French Tech News: How LumApps Kicked Down The Exit Door

Also inside: XMOBILITY CEO Magali Alix-Toupé revs up the engine of her new Le Mans accelerator.

Latest

La Machine #46: Special AI Cybersecurity Edition

It's Cybermois, France's cybersecurity month. For Part II of our special Cybersecurity package, we look at MokN's platform that uses AI and "fake doors" to trick hackers into revealing stolen credentials. CEOs Stu Solomon (HUMAN) and Philippe Humeau (CrowdSec) discuss the AI future of security.

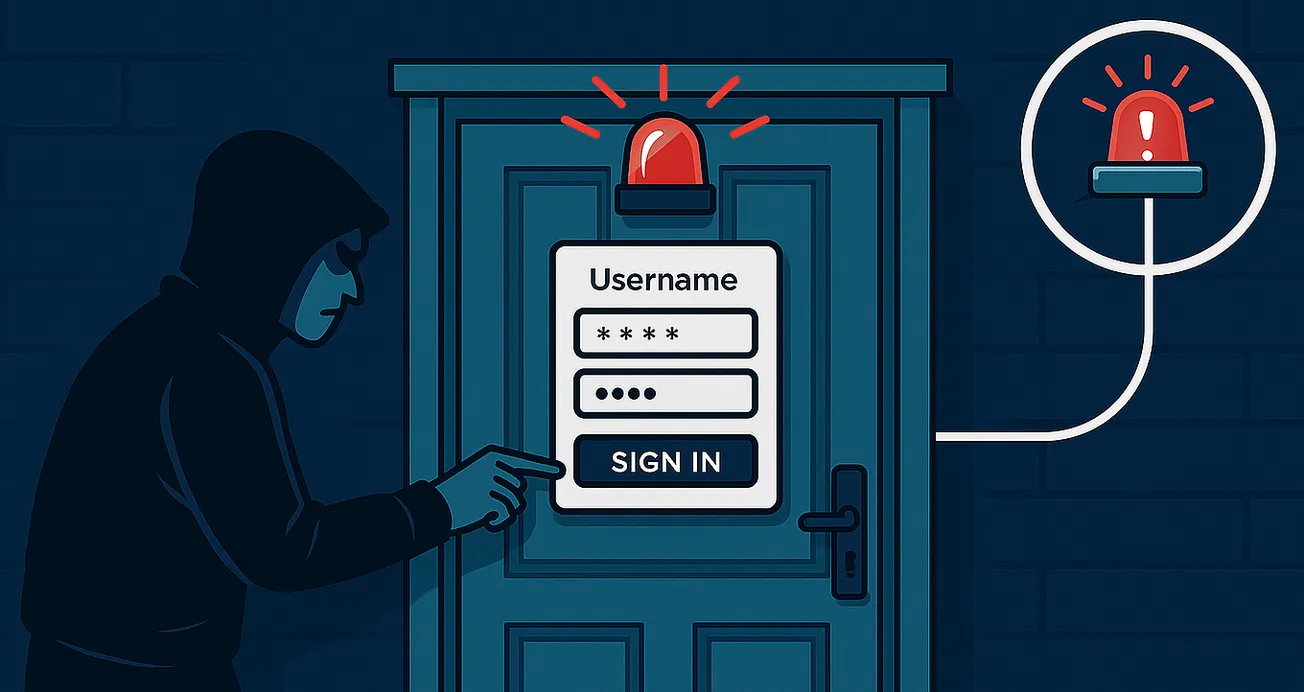

How Cybersecurity Startup MokN Combats Phishing With Deceptive 'Fake Doors'

When stolen credentials breached his 'impenetrable' system, Gautier Bugeon had an insight: give attackers fake doors to try. His startup MokN raised €2.6M, hit $1M ARR in 16 months with half its clients being billion-dollar companies, and is now expanding to America.

When Bots Go Agentic: How AI Is Rewriting the Rules of Cybersecurity

The cyber arms race has accelerated: humans once led attacks, AI now augments them, and MOAIs may soon strike autonomously. The big question: can defenders evolve fast enough to match a threat that never sleeps and learns on the fly?

