Welcome...

👋 In the 1983 film The Big Chill, Jeff Goldblum's character proclaims: "Don't knock rationalization. Where would we be without it? I don't know anyone who gets through the day without two or three juicy rationalizations. They're more important than sex." To which another character replies, "Come on, nothing's more important than sex." Goldblum retorts: "Oh yeah? Have you ever gone a week without a rationalization?"

In France, juicy government economic studies and plans may well be more important than both sex and rationalizations, because it's hard to remember a week going by without getting at least one. Economic plan, that is. To wit: Last week, the government's AI Commission delivered its report to President Macron.

The select group of 15 brainiacs was led by Anne Bouverot, president of the École Normale Supérieure's board of directors, and economist Philippe Aghion. After months of studying and talking to lots of other techsperts, the group concluded that AI is a BFD (Big Freaking Deal). They recommended the government spend €5 billion a year for five years to finance the sector, including boosting startups, training talent, expanding research, helping corporates get their heads around this stuff, and training workers. That would include a €10 billion "France & AI" fund to turbocharge these efforts.

What else? Beef up the nation's supercomputing resources through tax credits, "modernize" that supreme body of data overlords known as the Commission nationale de l'informatique et des libertés (CNIL) by changing requirements for access to sensitive info like health data, making sure AI models are trained on French data, and lighting a fire under every man, woman, and child in the nation to get with the algorithmic future.

"This investment is significant, but it is necessary if France is to become a leading country in Artificial Intelligence, and if our society is to reap its full benefits," the report reads. "This ambition is achievable, given France's and Europe's strengths It's also realistic and affordable for our country: the 'AI plan' we're proposing would represent 0.3% of total public spending. The cost of inaction, on the other hand, would be very high. We would forgo major economic and social gains, and risk a historic downgrade. The question set before us is this one: which spending will enable France to take control of its future?"

If hope is the thing with feathers, as Emily Dickinson once wrote, then France believes it has an embarrassment of AI plumage. It has been pushing the AI theme for almost a decade now, including a previous AI plan in 2018. More recently, the €54 billion France 2030 innovation plan includes some money and programs for AI. And then there are private efforts led by such big names as Xavier Niel plus global buzz around startups like Mistral AI.

The report signals that France needs to raise its ambitions even higher while emphasizing the stakes. There is indeed real reason for optimism, but there is also a kind of collective national post-traumatic disorder from decades of watching overseas tech giants eat the nation's digital lunch.

"Europe and France are well placed to play a leading role in this revolution, first and foremost thanks to the excellence of our talent," the report says. "This wealth and the exceptional dynamism of the French AI ecosystem must not, however, mask a worrying reality. For several decades, the trend has been for our continent to fall behind technologically and economically, jeopardizing its prosperity and independence."

Beyond the report's lofty goals, it's also lacking in a lot of specifics (which it acknowledges). That's going to be important to watch as the blanks get filled in. For instance, it remains to be seen how much of this may be new money versus money being re-deployed from the France 2030 program. And regarding the France & AI fund, it "will mobilize €10 billion in corporate private equity and public support to bring about the emergence of the AI ecosystem and accelerate the transformation of the economic fabric through AI. What exactly is that public-private mix, and who is going to make corporations give until it hurts? Stay tuned.

Also worth watching are any efforts to reform CNIL's mission, which sounds like a political powder keg. If the hierarchy in France is government reports over rationalizations over sex, you can probably guess where protests land on the spectrum.

