Welcome...

👋 French startup funding remained lukewarm as 2024 got underway. The Q1 fundraising numbers suggest that French tech is bobbing along the surface as the ecosystem continues to feel the hangover of the 2020-21 funding frenzy.

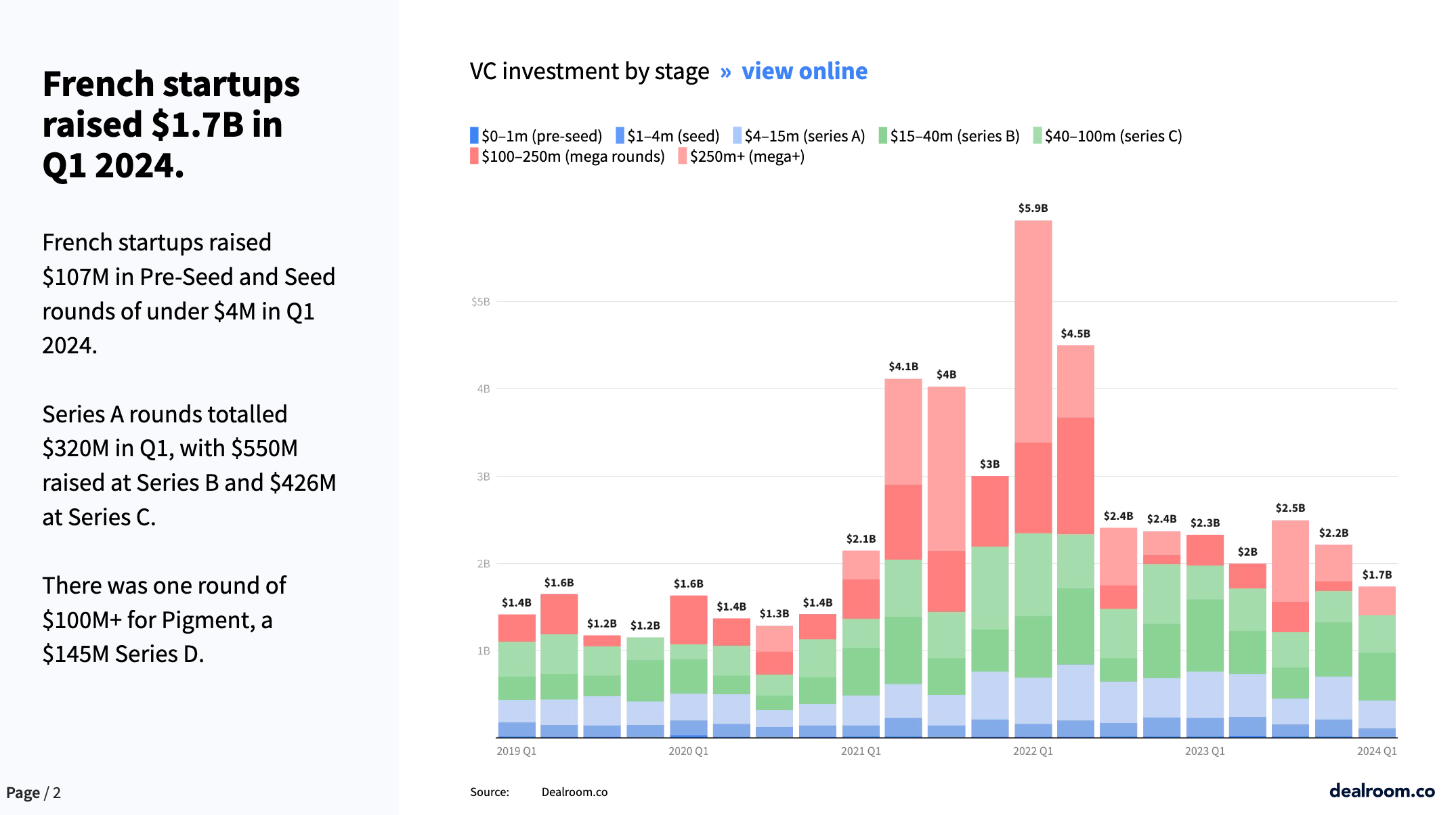

