Welcome...

👋 ...to the rentrée! The prolonged summer vacation period in France – which lasts 6 weeks but often feels like 16 – has come to an end. The Olympics and Paralympics are over and both were rousing successes. French President Emmanuel Macron has finally picked a new Prime Minister so France has a functional-ish government again.

Alas, the news for the French tech ecosystem is a bit more sober. Through the end of August, French startups had raised about $5.5 billion – on pace for $8.25 billion, a potential dip from $9.4 billion in 2023, according to Dealroom. Though, of course, August is notoriously a funding wasteland, so we'll see how much the pace picks up during the backstretch of 2024.

That said, France Invest's latest semestrial report confirmed that cleantech and renewable energy startups are riding a wave. They raked in €348 million in S1 2024, putting them in second place behind mobility. 2023 was a jackpot year with over €2 billion invested. From solar panels to biomethane, these startups are buzzing, and even Deep Tech startups are making waves. After a rough patch, energy tech is back on track — who knew saving the planet could be so profitable?

Meanwhile, the failure rates of French VC-backed startups continue to rise, according to a Bank of France study, and are predicted to set a new record in 2024.

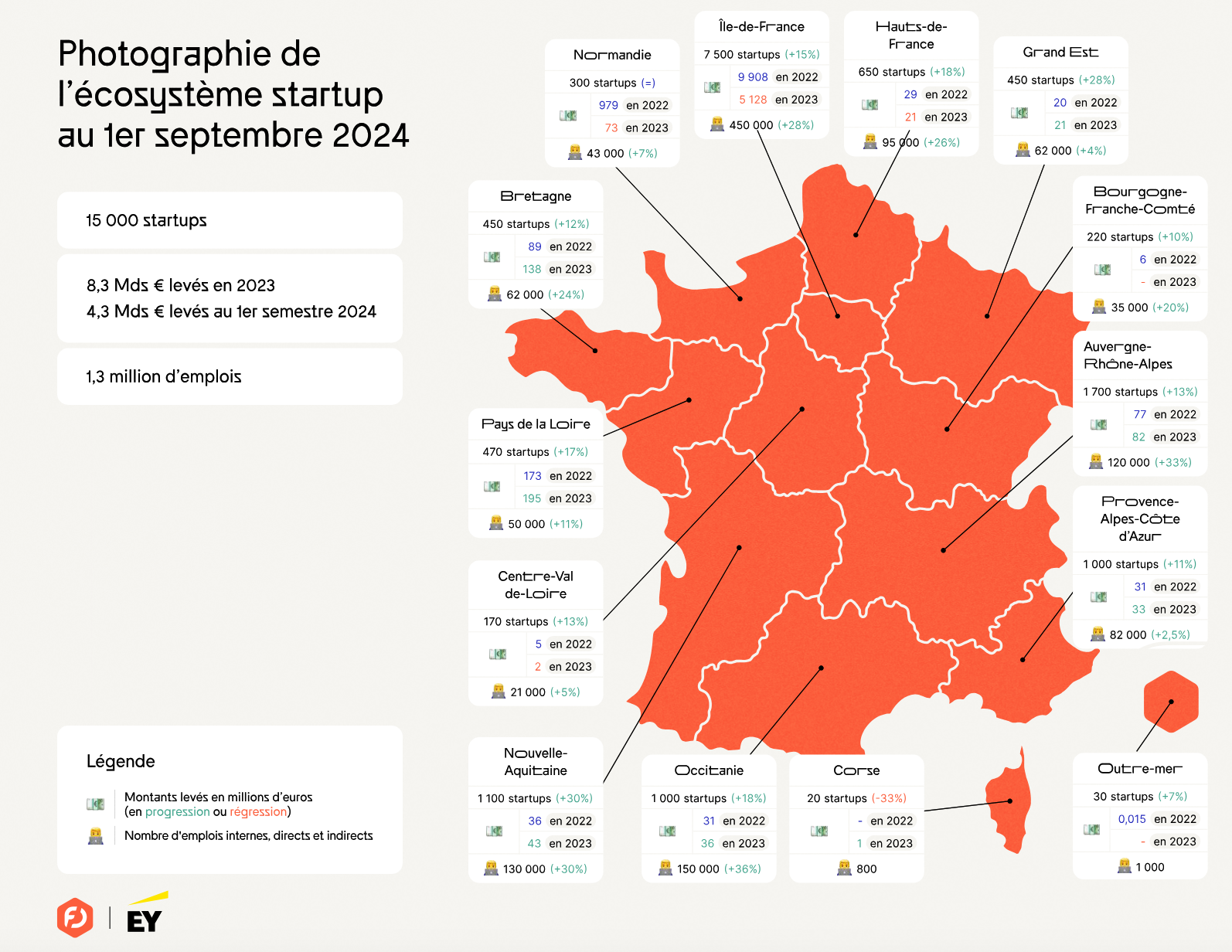

You can get more flavor of the overall state of play from the annual Barometer released this week by EY + France Digitale:

"What we're seeing is that we're still in a kind of landing phase compared to the COVID period when there was a phase of euphoria," said France Digitale Managing Director Maya Noël. "Today, investors are wondering what the new market standards are and what is the definition of a company in which they want to invest. There is still a balance to be found between cash consumption, the ratio between growth and profitability, and the business mode

Between the disruptions presented by AI, political uncertainty about state support for tech, and a drive to reach profitability, Les Echos described this as a "tumultuous rentrée for French Tech."

News About Our Future

With a new season comes changes to this newsletter. We are merging our General and Seed newsletters into a single edition that will be published twice each month. You're reading the first version of this new format! This newsletter will remain free to read but full access to select articles will still be reserved for paid subscribers.

