Want to reach an audience of more than 30,000 readers each month? The French Tech Journal is the leading English-language media platform covering France's dynamic tech ecosystem. With 31,000 + engaged readers across key global markets and consistently high engagement rates, our sponsorships provide unparalleled access to decision-makers in French tech.

👋 Welcome to our weekly recap of the big news + funding in the French tech ecosystem this week. In this week's French Tech Wire,

👀 Deep Dive: MSInsight CEO and co-founder Arnaud Dr. Cutivet explains how the company's breakthrough technology could point to the future of cancer detection and treatment.

👀 Deep Dive: Yubo CEO and co-founder Sacha Lazimi breaks down how the social media company reached profitability by focusing on a different experience for and business model for its Gen Z user base.

Subscribe to The French Tech Journal to access all the articles and archives.

Chris O'Brien + Helen O'Reilly-Durand

✊ Sponsored by: 🙌

EU-Startups Summit: 20% Discount

Join Europe’s top startups, investors, and innovators for 2 days of networking, inspiration, and learning. The next edition will take place on April 24-25, 2025, in sunny Malta. Bringing up to 2500 attendees, it will be bigger and better, with more exciting opportunities and connections than ever before! Whether you’re launching your first startup or scaling a unicorn, this is the event you won’t want to miss.🦄

Use the code FRENCHTECH20 to get 20% off tickets until April 2!

🤔 Edito 🤔

If you've been waiting for startup funding in France to hit rock bottom, well, you might want to cover your eyes for this next part...

