Want to reach an audience of more than 30,000 readers each month? The French Tech Journal is the leading English-language media platform covering France's dynamic tech ecosystem. With 31,000 + engaged readers across key global markets and consistently high engagement rates, our sponsorships provide unparalleled access to decision-makers in French tech.

👋 Welcome to our weekly recap of the big news + funding in the French tech ecosystem this week. In this week's French Tech Wire:

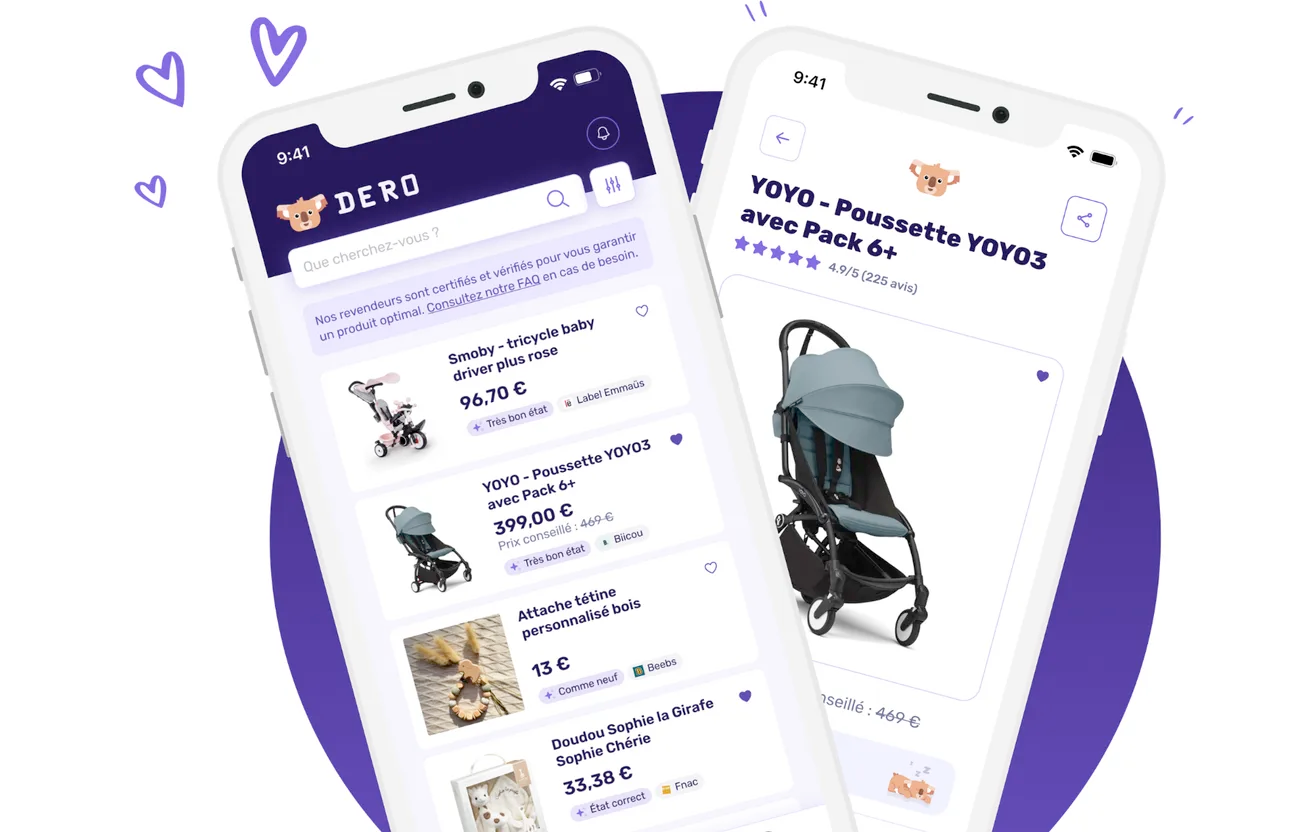

👀 Deep Dive: Dero is reshaping secondhand shopping in France by aggregating 65+ trusted marketplaces into one interface. With 150,000 users and a new mobile app, Dero wants to make buying used simple, secure, and better for your wallet. Co-founder Camille Colbus says, "We want people to feel proud of buying used products," said Colbus. "And we’re here to make that experience better, every step of the way."

