Thierry Vandewalle and Xavier Gury have been joined at the hip for almost 25 years. First as serial entrepreneurs, then as corporate colleagues, then as Business Angels, and now as Venture Capital partners.

The latest evolution of their partnerships is Wind, an early-stage European VC that has raised the first €90 million toward a planned fund of €130 million. The fund will target early-stage Deep Tech startups in such areas as decarbonization, AI, and robotics.

Entrepreneurial Roots: Gury is an AI engineer while Vandewalle is a construction engineer. The pair met at the business school incubator X-HEC Entrepreneurs. They launched their first company together, eQuesto, in 2000 with co-founder Alban de Villeneuve. The company raised €3 million – but the Q&A service was squashed when the dot-com bubble burst.

With money running out, they pivoted to a new business model of data analysis and website creation for e-commerce. Things stabilized and started to grow. They acquired a competitor, WCube, from bankruptcy court and rebranded the whole company. They sold the data agency to the international communications giant for €70 million to Publicis Groupe in 2007.

The pair stayed on and were put in charge of the company's Asia business, relocating to Shanghai and overseeing 20,000 employees. In 2 years, they oversaw 10 acquisitions to help the company with its digital transition.

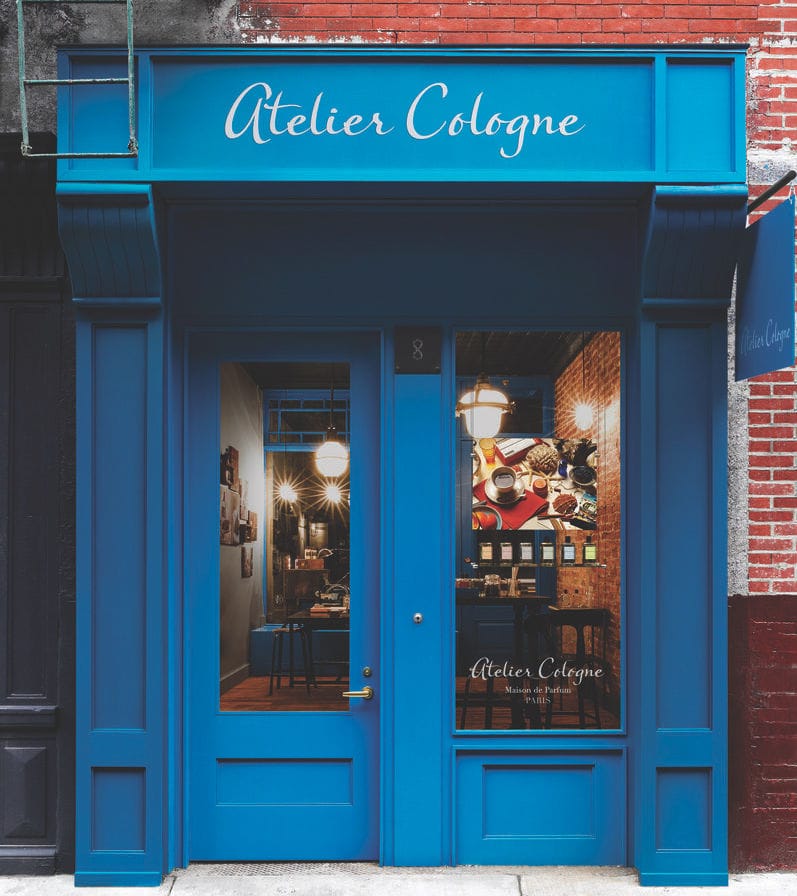

Meanwhile, from Shanghai, Vandewalle partnered with Sylvie Ganter-Cervasel et Christophe Cervasel, who had launched Atelier Cologne, which took a craft approach to developing luxury perfume. The company soon was selling its products in 80 countries. Eventually, they Atelier Cologne to L'Oreal.

More recently, the pair sold a French translation business to Germany's Deman in 2022.

Wind Capital: Between their WCube exit and their Publicis salaries, Vandewalle and Gury began investing in early-stage startups as Business Angels. Among their first deals: Drivy Getaround.

While they each had their own deal flow, Gury said they invested in close to 100% of deals together. So in 2015, they formalized this partnership and created Wind Capital, with the pair as the only LPs.

The €23 million evergreen fund invested €100,000 per month in startups, eventually backing 80 companies, with 29 exits. The companies operated in areas like fintech, SaaS, and mobility, including:

- Yuka (consumer guidance)

- Spark (decarbonized hydrogen)

- Néolithe (waste transformation).

Meanwhile, they each wanted to learn more about the VC world. So Gury joined Via ID - Mobivia (sustainable mobility) and Vandewalle joined ISAI.

"We wanted to make sure that what we were doing by intuition was meeting the needs of the founders and markets," Gury said. "We had never learned how to be professional investors. We learned a lot in these firms."

Eventually, the pair started discussing their next adventure. They wanted to keep working together and were trying to decide between a new startup or investing.

"For us, the idea of backing projects, working with entrepreneurs, and being close to innovations was the main driver," Gury said. "So we decided to launch a new fund. We wanted to have a bigger impact on the world and society."

Wind: The result of that debate was Wind. The fund will invest in 30 sustainable Deep Tech startups at the Seed and Series A stages, with checks ranging from €500,000 to €5 million. Wind is structured as an Article 9 fund, which means it can only back companies that focus on sustainability as defined by the EU’s Sustainable Finance Disclosure Regulation (SFDR).