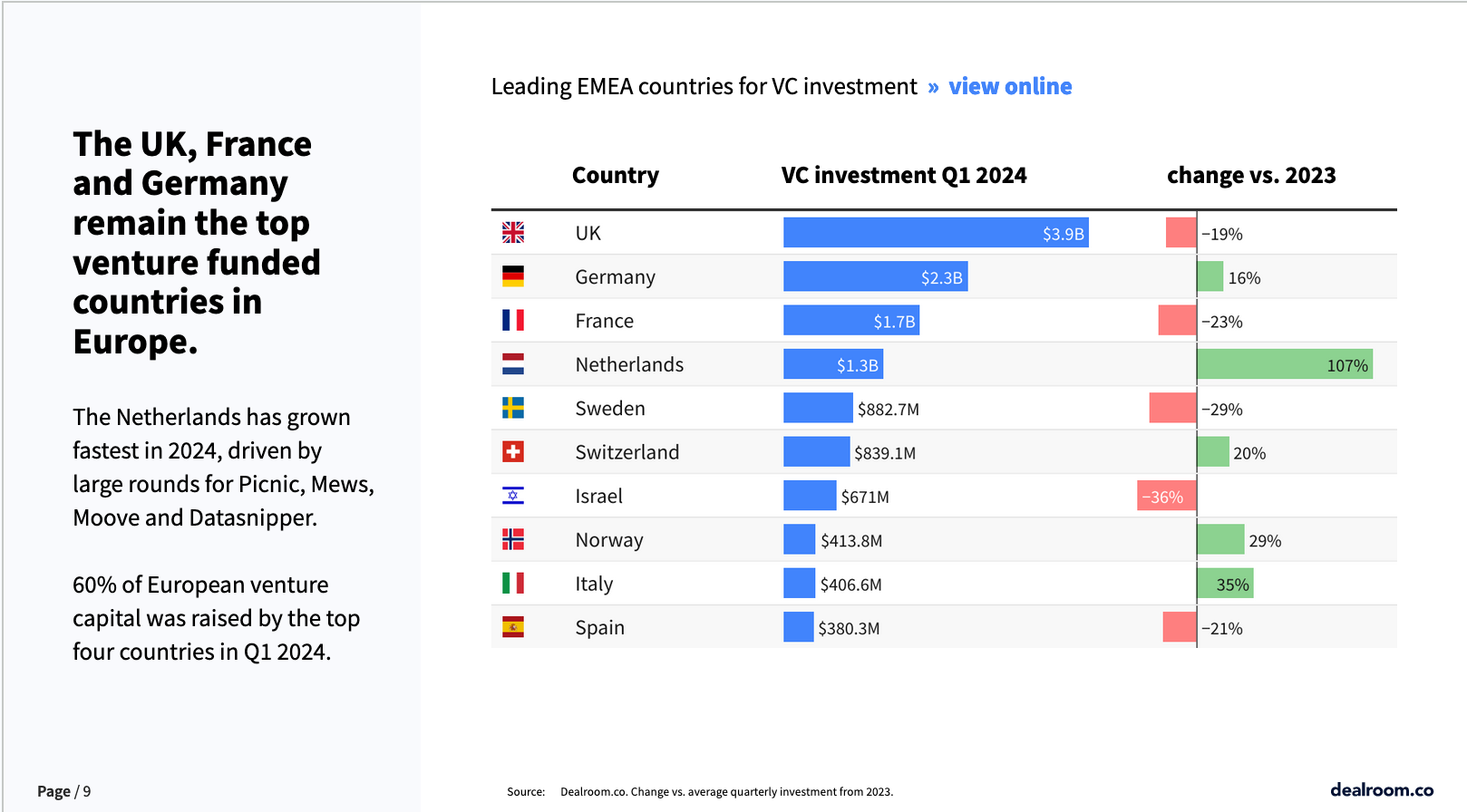

You can take your pick of reports from Pitchbook, CB Insights, or Dealroom. But they all roughly show that French startups raised about $1.7 billion in Q1, a steady drop from the last two quarters and roughly the same as Q1 2020.