Subscribe to The French Tech Journal to access all the articles and archives.

Chris O'Brien + Helen O'Reilly-Durand

🚀 Tech Talk 🚀

🔈📉 Devialet, the French luxury audio technology company, reported a substantial financial loss for the fiscal year ending March 2024 as the once buzzy startup fights for its financial life.

According to the company’s consolidated financial statements, Devialet recorded a net loss of €68.04 million for the year, significantly worse than the €25.4 million loss reported the previous year. This sharp decline was primarily attributed to a series of impairment charges and provisions, which resulted in a €32.18 million accounting write-off. The company fully depreciated its intangible assets, including patents, software, and capitalized research and development (R&D) expenses. Specifically, €18.22 million of development costs were written off due to their inability to generate expected future benefits. In other words, its future isn't worth as much.

The financial turbulence was not solely the result of these accounting adjustments. Devialet launched the Gemini II earbuds in September 2023, an upgraded version of its predecessor. Despite generating €8.9 million in revenue, the product’s contribution was insufficient to offset the company’s broader financial challenges. Devialet also divested its professional speaker brand PHL Audio, selling the assets to a former employee to focus on its core consumer products.

This came amid leadership changes. Franck Lebouchard resigned as CEO in October 2023, replaced by interim CEO Charles Henry Tranie, and eventually by Jacques Demont in January 2024. The company also saw the departure of its Chief Sales Officer, François Ruault, in February 2024.

Facing severe financial pressure, Devialet undertook a debt restructuring process, resulting in an accelerated safeguard procedure in December 2024. This arrangement, secured through a lock-up agreement signed in November, allowed for a €30 million capital injection, spread across multiple tranches through 2026. Additionally, the company rescheduled its outstanding bank debts, providing temporary relief.

It's no doubt a disappointing outcome for the company that seemed poised to be a hit with its Phantom speaker. I first encountered Devialet almost a decade ago when the hype around the company was just building. The quality sound and sleek design made it a coveted product for audiophiles.

The company still sold €40 million of Phantom speakers last year, but that was down from €42.5 million the previous year. The company still has some time to change its tune, but it remains to be seen just how the new leadership thinks it can turn things around.

🪙👮 Another week, another crypto kidnapping. The daughter and infant grandson of Pierre Noizat, CEO of Paymium, were targeted in a kidnapping attempt in Paris. Three masked assailants tried to force them into a van, but fled after her partner intervened; all three victims sustained minor injuries. This marks the third such attack on crypto executives or their families in recent months, following the abductions of Ledger co-founder David Balland and the father of another crypto entrepreneur. Founded in 2011 as Bitcoin-Central, Paymium is France's oldest Bitcoin exchange and was the first to be registered as a digital asset service provider by the AMF. While the company has remained silent on the incident, it has called for stronger protective measures for crypto professionals in France. | Maddyness

⚛️💻 Quantum computing startup Alice & Bob has announced plans to build a $50 million advanced quantum laboratory in Paris, funded by its recent €100 million Series B round. The 4,000-square-meter facility will support the development of next-generation quantum chips—Lithium, Beryllium, and Graphene—and will feature a nanofabrication cleanroom and a cryostat farm housing 20 Bluefors dilution refrigerators. The lab, developed in partnership with Quantum Machines and Bluefors, aims to accelerate the commercialization of Alice & Bob's fault-tolerant quantum processors based on cat qubit technology. A dedicated area is reserved for the installation of the company's large-scale quantum computer, Graphene, a 100-logical-qubit system planned for 2030. | Data Center Dynamics

