Welcome...

👋 A pillar of the French government's sprawling strategic plan to accelerate the nation's startup ecosystem has always been to get its corporate giants off the sidelines and into the innovation game. Buying stuff from startups, investing in them, acquiring them. Whatever.

Over the last few weeks, those efforts have shifted into a higher gear, creating a sense of urgency.

Last year, French Digital Minister Jean-Noël Barrot announced the creation of a program called Je choisis la French Tech to find ways to incentivize big corporates to purchase more products and services from startus. The goal: Double sales from startups to Big Companies and government by 2027.

As part of that effort, Bpifrance in January officially launched DAPI - Directions Achats Pour l'Innovation. (The French love their acronyms!) The government agency Directions Achats in partnership with Hub Bpifrance will facilitate meetings and find ways to reduce risks in buying from startups. IE, what if I buy a critical piece of tech from a startup and it goes poof in a few months? A Bpifrance study indicated that only 8% of purchasing managers at large French enterprises rank innovation and tech in their top 5 priorities.

Meanwhile, the French Tech Corporate Community, created in 2020 by France's Economy Minister, organized a soirée of its ambassadors that represent its 200 enterprise and startup members. The event was co-hosted by Comet, a global tech talent recruiter for enterprises. The theme was similar: Corporations and startups need to forge closer relations for the sake of both.

It remains to be seen how effective any of these programs will be. But they are pretty good examples of how France's government continues to play a central role in the ecosystem. It identifies barriers and shortcomings. It develops a possible solution. And then creates structures around those themes to push them forward.

As France Digitale CEO Maya Noël explains in our latest Spotlight Interview, her association has taken these efforts even further with its complimentary programs because improving these ties is seen as a vital way to catalyze startup growth.

"We now have half of France’s CAC 40 on board and co-organize weekly events to ensure growth commitment with the aim of doubling the current percentage of startup orders," she said.

And speaking of our latest newsletter:

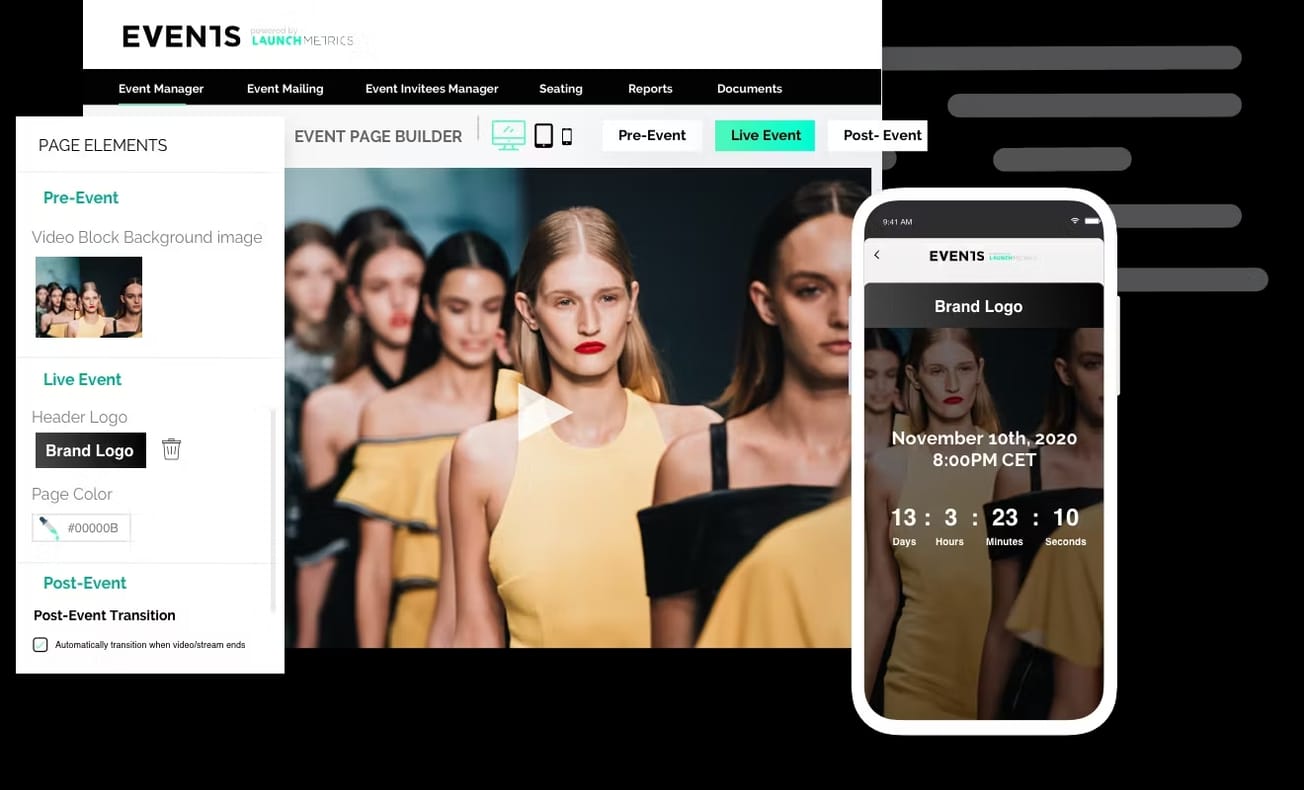

- Deep Dive: In the wake of a $240 million deal, CEO Michael Jaïs discusses how the company's focus on practical uses of AI helped it become indispensable to fashion, beauty, and luxury brands.

- Spotlight Interview: France Digitale's Noël discusses weathering the startup storm of 2023 and her tech forecast for 2024.

- The Big Deals: Aqemia, Latitude, Greenerwave, Kinvent & More!

Tech Talk

🐮 ⬆️ Agrilife Studio, a new startup studio dedicated to Agritech just announced a 1st funding round of €25 million. The moolah was provided by prize institutional investors; France 2030's French Tech Accélération 2 Fund, Crédit Mutuel Alliance Fédérale, and Crédit Mutuel Arkéa. The goal: To launch 10 or so sustainable startups focused on agriculture and healthy and eco-friendly food over the next 7 years. 🥬

🧠 ⬆️ According to Bloomberg, several brilliant minds from Google's Deepmind are launching a new AI startup, pre-named Holistic. Talks with investors are apparently underway to raise a mind-boggling $200 million. And that's not all: The masters of machine learning are thinking of setting up shop in Paris. Looks like the dawn of a new era for AI Made in France. 🦾

🤝 ⬆️ Welcome to the Jungle, the scaling French employer branding recruitment platform, bought its British Counterpart, Otta, to create a leading candidate-centric job search experience across Europe and the USA. Details of the deal were undisclosed. 🙅💂♂️🇬🇧

🤑 ↔️ According to Les Echos, French banking giant, Societe Generale, is in the process of selling off its digital neobank for pros, Shine. SG bought Shine in 2020, hoping to catalyze its fintech future. Alas, 'twas not to be. Rumor has it that several potential buyers have already been approached. SocGen has neither confirmed nor denied the rumor, preferring to stay schtum. 🤐

💶 ↔️ The Insurtech soap opera known as Luko has finally reached its series finale. After an initial €14 million deal to buy the ailing company fell through, Luko landed back in bankruptcy court late last year. Now Allianz Direct, a subsidiary of German insurance giant Allianz, has been approved to buy Luko for €4.3 million, according to Sifted. The good news: All 112 remaining employees at Luko keep their jobs. 🙏 The bad news: the investors who bet $75 million on the company are left holding the bag. 💇

The Deep Dive: Lessons From A French AI Exit

AI-powered Launchmetrics announced last month that a majority of its shares will be acquired by Lectra, a French company with an international reach that provides a range of advanced software and data analytics tools to large companies in the fashion, automotive, and furniture markets. Lectra has an agreement to potentially acquire the remaining shares over the next few years for a valuation that could reach $240 million – about 5 times Launchmetrics’ ARR.