Which brings us to this week's juicy newsletter:

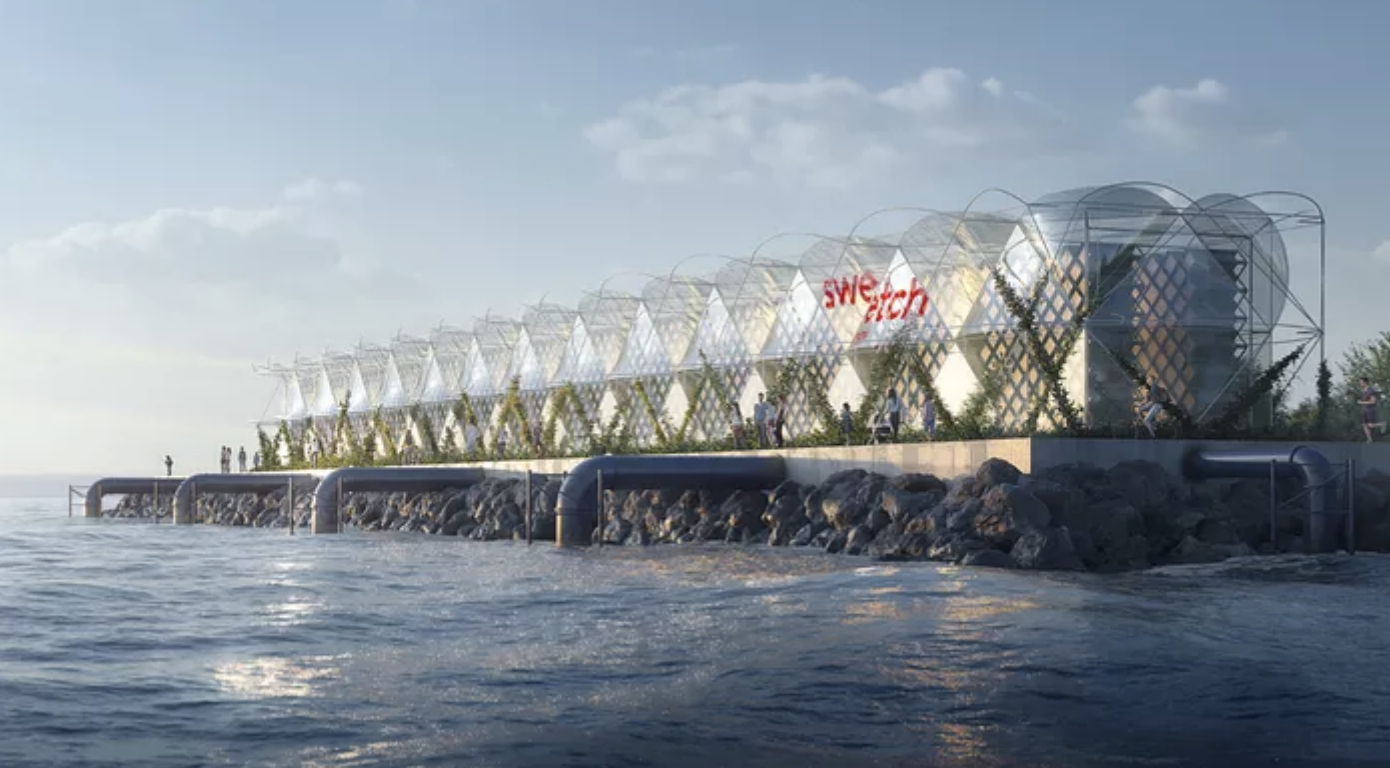

- Deep Dive: Sweetch Energy has developed a process for turning the natural interaction between salt and fresh water into power. The company has recently raised an extra €25m to complete a pilot project and begin scaling. CEO Nicolas Heuré explains why he believes this technology could one day provide 15% of the world's power.

- Spotlight Interview: One of the investors in Sweetch is EDF Pulse Ventures, part of the French energy giant's broader innovation unit. We spoke with Director Yann Coïc to better understand its mission and role when it comes to startup investing.

- International Investor Intro: Meet Verve Ventures, one of the most active deeptech venture investors in Europe with around 150 science and technology-driven startups in its portfolio.

- The Big Deals: Zama, Greenly, Lago & more!

