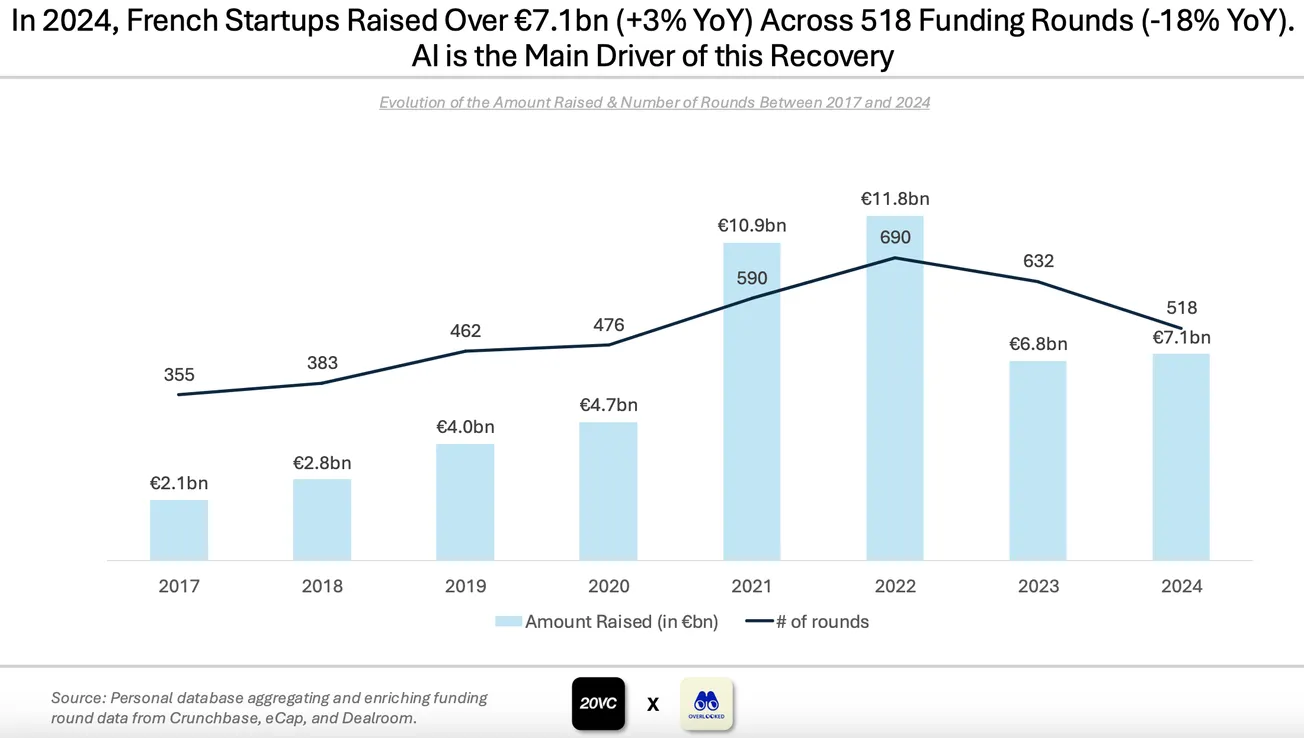

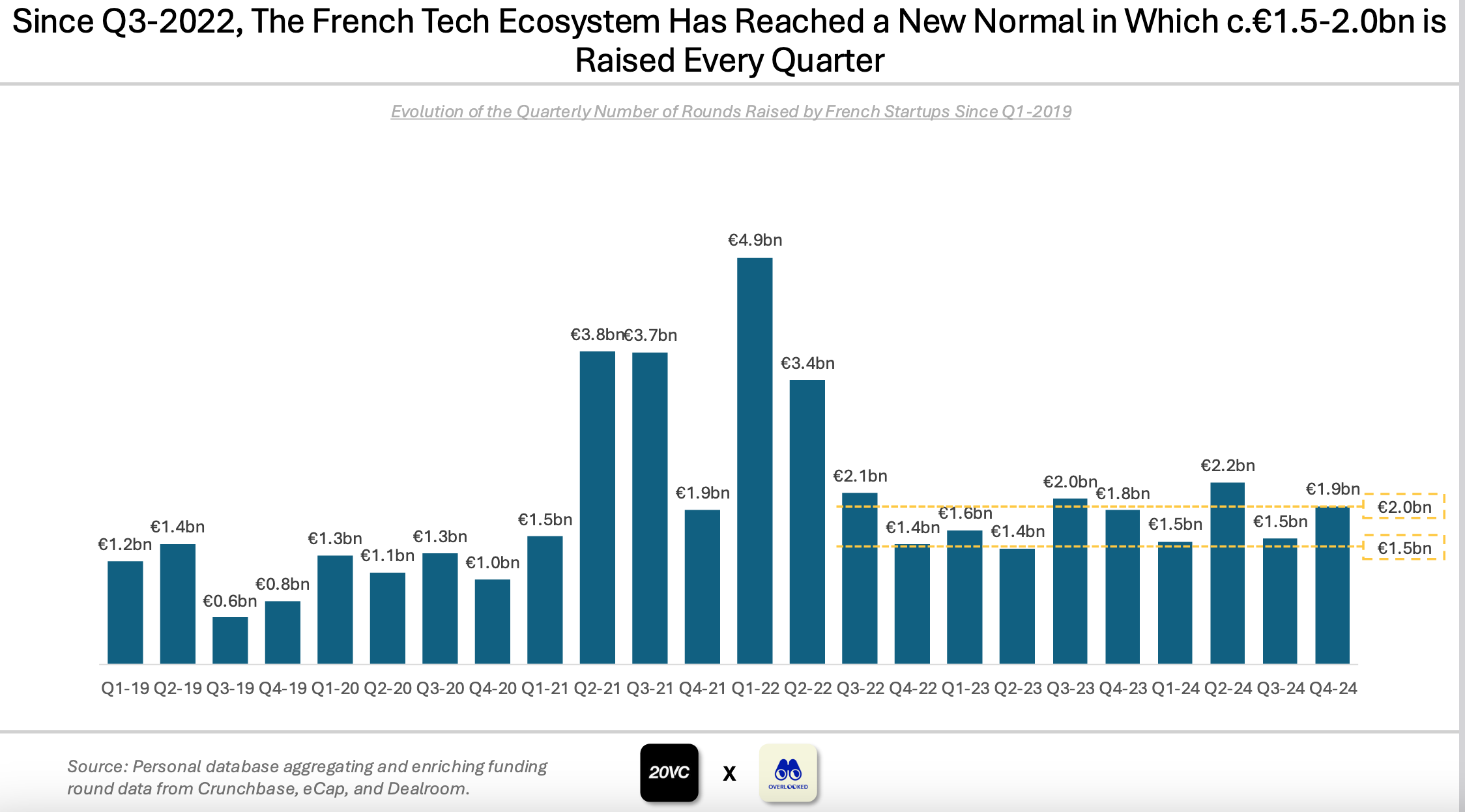

The French tech ecosystem showed resilience in 2024, with startups raising €7.1 billion (+3% YoY) across 518 funding rounds, according to The State of the French Tech Ecosystem 2024 report from 20VC.

But 2024 was also a story of the Haves and the Have Nots. AI has emerged as the major growth engine of French tech (as is the case just about everywhere), accounting for 27% of all capital raised (+82% YoY). Without AI investments, the ecosystem would have actually declined by 11% year-over-year, highlighting how this technology is reshaping the landscape, according to the report authored by Alexandre Dewez, the former Eurazeo VC who moved to 20VC last year.

I'll look more closely at the AI numbers in the next La Machine newsletter. But overall, the headline numbers suggest stability.

The ecosystem added three new unicorns in 2024 - Pennylane, Pigment, and Poolside - bringing the total to 45 French companies that have achieved billion-dollar valuations. Notably, 71% of these unicorns are still likely worth over $1 billion, demonstrating the underlying strength of these companies.