For the moment, that drops France just behind Germany in the EU startup funding sweepstakes. Though CB Insights puts France at number 2 and Germany in third place. (CB Insights says Germany raised much less than Dealroom's number, but the French numbers are about the same.)

Early-stage funding is holding up ok, but even that stage is feeling the squeeze. For others, getting to the Series A round and beyond is increasingly difficult. That means there are a lot of zombie startups lurking about, not quite dead but not able to raise money to continue growing.

While it's not a perfect measure, the monthly bankruptcy data from the Bank of France hints at the pain being felt. For the category of "information and communication" companies, there were 1,721 bankruptcies in January 2024 – up 40.6% from January 2023, and well above the historic average of 1,480 between 2010 and 2019.

So, it remains a buyers' market for solid startups that have cash or PE funds sorting through the bargain bins. For VCs who invested at overinflated valuations and founders who are watching their dreams deflate, there are still some painful months ahead.

Unless, of course, you have a GenAI startup. In which case, investors can't throw enough money at you.

Speaking of throwing money at someone...Here is your friendly reminder that this newsletter is free. 😉🥂 Upgrade to a paid membership to get full access to all the articles and archives. 🏆

🔎 Inside this week's newsletter:

- Deep Dive: France's SNCF must find a way to transport a predicted increase in passengers while cutting its carbon footprint – just as it is facing competition for the first time. To reconcile these challenges, it's making a €2bn annual bet on digital transformation. We visited one of its innovation centers and heard from the Big Brass about a data-driven future that includes AI, robots, and greater sustainability.

- Spotlight Interview: Qubit Pharmaceuticals CEO Robert Marino and Chief Science Officer Jean-Philip Piquemal explain how they want to use quantum computing to accelerate drug discovery.

- The Big Deals: FlexAI, Payflows, And BforeAI.

Tech Talk

⬆️ 💪 Elaia and Lazard sealed the deal to form a new Growth Equity firm that will be 75% owned by Lazard and 25% by Elaia. The newborn Lazard Elaia Capital (LEC) will be run by Elaia co-founder Xavier Lazarus who will put together a new investment team. As suggested previously when the 2 entered exclusive talks last December, Lazard acquired a minority stake in Elaia with an option to purchase 100% eventually. The new fund is expected to launch in 2025. See our Deep Dive on the deal for more details. 💶

↗️ ⚓ ❇️ Rodolphe Saadé, the billionaire boss of shipping and logistics giant CMA CGM (Compagnie Maritime d'Affrètement et Compagnie Générale Maritime), continues his courtship of French tech with a new €200 million fund in partnership with Bpifrance that help France's maritime industry reduce its carbon footprint. The money comes from a €1.5 billion fund called Pulse previously created by Saadé to back innovative projects that would help CMA CGM decarbonize. Saadé has emerged as a surprise supporter of France's GenAI ecosystem, including partnering with Xavier Niel to create the Kyutai AI research center last year. The new fund will provide €130 million in grants to help maritime companies decarbonize, €50 million for a fund to back innovative decarbonization startups, and €20 million for maritime research. ⛵🐬

⬆️ 💸 From the Fun with Funds Department, lots of buzzing in the VC industry. Maif Avenir, an investment fund launched by the insurance company, has declared its independence and renamed itself Ternel. The re-baptized firm is raising a €120 million fund to write early-stage checks for startups which focus on climatech, education, and health tech. Meanwhile, JuneX is a new pan-European fund that just raised a €100 million "evergreen" fund to back startups in the fields of education, health, nutrition, and the environment. On a more modest note, Hugo Amsellem – an alumnus of The Family – announced on LinkedIn that he and Heex co-founder Etienne Bouthas have launched a €15 million fund called Intuition VC to back founders of consumer and culture startups in the US and Europe. LPs include footballer Raphaël Varane, basketball player Axel Toupane, Daring co-founder Eliott Kessas, and Erika Batista (formerly The Family and partner in On Deck Runway Fund). And finally, Global Founders Capital (GFC), the venture arm of Germany's Rocket Internet, confirmed that it is no longer raising a third fund and has slimmed down to just a handful of partners, including Paris-based David Sainteff. GFC has backed at least 34 startups in France, according to Dealroom, including Pennylane, Ankorstore, Shares, Seyna, and Upway. Sainteff told Les Echos that the remaining partners will continue to make investments via money from Rocket's balance sheet. This will eliminate pressure to make returns to LPs and allow it to make longer-term bets, Sainteff said. 📡 🔭 👾