🛒 French fintech company Younited acquired eco-friendly neobank Helios. Younited offers consumer loans directly and through partnerships, with more than one million clients. Helios, launched in 2020, provides sustainable banking services to approximately 40,000 customers, including current accounts and eco-focused savings products. This strategic move allows Younited to expand its product offerings and leverage Helios's commitment to environmental sustainability. | TradingView

🚆🚗 BlaBlaCar has officially entered the French train ticket market by offering SNCF tickets through its app, covering 350 stations across 200 cities. This move follows a similar launch in Spain and marks a significant step in BlaBlaCar's strategy to become a comprehensive mobility platform. While discount cards and certain operators like Ouigo and Eurostar are not yet integrated, BlaBlaCar plans to expand its offerings and coverage in the coming months. The company aims to rival established players like SNCF Connect and Trainline by providing a one-stop solution for various modes of sustainable transport.

Secondhand Shopping Made Easy: Dero’s Mission to Transform France’s Circular Economy

When Camille Colbus became a mother, she quickly realized how many essential items, such as strollers, bassinets, clothes, and toys, were needed for a surprisingly short period. She turned to secondhand, but instead of finding a straightforward way to shop responsibly, she found a jungle.

“Everything was fragmented,” Colbus said. “Comparing listings across platforms took hours. Quality was hard to judge. And trust? Let’s just say we took a few leaps of faith.”

That pain point sparked a mission. As a co-founder of Dero, she's helping to create a one-stop shop for reliable, traceable, and user-friendly secondhand shopping, one that aggregates the best of what’s out there and removes the friction. Colbus is a mission-driven entrepreneur who was the first employee at Too Good To Go.

Dero is growing into a promising player in Europe’s booming circular economy. In just more than a year, it has aggregated more than 65 trusted second-hand marketplaces onto a single platform designed to streamline resale shopping by making it faster, seamless, and safe.

With 150,000 users, Dero wants to make secondhand purchases a first choice by riding the tailwinds of a fundamental shift in consumer behavior. Following the launch of its mobile app and the rollout of its national Dero Tour, the startup focused on establishing its place as a category leader in France’s secondhand revolution.

“We want secondhand to feel like the default,” Colbus said. “Simple, secure, and good for both your wallet and the planet.”

💸 Top Funding Deals 💸

📇 Company: Tinubu Square

🔍 Description: Leading expert in trade credit risk management, providing solutions for financial institutions and insurance companies.

💻 Website: http://www.tinubu.com

📍 HQ City: Issy-les-Moulineaux, France

🧗 Round: Growth Equity VC

💰 Amount Raised: €40.91 million

🏦 Investors: Morgan Stanley Expansion Capital

👨💼👩💼 Founders: Jerome Peze, Olivier Placca

🗞️ News: Morgan Stanley, LinkedIn

📇 Company: Orasio

🔍 Description: Develops AI-powered video analysis software to detect, alert, and provide actionable insights for cities, homeland security forces, and businesses.

💻 Website: https://www.orasio.com/

📍 HQ City: Paris, France

🧗 Round: Seed

💰 Amount Raised: €16 million

🏦 Investors: Global Founders Capital, Frst Capital, Expeditions Fund

👨💼👩💼 Founders: Florian Fournier, Arnaud Delaunay, Fabio Gennari

🗞️ News: LinkedIn, Sifted

📇 Company: Riverse

🔍 Description: Provider of a carbon credit certification platform tailored for industrial decarbonization projects, including biogas, equipment reconditioning, and bio-based construction materials.

💻 Website: https://www.riverse.io

📍 HQ City: Paris, France

🧗 Round: Seed

💰 Amount Raised: €5 million

🏦 Investors: Alven, Racine² (managed by Serena and Makesense), Speedinvest, Kfund

👨💼 Founders: Grégoire Guirauden, Clément Georget, Ludovic Chatoux

🗞️ News: Maddyness

👋🏻 If you’re enjoying The French Tech Journal, support the project by forwarding it to friends and sharing it on your social networks. You can also comment on this post. And if you have ideas for stories, tips, or just want to harass us, shoot us an email: chris@frenchtechjournal.com / helen@frenchtechjournal.com 👋🏻