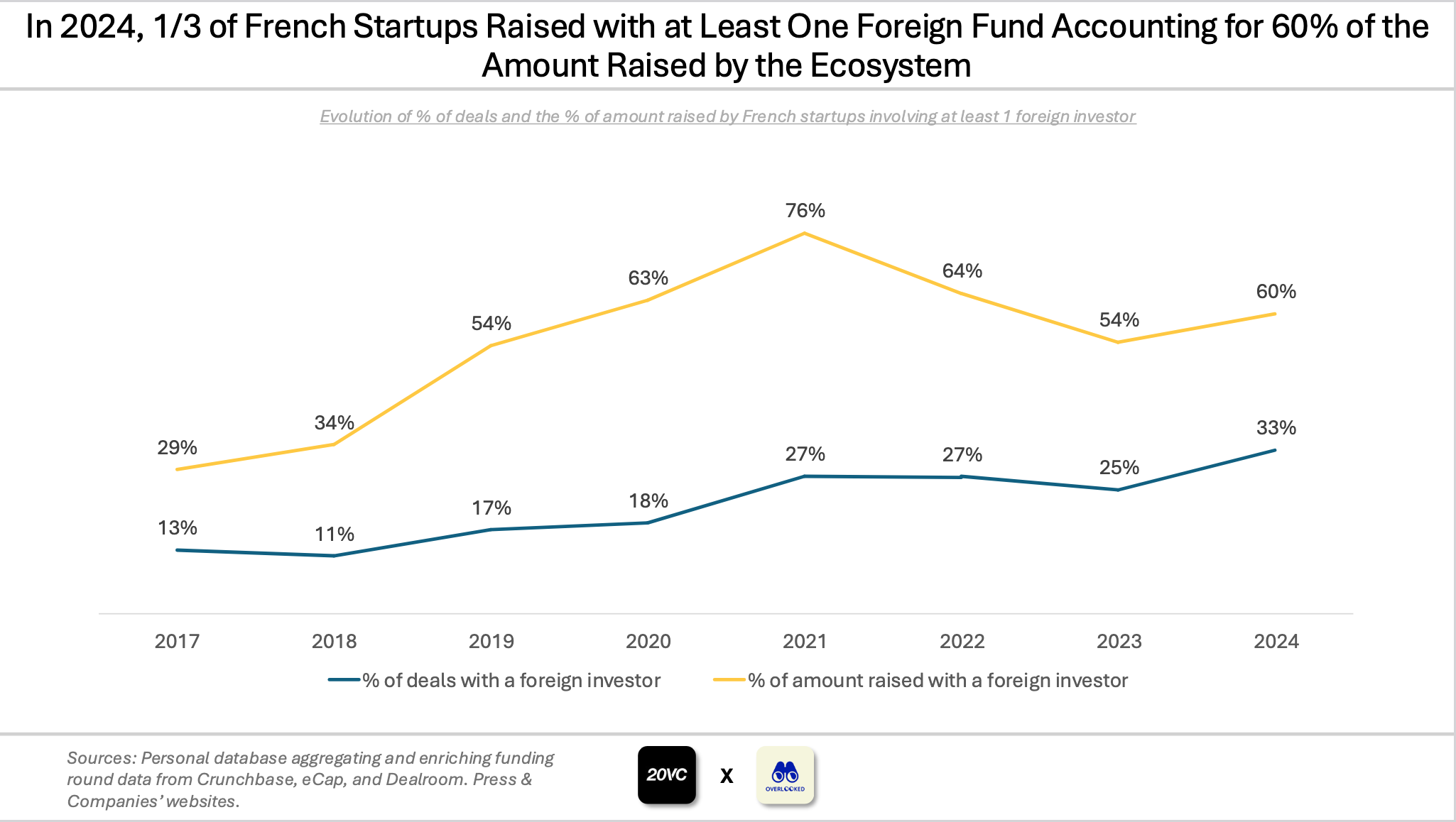

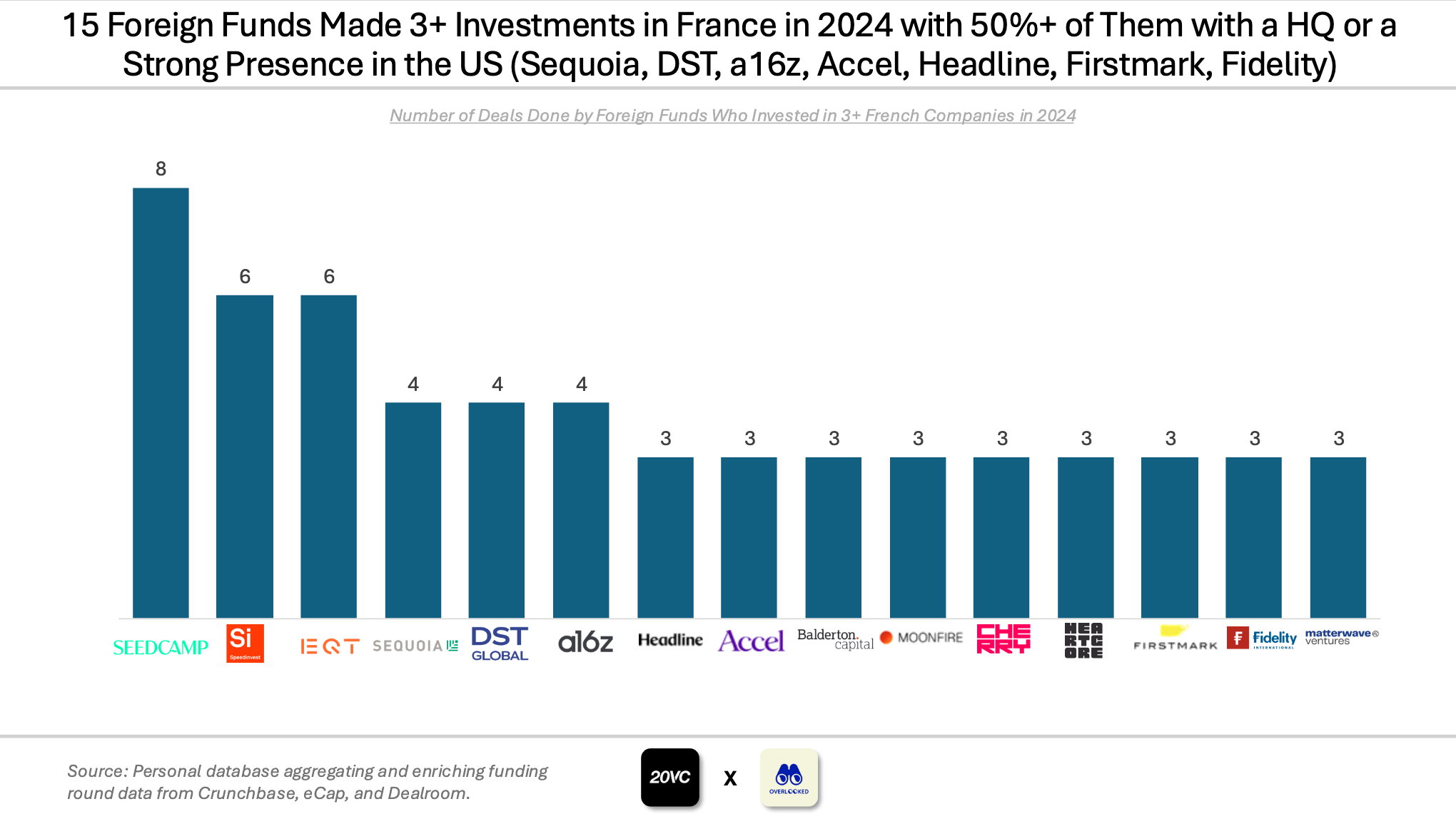

Meanwhile, foreign investors continue to show a strong interest in French startups.

