French Start-ups Navigate Turbulence as Growth Slows Despite Resilient Job Creation

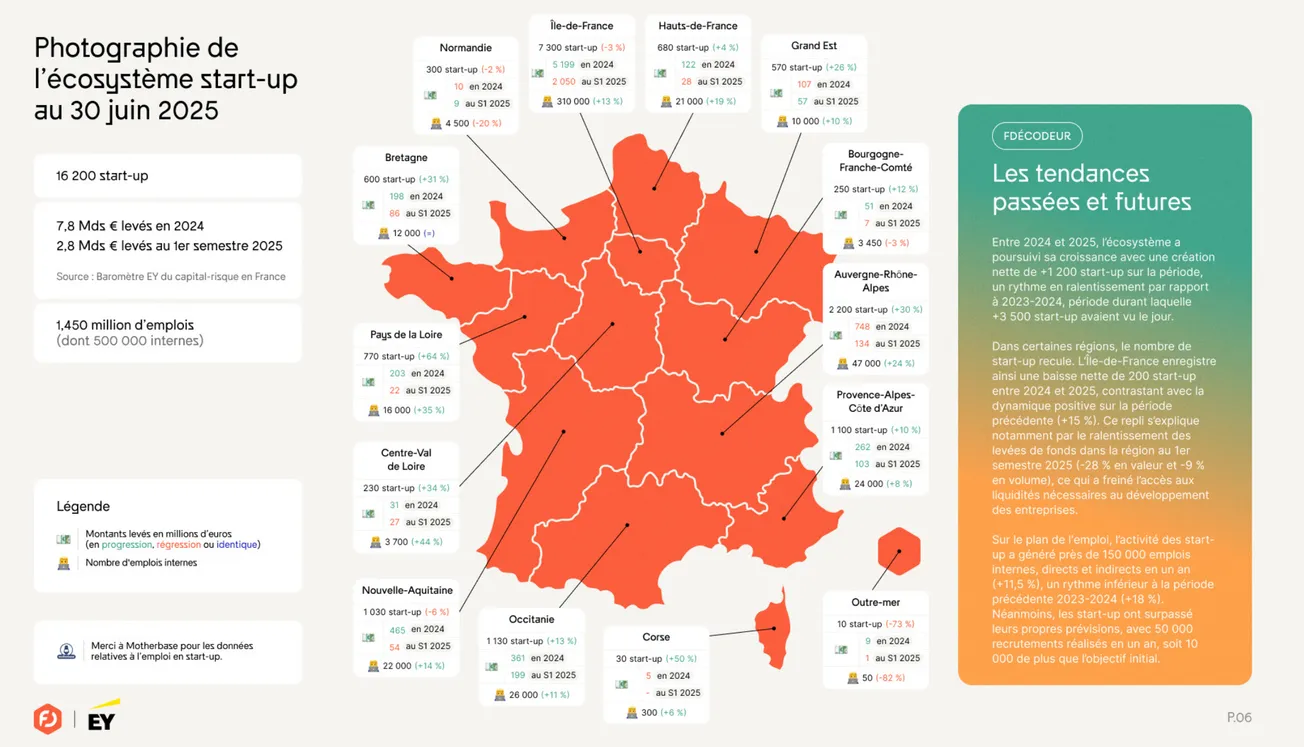

French start-ups navigate choppy waters as VC funding plummets 24% while employment surges 11.5%. The 2025 Barometer from France Digitale and EY reveals an ecosystem transitioning from growth-at-all-costs to sustainable profitability amid mounting political and economic headwinds.

Latest

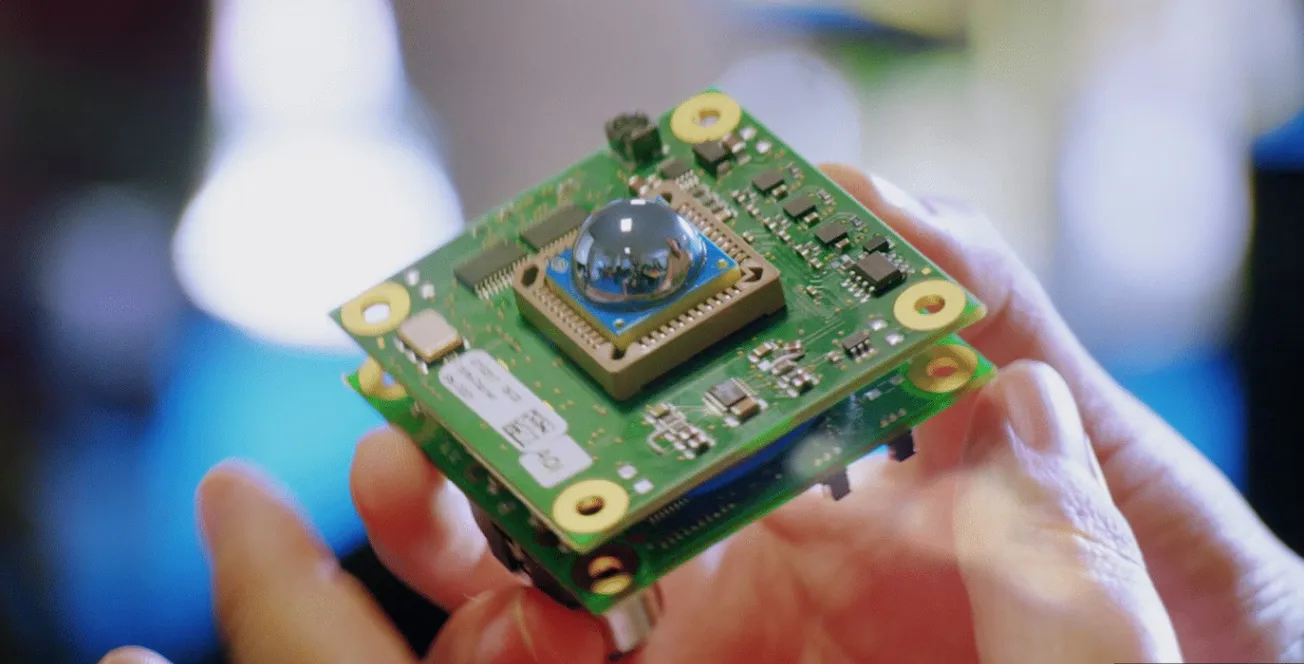

Inside TiHive: How a French Deeptech Startup Is Revolutionizing Quality Control, One Diaper at a Time

The Grenoble-based company just raised €8M to scale its terahertz-AI technology that can see inside products on production lines

La Machine #44: A €100M AI Fund To Defy Silicon Valley's Siren Song

C4 Ventures launches a €100M fund as French AI startups raise €30M+ across 8 deals, from Juisci's medical research platform to Chat3D's generative models. Yet Gigi and Rippletide still decamp for Silicon Valley despite strong European momentum.

C4 Ventures Bets €100M on Europe’s AI Future: New Fund and Partner to Challenge Silicon Valley & China

Paris-based C4 Ventures launches its third €100M fund and adds deep tech investor Valère Rames, underscoring its conviction that Europe can build world-class AI, quantum, and robotics companies despite a tough VC climate.

How Juisci Is Using AI to Save Doctors 8 Hours a Week and Fight Medical Misinformation

French startup Juisci just raised €5.5M to help 200,000+ doctors cut through the flood of medical research. Its AI app turns dense PDF studies into bite-sized insights, saving hours each week and fighting disinformation. Science, served up like Spotify.