As artificial intelligence reshapes the global technology landscape, the debate over hype versus bubble valuations has reached a fevered pitch.

European venture capital firm C4 Ventures is taking a longer view, doubling down on its conviction that something more profound is happening and that the continent can produce world-class AI and deep tech companies.

The Paris-based firm announced the launch of its third fund with a €100 million target, while simultaneously expanding its partnership team with the addition of Valère Rames, a seasoned deep tech investor.

The moves signal C4 Ventures' ambitious bet on Europe's ability to compete with Silicon Valley and China in the next wave of technological innovation, even as the firm navigates a challenging fundraising environment and questions about Europe's competitive position in AI.

"This is a defining moment," said Pascal Cagni, Founder & CEO of C4 Ventures. "I wasn't here when [Alessandro] Volta, born in Como [Italy], invented [electric batteries], right? But I'm here when the OpenAI guys crystallized 20 years of the digital world through AI. In another 20 years, my grandkids will say that you had the time of the combustion engines, you had the time of electricity, and you had the time of the internet. And then there is a fourth wave, which is AI. That's our conviction."

Strategic Expansion with New Partnership

Valère Rames joined C4 Ventures as a partner, bringing extensive experience in defense and high-frequency trading industries. His background as an electrical engineer and previous role at Seventure Partners aligns with C4's focus on technically complex startups that require deep operational expertise.

"I'm an electronic engineer by training, and I have some experience in the defense industry and the high frequency trading industry, so very deep tech environments," Rames said in a recent interview. "My ambition is to back deep tech entrepreneurs, entrepreneurs that are willing to build very strong technical assets and really ready to sell those assets."

The addition of Rames reflects C4's commitment to maintaining its operator-led approach, where former industry executives provide hands-on support to portfolio companies.

The firm's leadership team already includes Cagni, who previously served as Apple's head of Europe, Middle East, India, and Africa from 2000 to 2012, and co-founder Boris Bakech, who brings experience from Apple and Ubisoft.

The team also includes Eric Boustouller, former President of Microsoft Western Europe, Michel Sassano, Deep Tech Partner, and Mathieu Bourdié, CFO & Head of Investor Relations.

