What: Paris-based Serena's most recent fund is the €100m Data Ventures II. The early-stage fund is the successor to the €70m Data Venture I from 2017, which focused primarily on AI and big data. Serena is one of France's most influential VC firms. Founded in 2008, the firm now has €750m in assets under management across 6 funds that invest from Seed to Series B.

Focus: While ChatGPT and GenAI have investors in a frenzy, Serena wants to look beyond that at the infrastructure layer, blockchain, and quantum computing, according to Serena Partner Bertrand Diard. Data Ventures II has three main themes:

- Infrastructure: The architecture of the modern data stack for AI which enables better automation of data management, analysis, and governance.

- Blockchain: Tools that strengthen trust and data management.

- Quantum computing: Breakthroughs in cryptography, drug discovery, optimization, and climate modeling.

Diard that while infrastructure is often invisible, it remains vital. Because the bulk of VC investment goes to applications, Serena wants to target the technology behind the scenes that is too often overlooked by VCs.

Thanks to its first Data Venture Fund, Serena became active in the AI and data space well before the current hype cycle. That allowed the firm to establish a reputation in these areas before the GenAI gold rush.

"We started this investment thesis in 2017," Diard said. "It's a really specific sector and we have a pretty strong track record. That's important because LPs can consider us as established investors in a market with credibility. "

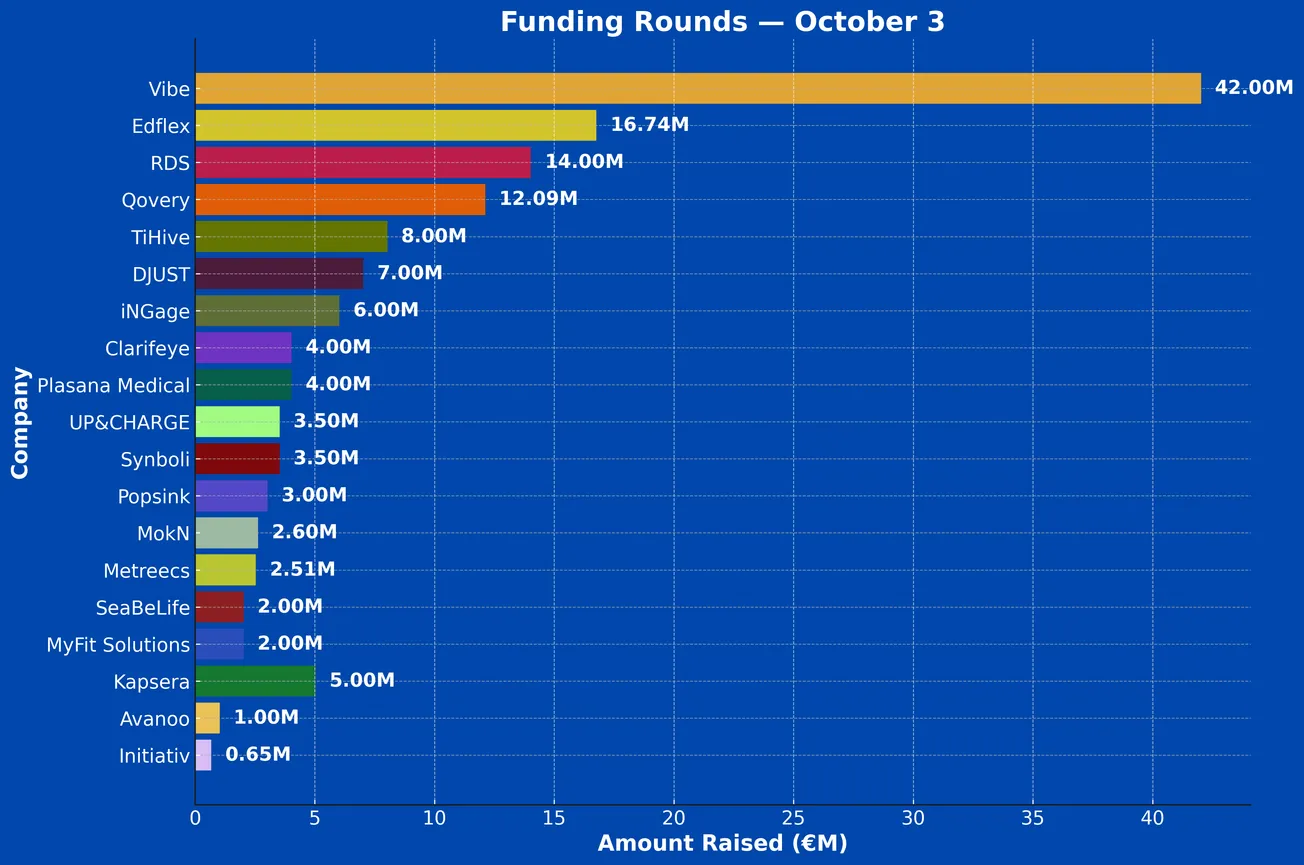

Size of investments: Early-stage deals between €500,000 and €3.5 million.

LPs: Institutional investors include Bpifrance via the Fonds National d'Amorçage 2 and the European Investment Fund.

The Full Scoop: Upgrade to a paid membership to learn more about Serena's investments, its portfolio, and Diard's outlook on the fundraising climate for VCs.