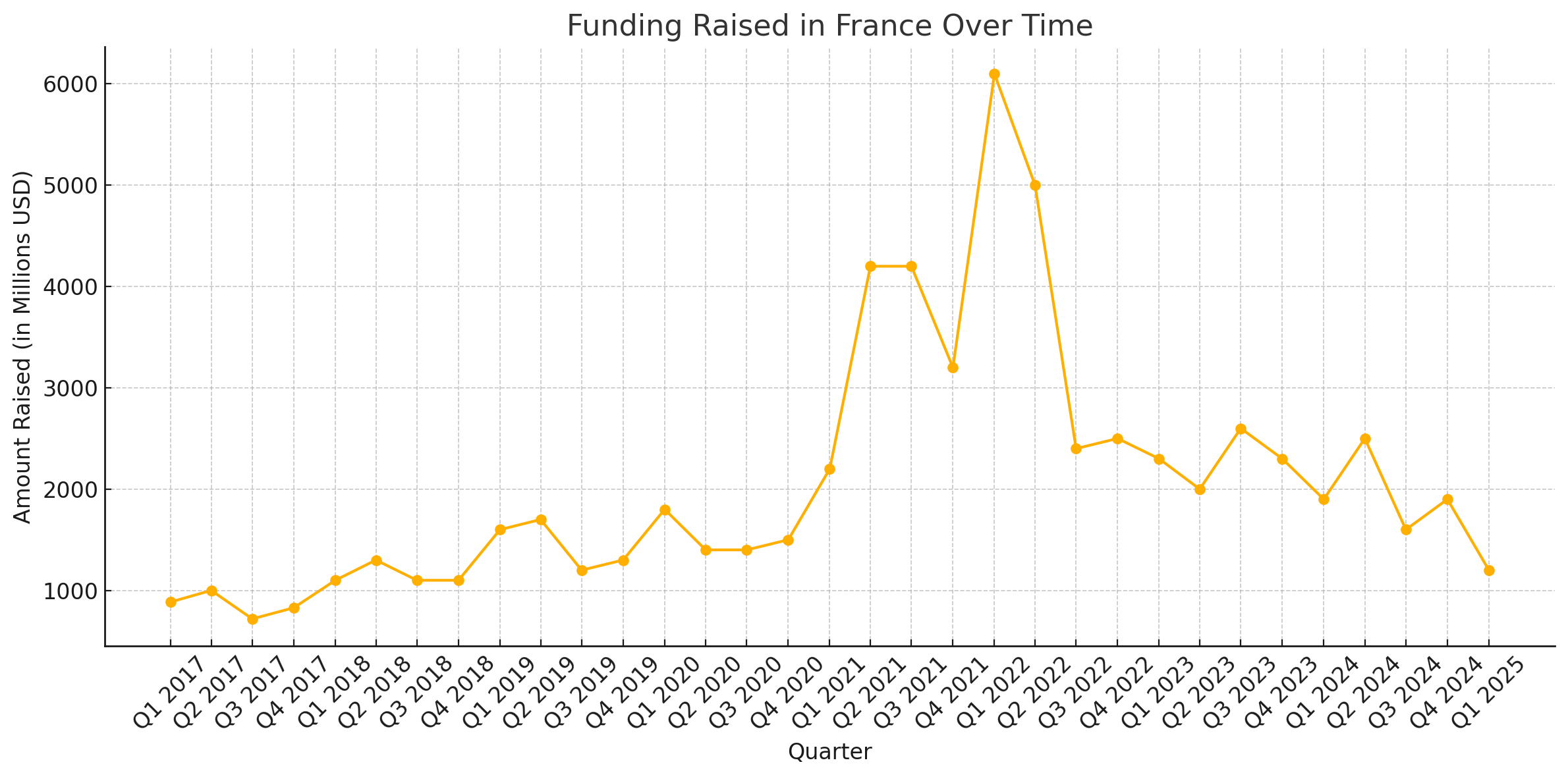

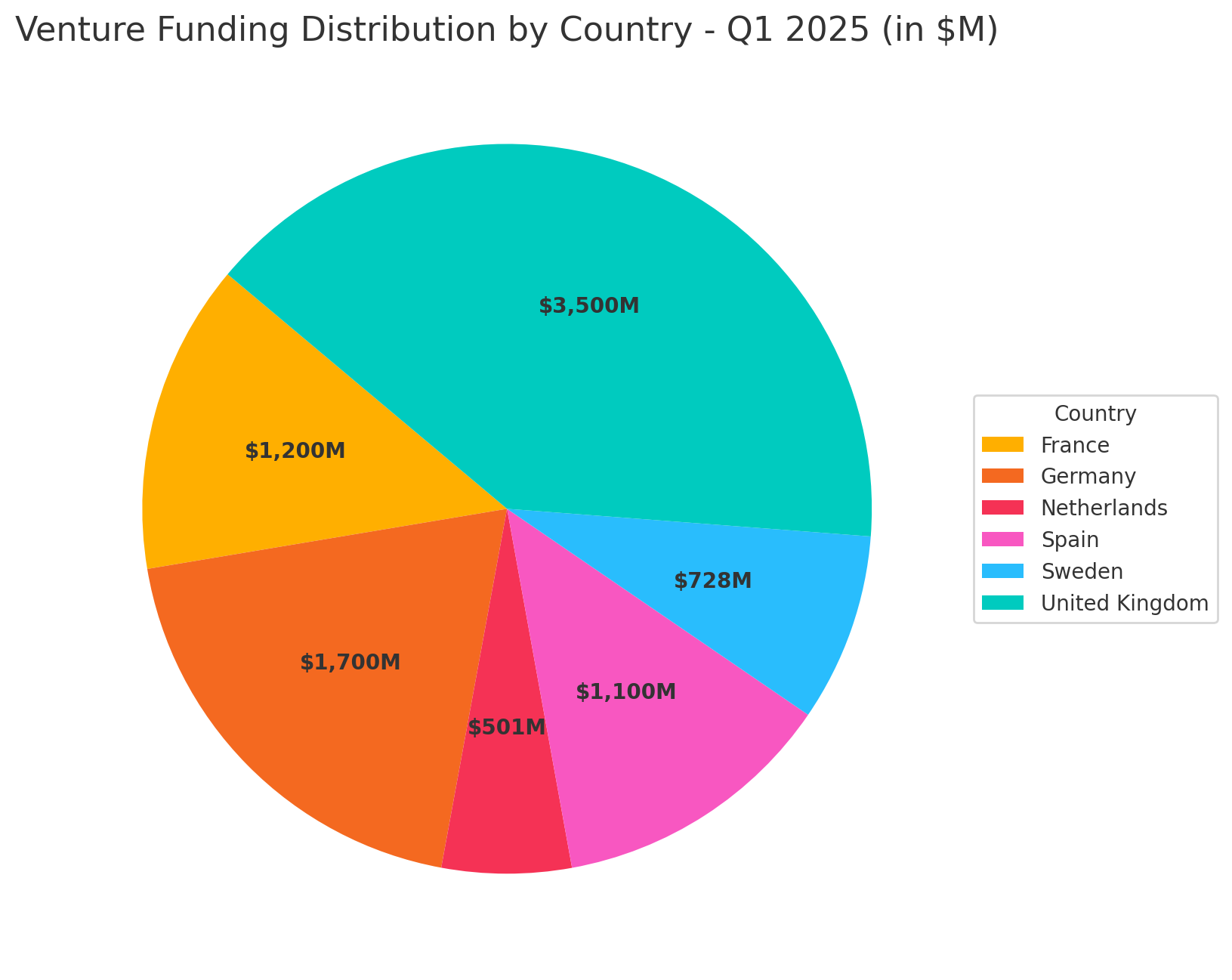

As Q1 2025 winds down, French startups have raised a mere $1.2 billion – the most anemic single quarter since Q3 2019. That amount puts France on pace to raise $4.8 billion in 2025, which would be well off the pace of the $7.9 billion raised in 2024 — which was well off the pace of the $9.2 billion raised in 2023 – which was well off the pace...well, you get the picture. Funding peaked in 2022 with $16 billion, and since then has been in free fall.