In addition, we will now publish our monthly newsletter that focuses on all things AI in France. We produced two test versions over the summer, which you can check out here and here. The goal is to create a source of advanced intelligence about France's AI ecosystem for entrepreneurs, investors, and corporates. The AI newsletter will officially launch on October 1. Anyone who becomes a paid subscriber now will get lifetime access to all of the AI newsletter content at no extra cost!

As we move forward, there are a few ways you can show your support:

- Tips: We've enabled a new feature that allows you to make a one-time tip. The suggested amount is €25, but you can adjust that up or down to whatever suits your budget. 🏆

- Subscribe: Sign up for a monthly subscription and use this link to get a €5 discount on the €10 monthly subscription for your first year. 💁♂️💁♀️

- Sponsorships: We're actively seeking sponsors interested in getting their brands in front of our global audience of readers who are focused on the French tech ecosystem. Reach out to me ([email protected]) or Helen (helen@frenchtechjournal) for details and a sponsorship kit. 😉🥂

And now, back to our regular programming.

🔎 Inside this week's newsletter:

- Deep Dive: Neoplants has released its first commercial product after 6 years of R&D: a bioengineered plant that absorbs indoor air pollution. This is a pivotal moment for the Deep Tech startup which must now turn science into business. The co-founders discuss the journey so far and the challenges ahead.

- Spotlight Interview: Marguerite de Tavernost oversees the Cathay Ledger fund that invests in all things Web3. She explains why she thinks the conventional wisdom is wrong and that now is the time to double down on a sector she argues is going to drive profound change.

- Seed Of The Week: Deep Tech startup Entroview wants to help manage the growing number of batteries in things like EVs by harnessing an old physics phenomenon. The company has raised a Seed Round for its groundbreaking method of testing battery defects, state of charge, and health in real time.

- The Big Deals: Morpho, WattAlps, Sekei & more!

- Hot Seed Deals: Agendize, Floatee, Greenscope, NomadHer & More!

