The French Tech Journal provides analysis of France’s digital ecosystem as well as in-depth interviews with French entrepreneurs and VCs. If you like what you read, please forward the newsletter to friends or share it with your social networks.

🔥🔥🔥🔥 Something new this week: On Friday (March 26) I'll be holding office hours from 2 p.m. to 4 p.m. CET. If you're a subscriber to this email (free or paid) you can book a free 20-minute Zoom call. I'll answer your questions about journalism and the media and explain my workflow to help you better understand the perspective and challenges of journalists as you think about how to start pitching. The link to sign up will go out in Thursday's newsletter.

For those who want to go deeper, you can book an appointment with me at Superpeer. Subscribers to this free email can get a code for a 20% discount. Paid subscribers can get a code for a 50% discount.🔥🔥🔥🔥

If you’d like to support independent and original reporting on the French Tech ecosystem, please consider a paid subscription. You'll wake up every morning feeling really good about yourself.

Send tips, comments, questions, and your ideas to our global headquarters: chris@frenchtechjournal.com.

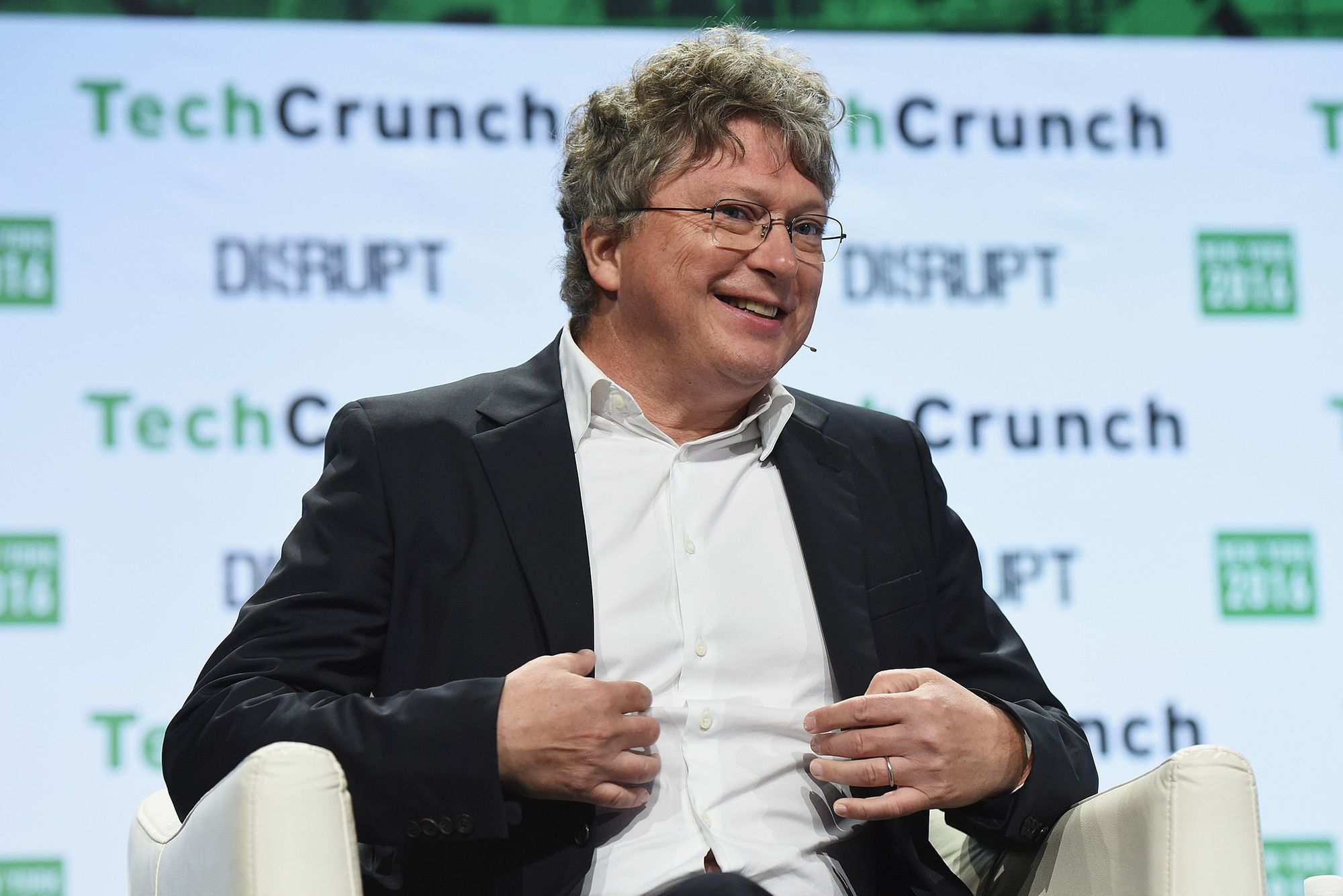

Henri Seydoux founded Parrot in 1994 and has been the only CEO in the company's history. Thanks to its consumer drones, Parrot has gained the kind of global brand recognition that can be rare for a French Tech company. But more recently, that drone business has struggled in the face of competition with Chinese drone giant DJI.

So for the past couple of years, Parrot has been trying to reinvent its business around commercial drones and data. It's a work in progress. Eliminating many of its consumer products was one of the main reasons annual revenue in 2020 fell to €57.3 million from €76.1 million in 2019 (and €109 million in 2018), according to Parrot's latest annual report released last week.

In a recent conversation, Seydoux expressed his frustrations over the competition with DJI, saying its lack of transparency about its business and ownership gave it an unfair advantage. But he also said he is determined to steer Parrot back to growth and lay the foundation for a new chapter in the consumer electronic company's history.

"I think the future of our business is very positive," Seydoux said. "We have finished moving from consumer to commercial drones. And we have invested a lot on the drones last year and I think you'll see some very nice announcements from us in 2021."

In The Beginning

Seydoux originally founded Parrot as a consumer electronics company, one that became successful at selling Bluetooth devices. It was only just over a decade ago that Parrot expanded into drones. Naturally, those drones were targeted at consumers.

