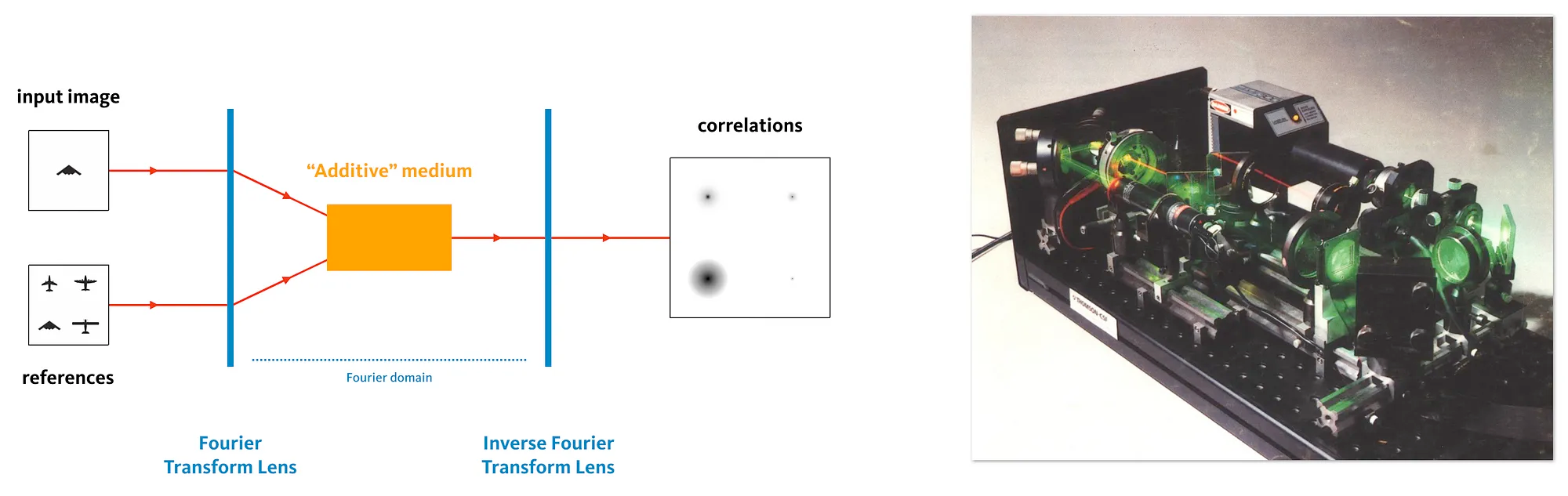

The founders began researching and developing an Optical Processing Unit or OPU, designed to process data rapidly in AI applications and with low energy consumption. A photonic co-processor uses light to transmit and process data, instead of electrical current. In theory, OPUs are more efficient than traditional processors because they don't use electricity.

LightOn founders believed this would be a critical advance to accelerate the development of AI, allowing it to be deployed on a widespread scale.

From a technical perspective, they were successful enough that the technology was first used in a data center in 2017. Four years later, the company announced that the optical appliance had been installed in one of France's supercomputers as part of a pilot project.

A research milestone for sure, but there wasn't much evidence that the company was making any progress in turning this appliance into a meaningful business.

Funding: Public + Private

To finance this work, LightOn received support from Bpifrance in the form of two loans:

- The first was granted in October 2019 for an initial amount of €400,000, repayable over 5 years. As of June 2024, the company still owed €200,000 on the loan.

- The second was granted in March 2020, for an initial amount of €60,000 and repayable over 5 years. As of June 2024, the company owed €30,000 on that loan.