Tech Talk

Now that the kids are back at school and the adults are back at their work cubicles, let's take a quick dive into the latest news from the French Tech scene. 😃

⬆️ 💸 HRTech unicorn Swile faced some serious backlash a couple of years ago when it disclosed financial reports that revealed tiny revenues and big losses. The company had to make the filing as part of its proposed acquisition of Bimpli, a subsidiary of BPCE. Fast forward to 2024, and Swile reports that it is...profitable! In the first half of 2024, it recorded an EBITDA of €23 million and a net result of €8 million, compared with €11 million and - €31 million in the first half of 2023. “On paper, doing an operation with Bimpli was beautiful, but it was necessary to confirm the test and make sure that 1 plus 1 plus 3,” Swile founder Loic Soubeyrand told Les Echos. 🤑

⬇️ 🪱 Alas, not everyone is bathed in such glory. Sifted reported that Ÿnsect, the startup that produces alternative proteins from mealworms, is struggling to raise the last chunk of cash it needs to fully ramp up a new mega-factory. Poor strategic choices and delays have made investors reluctant to open their wallets again, the story says. Meanwhile, autonomous shuttle startup EasyMile filed for bankruptcy. According to Les Echos, the company has managed to deploy a decent number of vehicles, but many potential clients remain in the pilot stage. With insufficient revenues and investors refusing to put more cash in, the company is hoping to reorganize its finances to remain independent. 🚌

➡️ 🚀 French tech enthusiasts are eagerly anticipating France Digital's FDDay next Wednesday (18/09). This year's annual event promises to be bigger than ever tech with over 4000 founders, investors, and key players in the tech ecosystem set to gather. Organizers say the day will be packed with opportunities to connect, exchange ideas, and explore the latest trends and deals shaping the future of tech. 🗣️💬

⬇️ 🦹♂️ If you've been following the saga of Pavel Durov, the founder of Telegram founder, you will know that he has had to swap his digital privacy crusade for something a bit more prosaic — like getting arrested. 11 days after his arrest on August 24, the French justice system has managed to break through the defenses of the 39-year-old Franco-Russian billionaire, who now faces 12 charges, mostly around Telegram’s lack of cooperation in cases involving child exploitation and terrorism. Despite now being out on bail (a cool €5 million) and under judicial supervision, he’s stuck in France for the foreseeable future, far from his Dubai digs. Tough times for Mr. Privacy! 🕵️♂️

⬇️ 😰 It’s not the best time to be in crypto! (Though our Spotlight Interview subject begs to differ!) French Web3 startups are having a hard time finding growth and funding. According to a recent study commissioned by Les Echos, after the FTX crash in late 2022, the sector’s decline has been sharp. In the first half of 2024, only 19 French crypto startups raised funds—down 35% from last year. While the total raised (€178 million) is slightly higher than in 2023, it’s largely thanks to just two deals: Zama (€67M) and Flowdesk (€50M). Meanwhile, investors continue to turn their attention to AI ... 🤖 👀

Deep Dive:

Neoplants' Bioengineered

Air Pollution Revolution

In an era of mounting environmental concerns, Paris-based Neoplants is leveraging bioengineering to tackle one of the most pervasive and invisible threats to human health: indoor air pollution.

Founded in 2018 by Lionel Mora and Patrick Torbey, the biotech startup has created an innovative solution that integrates nature and cutting-edge science. Their flagship product, Neo Px, is a bioengineered plant system designed to absorb volatile organic compounds (VOCs) from the air, offering a natural and sustainable alternative to conventional air purifiers.

After more than six years of development and research, the first commercial version of Neo Px went on sale earlier this year. The journey to reach this point meant navigating various regulatory and scientific challenges. Now the company needs to find a way to attract customers to buy a living air filter to solve a problem they may not even know they have while also scaling up a complex international manufacturing and logistics operation.

"Awareness is the number one goal for us," Mora said. "Because we're trying to create this category that sits somewhere between an ornamental plant and an air purifier. And it's not easy to do that."

Neoplants' ability to achieve commercial success that matches its scientific accomplishments may demonstrate whether the immense potential of synthetic biology can be harnessed at scale to address global environmental challenges.

Spotlight Interview:

Cathay Ledger Fund

Is Still Bullish On Web3

The investment world may be increasingly skeptical of Web3-related themes such as crypto, blockchain, and NFTs, but Marguerite de Tavernost believes the negativity couldn't be more wrong.

"There have been bear markets in the past, but every time it comes back stronger," she said. "The foundation and the base layers are being set. If you look at the market share and total value of the crypto market, we are only at the tip of the iceberg."