The funding environment remains highly competitive, with multiple tiers of investors actively participating:

- Traditional UK funds like Accel, Index, and Balderton maintain a steady presence.

- Emerging pan-European investors such as 20VC, Blossom, and Plural are increasing their activity.

- US funds were involved in 36% of the total capital raised, showing strong international interest.

- Local French investors Eurazeo, Elaia, and Serena led domestic activity.

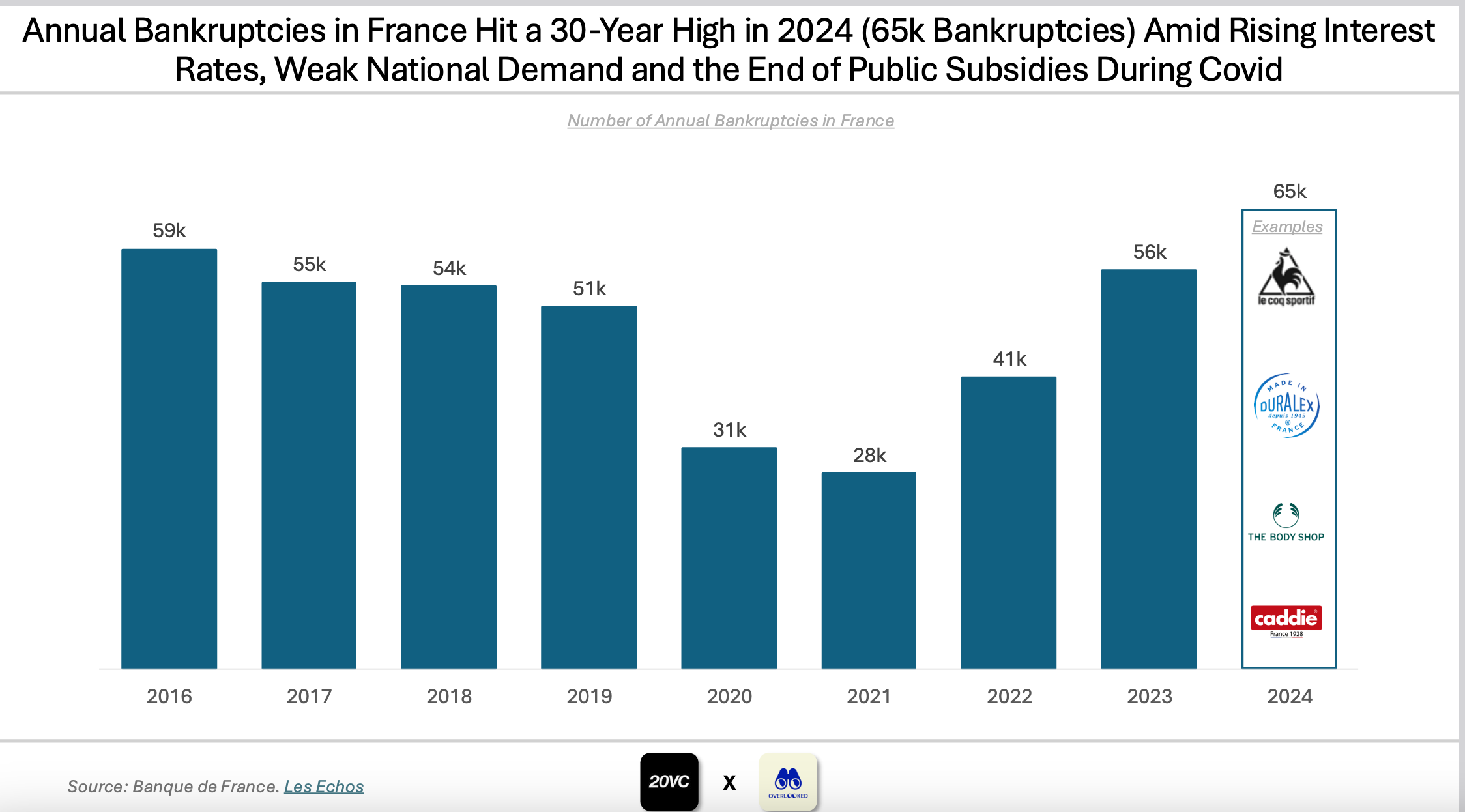

However, there are signs of stress in parts of the ecosystem. The number of seed rounds hit a five-year low, and several high-profile bankruptcies occurred, including Luko, Masteos, and Ynsect. This suggests a healthy rationalization of the market and an increased focus on sustainable business models rather than growth at all costs.

Exits

The exit landscape showed mixed signals in 2024. While there were three significant M&A deals above €200 million (Preligens, BeReal, and Lumapps), traditional IPO activity remained muted.

Instead, the ecosystem saw unconventional public listings through Planisware, Younited, and LightOn. The experience of Believe, which went private just three years after its IPO, highlights the challenges French tech companies face in public markets.

Currently, Dewez believes that only five French unicorns are ready for IPO, having achieved the necessary scale of €300M+ in annual recurring revenue with 20-30% growth and a path to profitability: Backmarket, Dataiku, Doctolib, ContentSquare, and Qonto.

Outlook

Amid the turbulence, Dewez believes there are still a number of particularly encouraging trends.

This includes is the emergence of "startup mafias" - successful companies spawning new generations of entrepreneurs. The report identified 1,900 alumni from French unicorns who have gone on to found their own startups, with Criteo, Veepee, and Doctolib producing the largest number of entrepreneurs. This creates a powerful flywheel effect, as experienced founders and operators reinvest their knowledge and capital back into the ecosystem, the report says.

The French tech ecosystem also showed increasing maturity in specialized sectors. Climate tech remained significant despite a slight decline in its share of funding, while infrastructure funds are stepping in to provide capital for industrial scaling in sectors requiring heavy capital expenditure. Additionally, emerging micro-funds are playing an increasingly important role in the pre-seed and seed landscape, often outpacing traditional local funds in identifying early opportunities.

