Fintech has become one of the most robust startup sectors across Europe, and France is no exception. The country’s entrepreneurs and political leaders have touted this as an area of enormous potential.

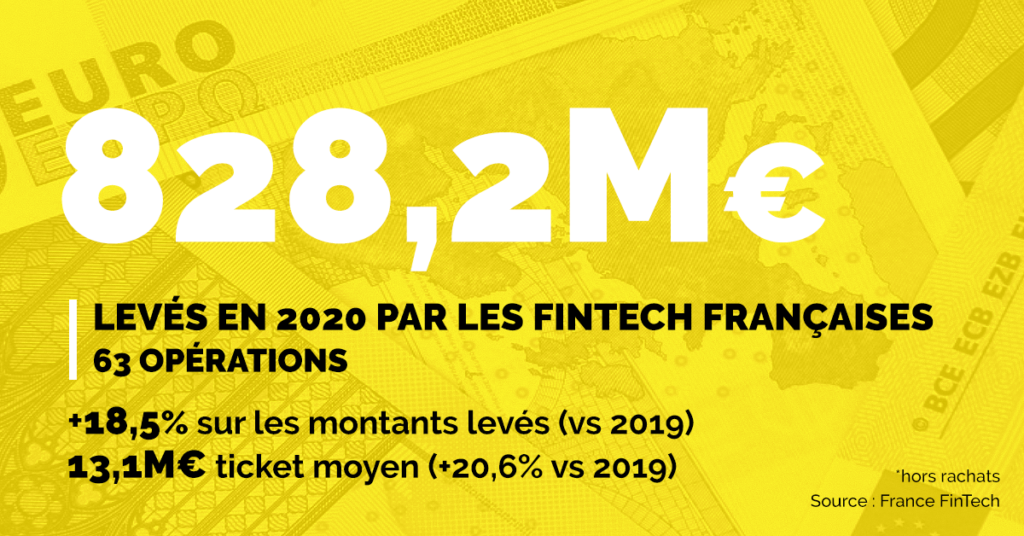

It seems investors agree. According to France FinTech, the professional association of Frances’s fintech companies (along with regtech and insurtech), fintech companies raised €828.2 million in 63 deals, up 18.5% from 2019.

The venture rounds driving those numbers, according to France FinTech included:

- Qonto: This neo-bank for professionals raised €104 million in January. Investors included Tencent and DST Global, along with previous investors Valar, Alven, Taavet Hinrikus, and Ingo Uytdehaage.

- Lydia: The company raised $131 million across a two-part round. Accel, the global fund, led the funding, along with previous investors China’s Tencent and XAnge.

- Dataiku: This big data and AI startup raised $101 million in August. ICONIQ Capital led the investment which also included money from Alven Capital, Battery Ventures, Dawn Capital, and FirstMark Capital. (Side note: This seems like a stretch to claim as a fintech deal. Dataiku works across a wide range of sectors, including “retail, e-commerce, health care, finance, transportation, the public sector, manufacturing, pharmaceuticals.” Though Dawn Capital does focus on fintech, so 🤷.)

- Luko: The home insurance startup raised $60 million in December. EQT Ventures led the round of funding along with previous investors Accel, Founders Fund, and Speedinvest.

- Pigment: The data-driven financial decision-making tool raised €25.9 million in December. Blossom Capital led the round of funding, which also included FirstMark Capital and Frst. Angel investors such as Paul Melchiorre (former CEO of Anaplan) and David Clarke (former CTO of Workday) also participated.

Also noteworthy, in 2020 the average round increased 20.6% to €13.1 million, a trend that tracks across global venture capital as investors turned to established startups seeking later rounds during the pandemic. Having three rounds over €100 was also a bit of a milestone, along with a growing number of international investors.

As for France’s ongoing fintech ambitions, 2021 has already gotten off to a strong start.

This week, accounting startup Pennylane raised $18.4 million to expand its roster of business tools. Global Founders Capital and Partech led the funding. And banking platform TagPay raised €25 million in a round led by Long Arc Capital.

Finally, Orange Bank acquired fintech startup AnyTime to offer professional digital and mobile accounts. Founded by Damien Dupouy and Thierry Peyre, this is the kind of exit France wants to see to revitalize incumbents and generate returns on VC investments.

Of course, this is just one week. But it’s a good omen for the rest of the year.

Speaking of exits…

The French Tech ecosystem could boast of at least two others this week:

And just today:

On the latter, it’s worth reading Elaia’s Marc Rougier’s post on the firm’s history with Acorus Networks, an anti-DoS-as-a-Service startup that Elaia first backed in 2018. Volterra acquired Acorus last year, and now F5 has bought Volterra. Rougier doesn’t disclose the return but having invested at the Series A round, it’s a good bet the firm did pretty well on the deal.

The big picture: Exits, exits, exits. This is still the big soft spot for France. While government officials tend to obsess about wanting more independent tech giants, the reality is that a regular flow of small and mid-sized acquisitions is what primes the entrepreneurship pump and puts more money back into the system.

The Week In Venture Capital

(See above for TagPay and Pennylane)

Too Good To Go: €25.7 million to address food waste.

Volta Medical: €23 million for AI that detects heart irregularities.

50inTECH: €600,000 for the social accelerator for women in tech.

Kinetix: €500,000 for AI-driven 3D animation.

And in a final funding note…Last month I noted that French startups had raised a record amount in 2020 of €5.2 billion, according to Atomico’s State of European Tech report. But tracking venture capital is a notoriously squishy process. So it’s worth noting that Maddyness reported that the total for 2020 was €4.3 billion, a 6% drop from 2019. Meanwhile, La Tribune reported the total as €5 billion, down .1%.

Anywhere in this range, the year was a good one despite the pandemic.