Banks will charge you when you spend or transfer money abroad. We’re not about that, and that’s why over four million people have switched to Revolut.

Sign up and get Revolut Premium free for 3 months!

Amid the French tech boom of recent years, the government has increasingly focused on elevating two related sectors it sees as crucial to the nation's startup future: Deep Tech and AI.

This week, we got two report cards about progress in both categories. So let's take a look at what's been accomplished and what challenges lie ahead.

I'll start with the Mapping AI report released today by France Digitale. AI has gone through a couple of hype cycles in recent years, and now it's in the midst of another one thanks to the release of tools like ChatGPT. According to the France Digitale report, French startups are in a strong position to surf the latest wave.

The association identified 590 startups based in France that have some kind of AI at the heart of their product or service. That is an increase of 24% since its last mapping 18 months ago (and includes a mix of both new companies and older companies that were newly identified.)

By the end of 2022, these AI startups had collectively raised €3.2 billion over their lifetimes, an amount that doubled since the last tally in 2021. Of those 590 AI startups, 156 have raised external funds, including 9 startups that raised rounds of more than €100 million: Alan, Contentsquare, Deepki, Descartes Underwriting Dilitrust, Exotec, GoJob, Innovafeed, and Leocare.

In an interview, Thomas Barreau, AI Regulation & Standardisation Manager for France Digitale, said the growth of that list reflected the growing impact of AI across society as well as the increasing diversity in France's AI startups.

"AI has spread quite widely, both in terms of uses and applications, and particularly from a sectoral point of view," he said. "We have fewer pure players in AI in proportion to previous mappings. We have more and more start-ups that define themselves by the sector in which they operate. There is a fairly wide diffusion of AI in many sectors such as health, finance, insurance, legal, in agriculture as well. There is a fairly wide range of concrete applications of artificial intelligence in France."

Indeed, use cases are multiplying in all sectors and there is a division between pure players (companies that develop an AI product that can be used in any sector) and sector-based startups (companies developing AI for a specific market like insurance or security). In the new mapping, 20% of startups are pure AI players while 80% are sector-specific. The three largest AI sectors are health, fintech, and insurtech.

In addition, France Digitale found that 76 start-ups in the mapping said they are putting generative AI – including text, sound, and video – at the heart of their value propositions. And French researchers and companies are collaborating on a language training project called Bloom.

The long-term outlook for existing AI startups seems relatively strong. About half said they are either profitable or will be within 3 years. (Of course, talk is cheap).

This crop of AI startups are just starting to create jobs. About half employ 11 to 50 people. Almost 10% employ more than 100. Of course, the Paris region (Ile-de-France) is home to 60% of the AI companies, followed by 8% in both the Auvergne-Rhône-Alpes and Occitanie regions.

To be sure, France's AI sector faces numerous challenges, according to the report. A survey of these companies identified several key obstacles: Establishing relationships and contracts with large enterprises and the public sector, access to financing, recruitment of talent and skills, and compliance with existing and anticipated regulations.

Barreau said helping startups and VCs address these issues in the coming months would be a key priority for France Digitale. That will include a series of talent fairs, efforts to create bridges between startups and corporates, and events that help match VCs and startups.

"Our mission and the mission of the ecosystem as a whole is to support these start-ups, to continue to push for their development," he said.

With the interest in AI intensifying around the world, Barreau said it's essential that France redouble its efforts to support its own AI ecosystem to ensure it remains competitive.

"We're at an interesting moment when AI is becoming more widespread," he said. "We have never had so many articles being written about artificial intelligence. We've never had so many ChatGPT users. Google has launched Bard. Chinese operators have also launched their generative AI project. In France, we have the Bloom project. AI is becoming part of everyday life and reality. Before, when we talked about AI, we were talking about a technical subject, really about researchers and hard-core entrepreneurs. Now we're seeing new applications every day. This democratization raises a lot of questions. But France and Europe have important roles to play."

The French Tech Journal is powered by Ghost, an open-source platform run by a non-profit organization that gives creators greater control and freedom over their publishing and content. Ghost is free, but Ghost(Pro) takes care of installs, updates, security, and backups. allows people to spend more time on the important stuff: creating content!

Deeptech Deep Dive

Meanwhile, Bpifrance yesterday presented its 2022 report card for France's €3 billion Deeptech Plan, which aims to accelerate the transfer of breakthrough research from labs and universities to startups.

According to the latest report, there were 320 Deep Tech startups created in 2022, up 27% from 2021, and double the annual number for 2018. The goal, eventually, is to boost that number to 500 annually.