A Decade of European Tech Investment

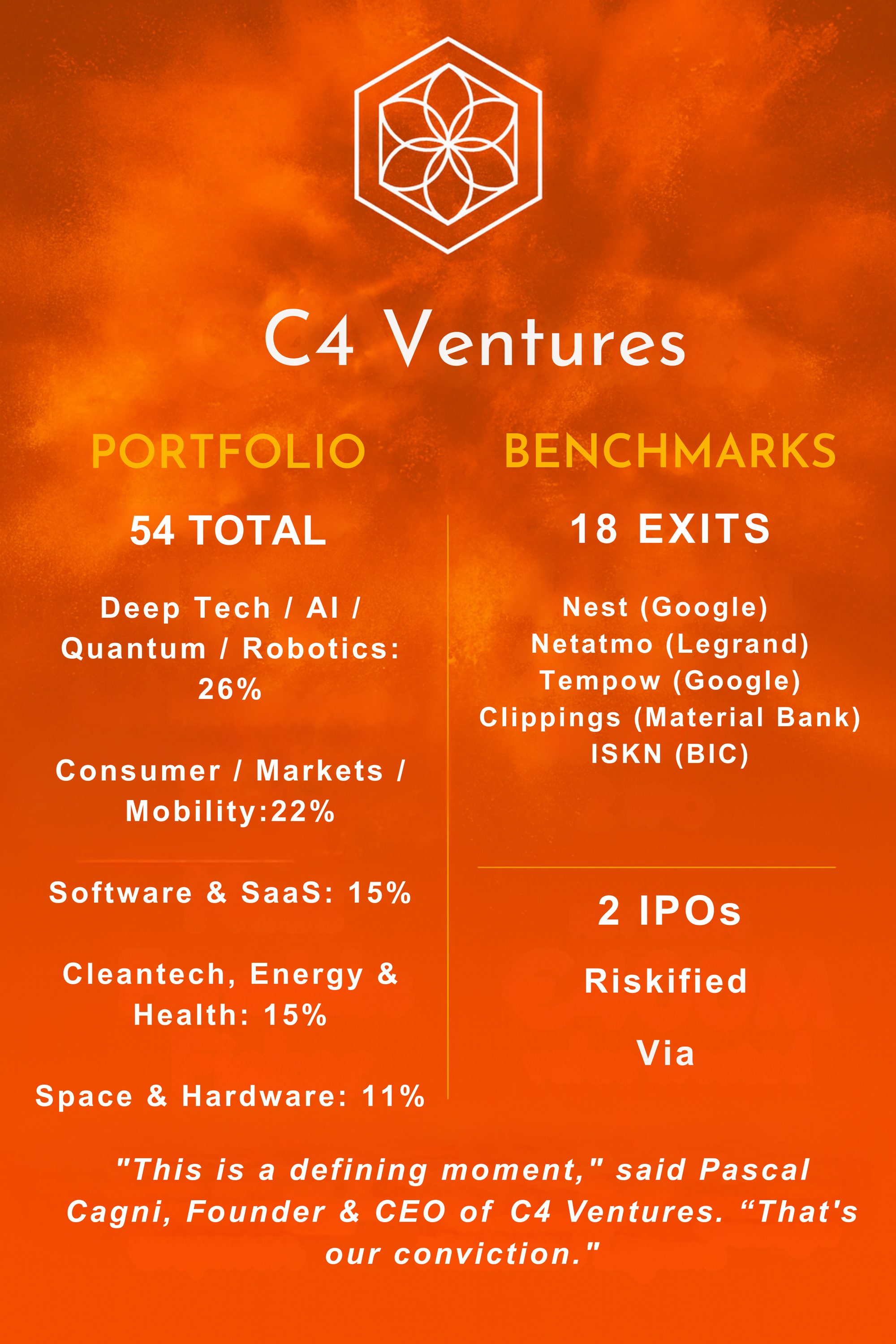

Since its founding in 2014, C4 Ventures has built an impressive track record that sets it apart in the European venture landscape.

The firm has invested in 54 technology startups, with 12 achieving unicorn status, a ratio that reflects both the quality of its deal selection and the hands-on support it provides to portfolio companies.

The firm's investment journey began when Cagni and Bakech invested in Nest, the connected thermostat company that Google acquired for $3.2 billion in 2014. This early success led them to professionalize their investment activities into what became C4 Ventures.

The firm has now completed a full investment cycle, achieving over 18 exits, including two IPOs on the New York Stock Exchange: fraud prevention company Riskified and public transportation platform Via, which debuted this month.

AI and the Future of Technology

The new €100 million fund represents C4 Ventures' response to what its leadership views as the most significant technological shift since the internet. However, unlike many AI-focused funds that concentrate on large language models or software applications, C4 Ventures is taking a more diversified approach across the AI technology stack.

Rather than competing directly with the capital-intensive world of foundation models, C4 Ventures is focusing on areas where European companies can build sustainable competitive advantages.

This includes investments in quantum computing companies like Alice & Bob and PsiQuantum, AI chip makers like Arago, and robotics companies like NEURA Robotics.

"We need to be on the f**king chip," Cagni said. "We need to be on the processing power. We need to be on decarbonized energy. We need to be on the real estate, which was the data center. First, we need to be in the other layers to orchestrate the software. That's why we invested in Arago, at the chip level.

Market Opportunities in Defense and Beyond

While AI grabs the headlines, the new fund comes at a time when several technology sectors are experiencing renewed investment interest.

Defense technology, in particular, has emerged as a significant opportunity area, driven by increased government spending and the dual-use nature of many modern technologies.

"Definitely there's a strong need from defense," Rames said. "The budgets are rising a lot, and there are very, very strong teams that are really bringing out new products for defense. And it's not only 100% defense. It's more dual-use technologies which rely also on the public sectors for defense, but also on the private sectors for faster adoption. Definitely, we see more and more opportunities in this field."

Robotics represents another key focus area, where C4 Ventures sees Europe's traditional manufacturing strength as a competitive advantage. "Robotics is important," Bakech noted. "There is a huge robotic trend happening right now, combining AI and traditional robotics to do physical AI."

Climate technology, while currently out of fashion in many investment circles, remains a long-term conviction for the firm. "Climate tech is still there. There's still innovation in climate tech. It's not buzzing in the newspapers right now, but the needs are there," Rames said.

European Ecosystem Challenges and Opportunities

Despite the optimism about European technology potential, C4 Ventures' partners acknowledge significant challenges facing the continent's startup ecosystem.

The funding gap between Europe and the United States has widened since 2022, particularly in AI, while exit opportunities remain limited compared to more mature markets.

"If you look at the numbers, the gap was starting to narrow up until 2022. And from what I've seen, the gap is actually now increasing big time," Bakech said. "This is amplified by AI."

However, C4 Ventures believes these challenges create opportunities for funds that can provide more than just capital. The firm's operator-led model, combined with its network of operating partners from leading global technology companies, positions it to help European startups navigate these complexities.

Navigating a Difficult Fundraising Environment

The launch of Fund III comes during one of the most challenging periods for venture capital fundraising in recent memory. With higher interest rates and poor returns across much of the asset class, many institutional investors have reduced their venture allocations.

C4 Ventures has chosen to maintain its boutique approach, raising capital primarily from high-net-worth individuals and family offices rather than institutional investors, Cagni said.

This approach, while more labor-intensive, allows the firm to maintain its hands-on investment style and avoid some of the constraints that come with institutional capital. With a target of €100 million, Fund III will likely make 15-20 investments with typical check sizes of €3-5 million.

For Cagni, the current challenges facing European venture capital are temporary fluctuations that cannot reverse a fundamental cultural transformation.

He points to data showing that young French people's willingness to become entrepreneurs has surged from 13% to over 60% in just over a decade, a shift that transcends political cycles and funding environments. This represents more than changing career preferences; it reflects a generation that has embraced risk-taking and innovation as core values.

While politicians may come and go, and funding markets may rise and fall, Cagni believes the underlying entrepreneurial infrastructure and mindset that has developed across France and Europe has reached a point of critical mass.

The ecosystem has matured beyond dependence on any single government program or investment cycle, creating a self-sustaining momentum that will persist regardless of near-term obstacles. As he puts it, in terms of France's innovation economy: "I have no doubt that the train left the station. We are going to continue to run."