The deal is a major milestone in a journey for Launchmetrics that started almost 20 years ago and traveled across several waves of AI hype. CEO Michael Jaïs explains how a decision to remain focused on core markets of fashion, beauty, and luxury allowed the company to build a practical use case for its AI platform that became indispensable in those industries.

“Because the DNA of the company is focusing on fashion and beauty we've got a real track record,” he said. “Not only do we sell to the industry, but we are really part of this industry.”

Spotlight Interview: France Digitale CEO Maya Noël

After the tech highs of the past two years, France’s startup scene, along with that of the rest of the world, hit a low patch. 2023 was the year when growth investment slowed to a practical halt, valuations came crashing down, and several major tech companies made sizeable layoffs.

Are things still as gloomy as all that for French startups, or is there a silver lining to the cloud that hangs over the ecosystem? We tracked down Maya Noël, CEO of France’s national tech association France Digitale, to get the low down on 2023 and find out what the forecast is looking like for 2024.

"If you zoom out over a decade, France's trajectory has remained decidedly positive," Noël said. "Despite its challenges, at France Digitale, we view 2023 as less of a harsh downturn and more as a phase of normalization following the overly optimistic valuations and funding frenzy of the past 3 years."

The Big Deals

What: Aqemia is a drug discovery pharmatech.

Why: To rapidly design innovative drug candidates for dozens of critical diseases using AI and quantum-inspired physics.

Funding: €30 million (Series A extension)

Who: Co-Founders are Emmanuelle Martiano-Rolland & Maximilien Levesque

Investors: Wendel Growth, Bpifrance (Large Venture fund), Eurazeo & Elaia.

What's Next: The deep tech will leverage the new funding to accelerate the development of its proprietary pipeline of drug discovery projects and assets, with the latter already counting several projects being tested in animals, mostly in the fields of oncology and immunology-oncology. In December, the company announced a major research partnership with French pharmaceutical giant Sanofi valued at $140 million.

What: Latitude manufactures the Zephyr launch vehicle, a reusable space launcher.

Why: To provide small satellite operators with a fully dedicated launcher to reach the space data they want to access.

Funding: €27 million

Who: Co-Founders Stanislas Maximin & Ilan Saidi-Bekerman

Investors: Blast.club, Crédit Mutuel Innovation, Expansion, UI Investissement, Audacia, DeepTech 2030, which is a France 2030 fund managed by Bpifrance.

What's Next: The funding will go towards financing the development, testing, and manufacturing of its Zephyr launch vehicle, and recruiting new talent.

What: Greenerwave, an industrial deeptech specializing in the control and orientation of electromagnetic waves.

Why: To drastically improve. the energy efficiency of equipment, making it more economical, environmentally friendly, and less dependent on semiconductors.

Funding: €15 million

Who: Co-Founders Geoffroy Lerosey & Mathias Fink

Investors: Fonds innovation défense (l’Agence de l’innovation de défense & Bpifrance), Safran Corporate Ventures, Intelsat, BNP Paribas Développement & Plastic Omnium.

What's Next: The new cash will be used to accelerate its growth, notably via the development of a sales department, and expand its product range.

What: Kinvent, a physiotherapy startup offering connected physiotherapy devices and services.

Why: To transform the practice of physiotherapists and fitness trainers through the collection and analysis of bio-mechanical data (force, balance, range of motion etc.).

Funding: €16 million

Who: Founder Athanase Kollias

Investors: Uni.Fund, Sofilaro, BADGE, Eurazeo & Business Angel/pro footballer Raphaël Varane

What's Next: The 3rd funding round will go towards Kinvent's international expansion and funding R&D projects.

👋🏻 If you’re enjoying The French Tech Journal, support the project by forwarding it to friends and sharing it on your social networks. You can also comment on this post. And if you have ideas for stories, tips, or just want to harass us, shoot us an email: chris@frenchtechjournal.com / helen@frenchtechjournal.com 👋🏻