Tech Talk

⬇️🦄🪓 While there are signs the tech economy is stabilizing, and perhaps even improving, the waters are still choppy for many. To wit, NFT-powered fantasy sports startup Sorare cut 22 jobs in its NYC office, says TechCrunch. Sorare replied that it's merely consolidating some roles back to its Paris office, but otherwise, all is well. Meanwhile, another French unicorn PayFit, is slimming down (again) by launching the complicated administrative procedure to fire people, leaving it with 750 employees compared to 1,000 one year ago. “We will support employees, either reclassify them internally or help them externally. We will communicate transparently,” Firmin Zocchetto, co-founder of Payfit, told Les Echos.🚪🚶

⬆️💸 On the flip side of the coin, a couple of notable French startups report that are making some coin. HRTech startup Deel, co-founded by Frenchies Alex Bouaziz et Shuo Wang, has now reached a pace of $400 million in ARR, according to The Information. And while Insurtech has taken a beating in recent months, reports of its death may be at least partly exaggerated. Acheel, co-founded by Francky Défossé and Ralph Ruimy, announced it had grown 100% over the past year and even reported a slight profit in 2023.💪

↕️🎵 Deezer CEO Jeronimo Folgueira cued up his swan song 🎻 on LinkedIn, announcing he was stepping down after 3 years. (See our profile of Fogueira here.) France's music streaming service has had a bumpy history, but is still alive and kicking. Fogueira came aboard in 2021 to steady the ship and steer it toward an IPO, which he did in 2022. He leaves on the heels of a solid annual report, with annual revenues up 7.4% last year to €484.7 million, and subscribers up 1.1 million to 10.5 million. Deezer projects it will be cash-flow positive this year and report an operating profit in 2025. Stu Bergen will serve as interim CEO while the company searches for a permanent one. 👀🔍

⬆️ 🤖 Quantumania continues in France, where it is now even a national quasi-holiday: la Journée nationale du quantique (National Quantum Day!). At a day-long event organized by the overseeers of the France 2030 program, the government announced a kind of Quantum Computing Hunger Games. Five quantum startups (Alice & Bob, Pasqal, Quandela, C12, and Quobly) have been selected for a competition to create a fault-tolerant quantum computer. The program has a budget of €400m over the next 8 years. In the end, only 2 will be selected for the next stage of industrialization. May the atomic odds be ever in your favor! Meanwhile, OVHCloud announced it had become the first European cloud provider to install a quantum computer, one made by Quandela which uses photonics. The goal is to let companies start experimenting with it to develop applications. ⚛️

The Deep Dive:

How Sweetch Energy

Wants To Tap Into Water Power

Rennes-based Sweetch Energy has spent a decade refining a process that harnesses the natural properties of fresh and salt waters when they collide in estuaries to generate a natural and permanent source of energy. Now Sweetch has raised a €25 million Series A round with a mix of public and private funding to finalize its first demonstrator project and lay the groundwork for scaling its technology across Europe and the U.S.

The co-founders believe their technology represents a significant leap forward in the quest for sustainable and renewable power sources, a breakthrough that could one day provide 15% of the world’s energy. Still, reaching that scale will present enormous engineering and financial challenges pushing the boundaries of their capacity to move from the lab to making that global impact.

It is a bet on a big idea that Heuzé is determined to make pay off. “Climate change is here,” he said. “We have to go fast. There is no time to lose.”

Spotlight Interview:

EDF Pulse Ventures's Yann Coïc

Yann Coïc, the director of EDF Pulse Ventures, is a self-described “EDF baby.” He has worked for the multinational energy company for almost 20 years in a wide range of roles that have taken him around the globe. From finance and M&A deals in Latin America to energy trading in London to modernizing the hydro-electric department in France, Yann has a breadth of experience with the business and technologies that have made EDF (né Électricité de France) one of the largest energy companies in the world.

Those experiences led to his appointment as director of EDF Pulse Ventures last year. He now oversees a corporate venture operation that has invested almost €500 million since it was created in 2017. A core part of that mission, beyond finance, is to find startups that can help advance or transform EDF's businesses.

"Synergies are our main focus," he said. "We won't invest in startups if there are no synergies between the startups and the group businesses."