Business boomed. Parrot sold millions of those drones and became a worldwide name. The company regularly made a big splash at CES. And it became a celebrated French Tech success.

Two forces collided to rock Parrot. First, that consumer drone frenzy turned out to be a bubble. And it began to pop. And second, DJI came to dominate the global drone market with cheaper yet powerful drones. The competition with DJI still obviously rankles Seydoux, who talked about the company at length.

In particular, he feels DJI has unfair advantages because it doesn't face the same disclosure requirements. Its ownership structure is murky. And he pointed to news stories last year that suggested DJI drones have a backdoor that is sending user data to the Beijing government. While China has a wealth of its own tech giants, DJI is the rare Chinese company that has claimed such power over a global market.

"I think this is the first time a tech market like this is dominated by a company where it's difficult to know who owns the company," Seydoux said. "I think this is very, very particular to the drone market. It's the only market led by a Chinese company that is very secret and very agile."

In January 2017, Parrot had to layoff 35% of its drone employees and sold off its hands-free kits and automotive accessories business. By early 2018, the company had begun its pivot to a commercial business with the launch of the Anafi drone, which included a 4k camera which the company thought would appeal to pros and amateurs alike. But it missed initial sales targets badly, selling only one-third of projections.

By the end of 2018, Parrot moved more directly into its commercial strategy that eventually led to all but winding down the consumer business. The following year, Seydoux launched a takeover bid to rescue the ailing company.

The strategy now: Focus on drones and professional solutions that are reliable in terms of performance and data security. It's a logical move, but there's still no guarantee of success.

Commercial Drones

Seydoux believes commercial drones play to Parrot's technical strengths.

"I think the drone business is moving in a direction technically which is more autonomy, more artificial intelligence," he said. "The reason is that the tasks that you want to do with drones are not easy to perform."

The target is large companies like utilities to help perform maintenance, surveillance, or inspections. Imagine drones being used to inspect large windmills so that a technician doesn't have to perform the dangerous tasks of climbing them.

On such missions, it's not easy to manually maneuver a drone. So flight paths ideally need to be automated. And when it comes to the data and images collected, the analysis also needs to be rapid and automated. To that end, Parrot acquired startups Pix 4D for image processing and Sensefly for drone mapping.