Two years ago, de Tavernost joined global investment firm Cathay Innovation at its Paris offices where she oversees the Cathay Ledger fund. The early-stage venture fund is a partnership between the global investment firm and Ledger, the Paris-based crypto hardware wallet company that has become a major force in the Decentralized Finance movement. The fund targets cryptocurrencies, DeFI, blockchain, NFTs, DAOs, and tokenization of everything.

While de Tavernost acknowledged that many players in the investment space have retreated from blockchain due to market volatility, she said that Cathay sees this as short-sighted. She believes in the value of these technologies, especially their potential to integrate across various industries in a way that mirrors the adoption of the Internet.

"I think a lot of people who are not completely ingrained in the industry are just surfing the waves and don't understand it," she said. "I think there is a market situation that fails to understand that is fundamentally a long-term game. It's all about putting in place the structures and the foundations of the crypto industry so that it can become more mainstream."

Seed Of The Week: Entroview

Since its debut in 2021, Entroview — founded by Gaetan Depaepe and Sohaib El Outmani— has been promising to electrify the battery world with its innovative diagnostic software.

By using a cutting-edge physics-based approach called Entropy, Entroview tracks battery aging and health with precision, helping manufacturers spot issues early and tweak performance. This not only boosts battery longevity by up to 40% but also has industry giants buzzing: their tech is currently being tested by three top gigafactories and two major car makers across Europe. And they will be launching their first product this fall.

The Big Deals

What: Morpho, a developer of an open decentralized platform that allows anyone to earn yield, borrow assets, curate markets and vaults, and build lending applications.

Why: To earn yield and reduce borrowing costs for users while making financial infrastructure a public good and bringing Decentralized Finance (DeFi) to mainstream consumers.

Funding: €46.15 million

Who: Co-Founders Paul Frambot, Merlin Egalite & Julien Thomas

Investors: Ribbit Capital and over 40 other strategic non-equity partners that have invested in Morpho tokens including a16z crypto, Coinbase Ventures, Variant, Pantera, Brevan Howard, BlockTower, Kraken Ventures.

What's next: The funding will allow Morpho to fuel the growth and decentralization of its network while benefiting from the expertise and resources of a long list of industry leaders who share its vision of building finance like the early internet–via layered, open protocols.

What: Calyxia, a producer of eco-engineered biodegradable microcapsules and microparticles for use in Consumer Goods.

Why: To build an advanced and sustainable future for the chemical industry by providing leading manufacturers with innovative microcapsules that contain, protect, and deliver valuable chemical and biological ingredients.

Funding: €31.6 million

Who: Co-Founders Jamie Walters, Damien Demoulin, David A Weitz, and Jerome Bibette.

Investors: Lombard Odier IM, Bpifrance

What's next: The new capital will enable Calyxia to achieve profitability, deploy globally its innovative manufacturing technology, and establish itself as the leader in a market exceeding $10 billion by 2030.

Hot Seed Deals

What: NomadHer, a travel app for women.

Why: To provide as much information as possible about a travel destination, from a female traveler’s perspective, that’s commonly overlooked by traditional travel platforms.

Funding: €1.2 million

Who: Founder & CEO Hyojeong Kim

Investors: NBH Capital, CNT Tech, Kosnet Technology, K Bridge Investment

What's next: The fresh cash will go towards fueling the startup's growth.

What: Agendize, a publisher of appointment scheduling and diary management software for businesses

Why: To ensure companies remain accessible, even outside of regular business hours, save time, and increase productivity by streamlining scheduling management

Funding: €3.6 million

Who: Co-Founders Alexandre Rambaud, Cédric Peyruqueou, Christophe Berge

Investors: Entrepreneur Invest

What's next: The raise will be used to fuel the company's growth in France and abroad.

👋🏻 If you’re enjoying The French Tech Journal, support the project by forwarding it to friends and sharing it on your social networks. You can also comment on this post. And if you have ideas for stories, tips, or just want to harass us, shoot us an email: [email protected] / [email protected] 👋🏻