Looking ahead to 2025, the ecosystem faces both opportunities and challenges. AI is expected to continue its dominant role, potentially reaching 40% of total funding.

However, questions remain about the sustainability of some AI valuations, and at least one prominent AI startup is predicted to face significant challenges.

The ecosystem also needs to address several key gaps, including:

- Stronger bridges between academia and startups

- More experienced talent in growth-stage operations

- Better access to public markets

- Increased density of serial entrepreneurs

The report also outlines three things that are holding the ecosystem back:

- "French entrepreneurs are too risk-adverse to create their own category. This is particularly relevant for experienced operators or serial entrepreneurs who have already found success and are able to take bolder risks. Entrepreneurs will often opt to replicate a successful U.S. model or enter an existing category (e.g. expense management, procurement, AI-powered customer support, KYB). In these cases, you end up competing for customers and funding with 5-10 other early stage European companies started around the same time. Failing to create a unique company limits your upside potential and forces you to compete in a saturated market."

- "Achieving 3x growth to reach $1m in ARR or following the T223 framework to hit $100m in ARR is not enough to create an outlier company - especially in the AI era, in which companies are shattering traction records (e.g. OpenAI, ElevenLabs). Additionally, French startups often place more focus on engineering and product development than on commercialisation. The most successful companies consistently outperform traditional growth benchmarks and excel at building high-performing sales organisations (e.g. Doctolib, Alan, Contentsquare in France)."

- "Like Germany and the UK, France’s market is large enough for startups to build a decently sized business without having to expand abroad. However, the perverse consequence is that French startups often delay their international expansion for too long. Whether your product is global (e.g. Mistral, Poolside, Pigment) or regional (e.g. Qonto, Payfit, Pennylane), it’s crucial to demonstrate the ability to sell beyond France by Series A. Delaying this process opens the door for emerging competitors and can hinder the development of an international culture within the company."