"The business of the drone is moving more and more into robotics for those tasks," Seydoux said.

That said, commercial drones remain a much smaller business. Indeed, Toulouse-based Delair, which makes fixed-wing commercial drones that target similar markets, announced it was spinning out its data platform last October into a new company because drone sales were not expected to become a robust market.

Seydoux understands the move but says he's more optimistic about the commercial sector

"Today, you don't have large quantities of drones used by telecom companies to inspect their assets or to inspect fields in agriculture," Seydoux said. "It's still a small business. Where we were selling millions of drones now only thousands are sold."

The key to succeeding is developing more autonomy and AI, he said, as well as more powerful imaging tools. The drones have to be able to fly by themselves to be useful and cost-effective and the analysis needs to be rapid and full of insights. And using all these tools need to be simple, just pointing and clicking to set flight paths.

If Parrot can get that formula right, Seydoux also believes the company could be in a more competitive position against DJI. Many of these commercial and government services that Parrot wants to target may be reluctant to work with DJI due to security concerns. Late last year, the U.S. government placed DJI on an "entity" list (as it had with Huawei), which restricted the company's access to U.S. technology and was seen as a possible prelude to a ban.

"I believe Chinese drones will not be accepted for most of the commercial tasks in the future," Seydoux said. "And I believe there is a lot of room for entrepreneurs to innovate in drones."

Signs Of Life

Anyone looking for some hopeful signs for Parrot's future should turn their gaze to the new version of the Anafi drone launched last June. The Anafi USA boasts enterprise-class data security, simple operations, a 32x zoom 4K HDR video, and a more rugged exterior. The company is pitching it to first responders, firefighters, search-and-rescue teams, security agencies, surveying, and inspection professionals.

As the name suggests, the drone is manufactured in the U.S., and two months after its release the U.S. Department of Defense approved it for military purchases, an important step toward landing defense contracts. In January, Parrot signed a major deal to provide drones to the French military.

That deal is not reflected in the company's 2020 financial report, which showed sales of software up, but hardware sales still tumbling amid the shift to the new strategy. Covid also put a dent in sales. But the company said its drop in North American sales was partially offset by sales of the new drones. In France, the picture is grimmer with sales down 42% last year.

Meanwhile, more than 26 years after starting Parrot, Seydoux is digging in harder than ever.

Having been confined off and on like much of France, he's re-engaged in all aspects of development.

"I think for the first time in 20 years, I have had the opportunity to write software," he said. "I think I've never worked so much. I'm working 7 days a week, 10 hours a day. I sleep at my computer and I'm managing the company and writing software. Writing code has always been very interesting. But I think now it's even more interesting than ever."

And for Parrot's future, the stakes for each line of code has never been higher.

Audio Goodness!

Join me and co-host Ethan Pierse each Monday and Thursday night at 7 p.m. CET for our French Tech News Clubhouse session.

🎙️ Also: Please subscribe to the French Tech News podcast, a weekly discussion with France's entrepreneurs, innovators, and venture capitalists.

In Other News...

AgTech startup Jungle raised €42 million (including €35 million in debt) for a vertical farming system that it claims is super efficient. It's the first investment out of Founders Future new impact fund. The goal is to make large-scale farming profitable. From Sifted.eu:

“We don’t claim to be instigating a revolution, we are part of an equation that wants to be a solution,” explains Gilles Dreyfus, who cofounded Jungle in 2015.

The big picture: This was part of a strong streak for AgTech in France. Last week, Babylone Growers raised €2 million for its hydroponic garden system. And Miimosa raised €7.5 million for its financing platform for farmers. Throw in companies like iFarm, which is using robotics to improve farming, and Agricool, which is using shipping containers to grow strawberries in urban areas, and France's AgTech ecosystem shows some real promise.

👋🏻 If you’re enjoying The French Tech Journal, please support the project by forwarding it to friends and sharing it on your social networks. You can also comment on this post. And if you have ideas for stories, tips, or just want to harass me, send me an email: chris@frenchtechjournal.com. 👋🏻