The Deep Dive:

SNCF Lays Tracks For

A Digital Future

Once known as a mobility pioneer thanks to its high-speed TGV trains, France's railway giant SNCF is trying to recapture its innovation mojo through an ambitious series of digital projects. During a recent Digital Keynote at one of its innovation centers north of Paris, SNCF execs unveiled a bold set of plans that leverage internal and external innovation to reinvent almost every aspect of rail travel.

"Innovation is integral to SNCF," said Julien Nicolas, Director of SNCF’s Digital Division and President of its 574 venture capital fund. "From our inception with the creation of the railway network to the advent of the TGV, and now with the integration of generative AI and IoT, we're constantly leveraging new technologies to elevate the customer experience."

Spotlight Interview:

Qubit Pharmaceuticals

Qubit Pharmaceuticals is trying to unlock the potential of quantum computing to accelerate the drug discovery process. The startup is part of France’s larger bet on becoming a global leader in quantum computing.

I spoke recently with CEO Robert Marino and Chief Science Officer Jean-Philip Piquemal about the startup’s history and the challenges ahead.

"Quantum computing will be...capable of predicting quickly and with accuracy the chemical processes we are looking at," Piquemal said. "And if we can predict, we can go faster."

The Big Deals

What: FlexAI is developing a platform to make building and training AI applications easier and less expensive.

Why: Deploying AI-powered services can be complicated by a lack of access to computing power and programmers. With its new platform, FlexAI wants to automate the process of adapting an application to run on different hardware so developers have more options for accessing computing power, while also running more efficiently so operating costs are lower.

Funding: €28.5 million

Who: Co-founders Brijesh Tripathi and Dali Kilani. The pair previously worked at Nvidia together. More recently, Tripathi has worked at Apple, Tesla, and Intel, while Kilani has worked at Zynga and then Lifen in Paris.

Investors: Alpha Intelligence Capital (AIC), Elaia Partners, and Heartcore Capital participated in this round, while previous investors include Bpifrance, Frst Capital, Motier Ventures, Partech, and InstaDeep CEO Karim Beguir.

What's Next: The company will release its first commercial product later this year and is working to have its platform integrated with major cloud-computing partners.

What: Payflows has developed an automated financial management platform.

Why: CFOs rely on a tangle of different systems to manage a company's internal finances. Payflows has developed a platform that aggregates and centralizes these systems into a central dashboard that makes tracking and oversight easier.

Funding: €25.0 million

Who: Co-founders are Pauline Glikman and Joseph Assouline, both formerly at Luko.

Investors: Balderton Capital, Headline, Ribbit Capital, 20VC, plus Business Angels including Angélique Elizé of Raise Sherpas, Guillaume Durao of Emblem VC, Alexandre Berriche of Fleet, and Salomon Aiach of Origins Fund.

What's Next: The company has earmarked the money for international expansion, including opening a UK office later this year and studying a possible move into the U.S. market.

What: BforeAI is a predictive cyber security solution that autonomously maps and predicts malicious software by analyzing internal and external data to detect anomalies.

Why: By identifying potential attacks and stopping them before they occur, the company wants to prevent damage which in turn saves clients money.

Funding: €15.0 million

Who: Founder and CEO is Luigi Lenguito

Investors: SYN Ventures, Partnership Fund for New York City, Karma Ventures, Karista, Addendum Capital

What's Next: The money will be used to expand R&D and expand into the U.S. market.

👋🏻 If you’re enjoying The French Tech Journal, support the project by forwarding it to friends and sharing it on your social networks. You can also comment on this post. And if you have ideas for stories, tips, or just want to harass us, shoot us an email: chris@frenchtechjournal.com / helen@frenchtechjournal.com 👋🏻