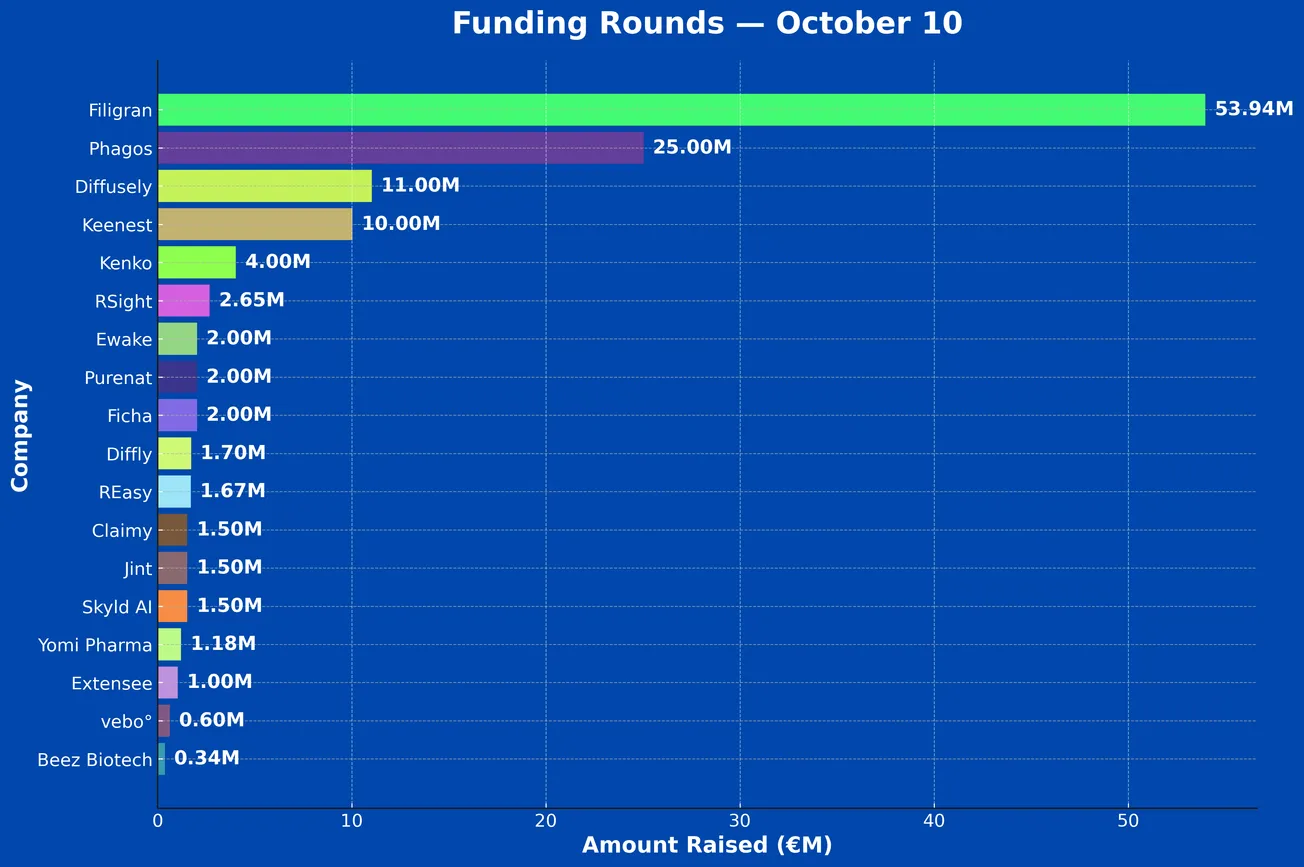

French Tech Funding Wire Oct 10: Filigran, Phagos, Diffusely & More!

Between Oct 6 and Oct 10 a total of 19 French Tech companies raised €123.6M including: Diffusely, Keenest, Kenko, RSight, Ewake, Purenat, Ficha, Diffly, Claimy, Jint, Skyld AI, Yomi Pharma, Extensee, vebo°, REasy, Beez Biotech, Biomunex Pharmaceuticals.