International Investor Intro

Who: Verve Ventures

What: Verve Ventures is one of the most active deeptech venture investors in Europe with around 150 science and technology-driven startups in its portfolio. A dozen investment professionals identify the most promising digital, tangible and health & bio startups. It invests not only from its venture funds. Selected private and institutional investors can also get access to investment opportunities through a digital platform. The company invests EUR 0.5 million to several million in Seed and Series A stage companies across Europe. Verve Ventures helps startups with their most pressing needs such as hiring, client introductions, and an expert network of high-profile individuals.

Where: Headquartered in Zurich with offices in Paris, Berlin and Cambridge

Founder: Steffen Wagner and Lukas Weber

Investor type: Seed, Series A, and opportunistic investors at later stage

N° of funds: 1 closed, 1 in fundraising, deal-by-deal platform

Amount under management: +350m EUR

N° of portfolio companies: 150

Sectors of interest: Future of computing, Climate and Energy, Industrial tech, Robotics and automation, Health & Bio, Techbio

Notable French investments: Orakl Oncology, Figures, C12, Veesion, Poppins, WeMaintain, Groover, FineHeart, Otoqi, Groover

How to pitch the French team: We have deep expertise in science and technology and are keen to take tech risks with entrepreneurs who have global ambitions.

Anything else notable: In 2023, Verve Ventures invested EUR 50 million from its funds and private individuals' vehicles (SPV). We also had 4 exits including the sales of Metaco to Ripple. The former CEO of Switzerland’s second-largest bank joined Verve’s board of directors.

The number of private investors in France that invest together with Verve Ventures through its digital platform is increasing. To join Verve Ventures’ growing community of entrepreneurs and investors, visit verve.vc.

The Big Deals

What: Zama, an open-source cryptography company building state-of-the-art Fully Homomorphic Encryption (FHE) solutions. An advanced form of encryption that allows computations to be performed directly on encrypted data without requiring decryption, thereby preserving the privacy and security of the data.

Why: To protect privacy in blockchain and AI.

Funding: €62.3 million

Who: Co-Founders CEO Rand Hindi and CTO Pascal Paillier

Investors: Multicoin Capital, Protocol Labs, Metaplanet, Blockchange Ventures, VSquared, Stake Capital & blockchain pioneers such as Juan Benet (Filecoin), Anatoly Yakovenko (Filecoin), Gavin Wood (Ethereum & Polkadot).

What's Next: After 4 years of R&D, this large Series A fundraising will be used to fuel Zama's go-to-market and accelerate its business development.

What: Greenly, a carbon accounting platform for businesses, in particular SMBs.

Why: To provide businesses of all sizes and sectors with the necessary tools and insights for effective carbon footprint management.

Funding: €49 million

Who: Co-Founders Alexis Normand, Arnaud Delubac, Matthieu Vegreville

Investors: Fidelity International Strategic Ventures, Benhamou Global Ventures, Move Capital, XAnge, Impact Partners.

What's Next: The cash will be used to propel Greenly's expansion plans, enabling it to extend its global reach and enhance its suite of carbon management tools.

What: Lago, an open-source metering & usage-based billing solution.

Why: To help businesses manage complex billing processes by building a flexible billing system tailored to their specific business model thereby helping them improve the efficiency of their monetization strategy.

Funding : €22 million

Who: Anh-Tho Chuong & Raffi Sarkissian

Investors: FirstMark, SignalFire, Lee Fixel’s Addition, New Wave, Script, Y Combinator & various business angels such as Meghan Gill (MongoDB) & Clément Delangue (Hugging Face).

What's next: The new funding will enable Lago to double down on R&D and expand the services offered by the platform.

👋🏻 If you’re enjoying The French Tech Journal, support the project by forwarding it to friends and sharing it on your social networks. You can also comment on this post. And if you have ideas for stories, tips, or just want to harass us, shoot us an email: chris@frenchtechjournal.com / helen@frenchtechjournal.com 👋🏻