Back Market is an easy company to underestimate. But its platform for selling refurbished gadgets has made it one of France's fastest-growing startups. Not only has the company raised $176 million in venture capital, but its expansion into the United States has been explosive.

The company seems to have found the right idea at the right time. It leveraged a growing roster of factories that repair and restore consumer electronics to almost-new states. And it resonates with consumers who are more environmentally aware but are also looking for reasonable economic alternatives to the soaring price tags of items like smartphones.

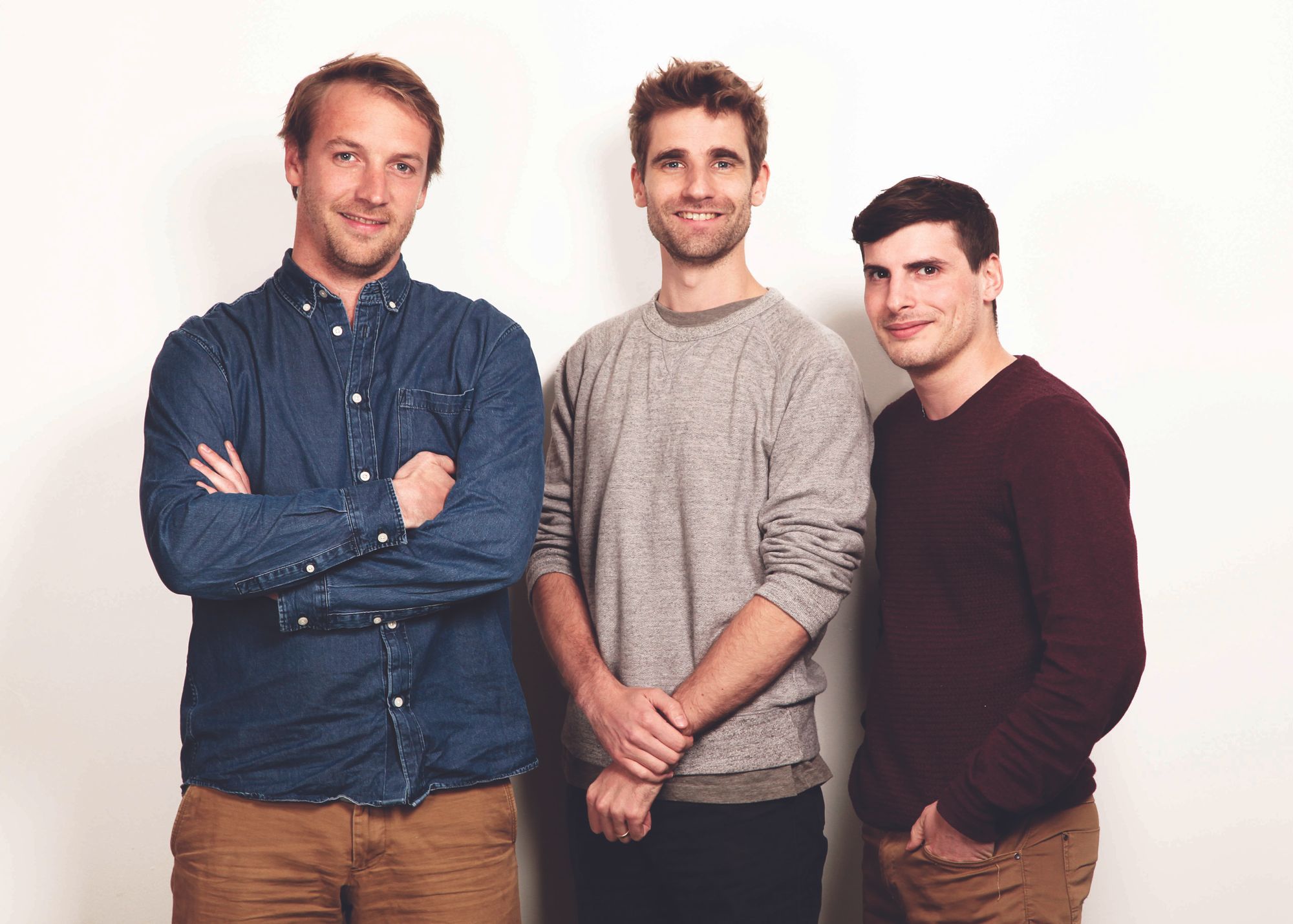

During a recent session on Clubhouse, Back Market co-founder and Chief Creative Officer Vianney Vaute and Serge Verdoux, who runs U.S. operations, joined us to talk about the company's journey and to offer some lessons about scaling.

Vaute said when they launched Back Market 7 years ago, the founders spotted a disconnect between those refurbishers and consumers who didn't know who to trust. The first time I spoke with Back Market for a story, I was surprised when they showed me videos of sophisticated factories designed to restore used gadgets. It was a far cry from the image I had of two people in a back room with a few specialty tools replacing cracked screens and broken batteries.

That was the same reaction co-founder Thibaud Hug de Larauze had when he first visited one of these operations while working for another company.