All the hype you’ve been hearing about French Tech over the past year turns out to be more than just hype.

According to a new report, French startups blew the doors off in 2017. But those numbers contain some caveats, including a significant slowdown in the second half of the year.

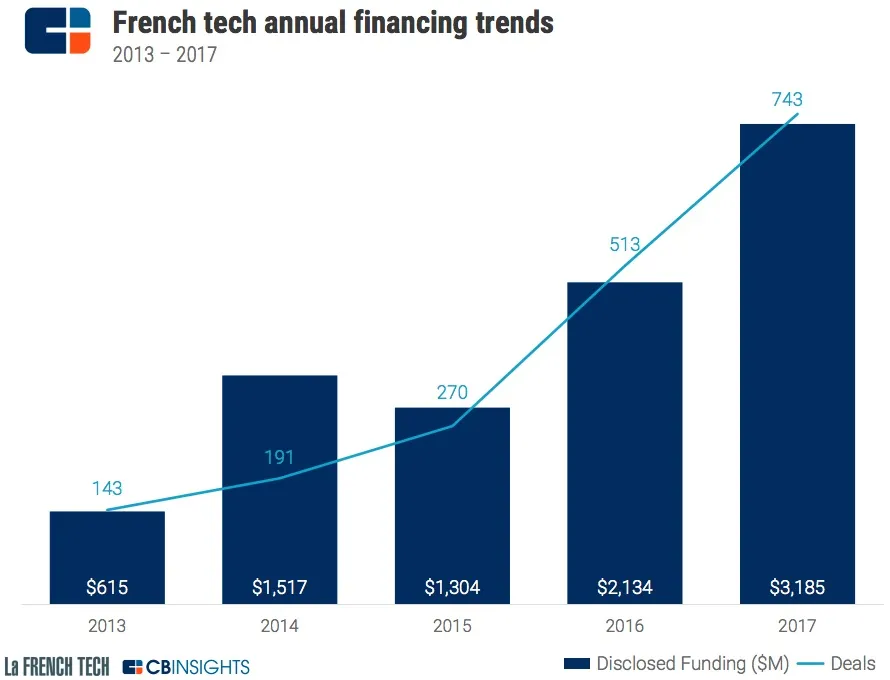

According to CB Insights, the number of French startups raising money in 2017 grew to 743 in 2017, up 45% from 2016. By the same measure, these startups raised $3 billion in 2017, up 49% from 2016. Big numbers for sure, but it’s important to note that a large chunk of that haul was $456M debt financing raised in the second quarter by web hosting company OVH. That’s not uncommon in Europe, that stats tend to include all types of financing, from venture capital to debt. Because of that big bump in Q2, funding in Q3 and Q4 where down quarter-to quarter.

Another bright spot: France is increasingly a rabbit’s warren of early-stage startups. As a result, France was second in number of deals behind the U.K. and ahead of Germany. However, that also means that the average deal size in France was $2.7 million, far below the U.K.’s average of $11.4 million where the startup track record is longer, and filled more late-stage companies. Which meant that Germany, also with more late-stage companies, edged out France for 2nd place in terms of money raised.

France’s startup ecosystem is still also being powered Bpifrance, the state-backed bank, which was the most active investor in the country last year with 90 deals.

The news from corporate investment remained mixed. The number of deals backed by corporations dropped in Q3 and Q4. But France’s largest public companies, the CAC 40 made 60 investments in French startups in 2017, up 10 times since 2013.

Finally, perhaps the most optimistic part of the report comes from a measure of the positive international buzz the country is getting. On the heels of the opening of startup campus Station F and the election of President Emmanuel “Startup Nation” Macron, years of marketing the growing French ecosystem seems to having the desired impact.