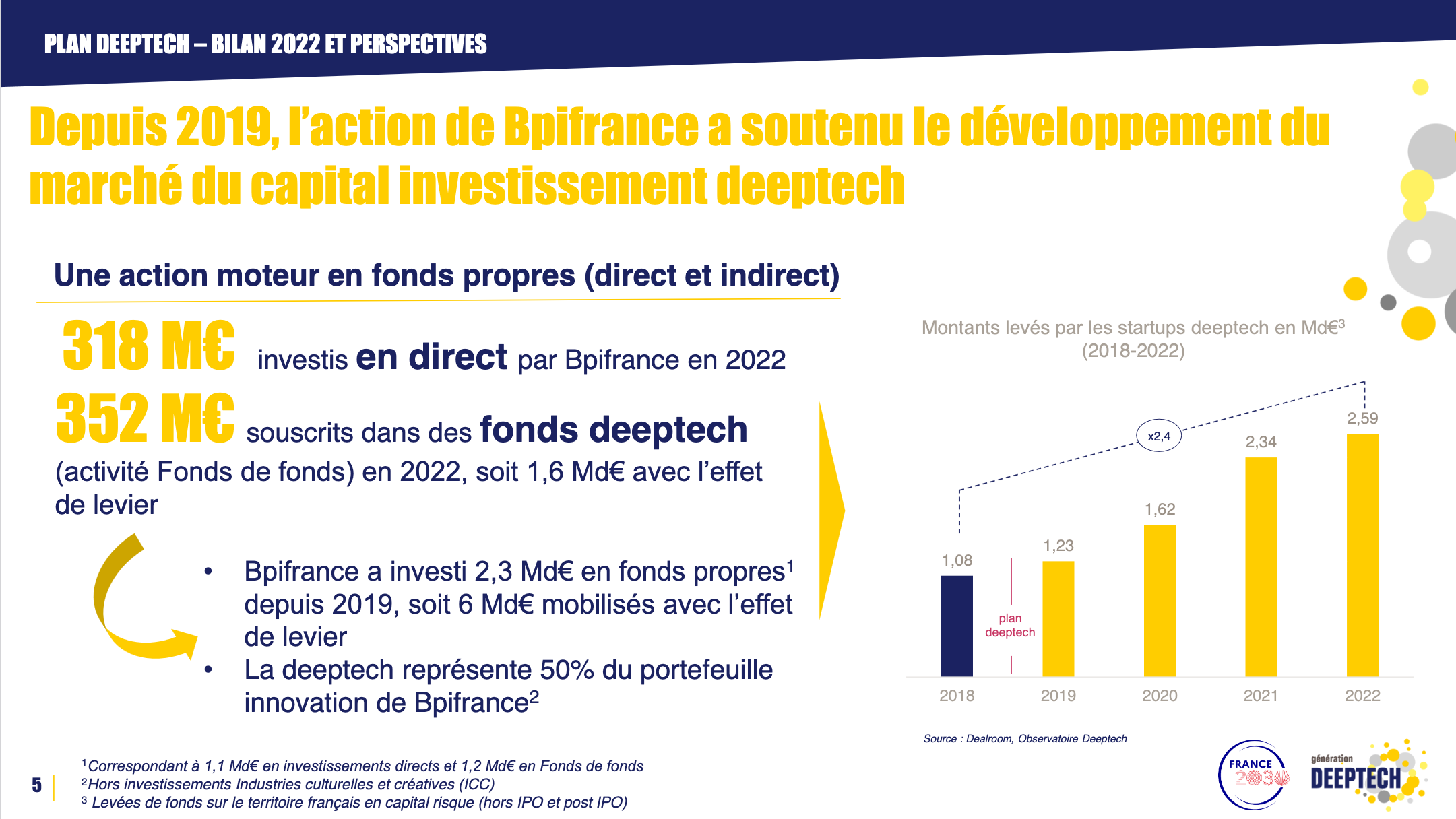

Bpifrance has now invested €1.1 billion directly into Deep Tech startups since the program launched in 2019 (including 75 startups that received €318 million in 2022) and deployed another €1.2 billion via its fund of funds to VCs who do Deep Tech investing (including €352 million in 2022). Deep Tech startups now represent more than 50% of the active holdings of Bpifrance.

That money has helped those startups raise another €5 billion in funding, according to Bpifrance. Deep Tech startups now employ 50,000 people.

Of course, Bpifrance's Deep Plan extends well beyond just writing checks. The bank says 30,000 people have attended events its various Deep Tech events.

And beyond the development of products and services for Deep Tech startups, Bpifrance is pushing to make sure the results are eventually manufactured in France. The bank wants to ensure that the fruits of all this public investment are spread to regions outside of Paris, part of the massive France 2030 plan.

That effort includes the recent launch of a $350 million National Industrial Venture Fund.

If you want to geek out on Bpifrance's impact and how it works, check out these two recent stories that I wrote in an attempt to decrypt the role of this critical player in the French tech ecosystem.

Want to talk about tech journalism or get feedback on pitching? Book a video call with me on Superpeer. Paid subscribers to the newsletter get a 50% discount.

👋🏻 If you’re enjoying The French Tech Journal, support the project by forwarding it to friends and sharing it on your social networks. You can also comment on this post. And if you have ideas for stories, tips, or just want to harass me, send me an email: chris@frenchtechjournal.com. 👋🏻