The optimists had taken some solace that annual numbers remained above pre-pandemic levels, suggesting that 2021-2022 were frenzied aberrations, but the long-term trends were still positive.

It's getting harder to make that case as France seems poised to return to something closer to the $4.6 billion raised in 2018.

It appeared that France was set to ride the AI wave, but the mega rounds raised by the likes of Mistral AI, Poolside, and H were blips that helped prop up annual numbers last year. Meanwhile, bankruptcies continue to rise, and the exit market remains tepid.

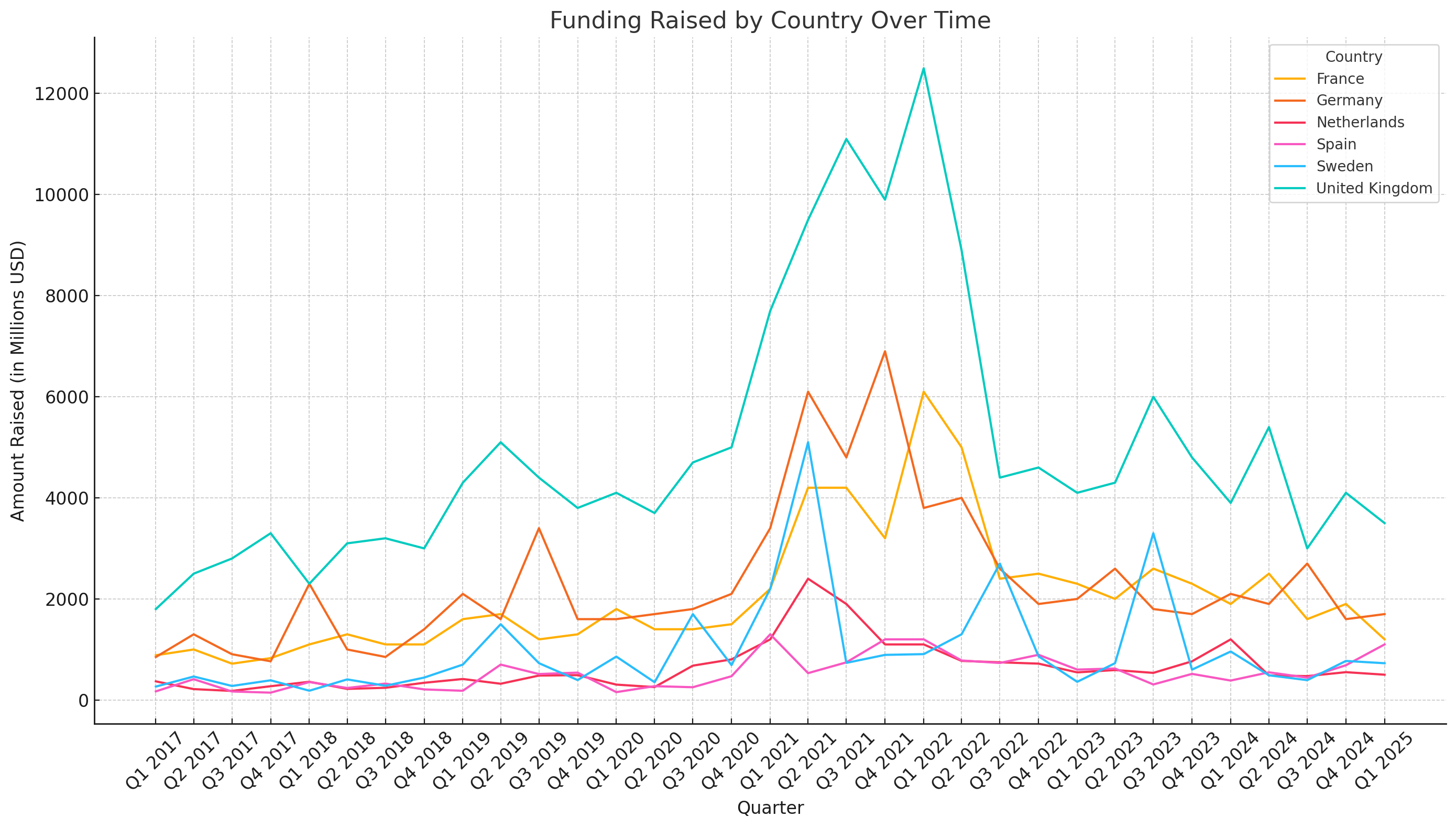

The good news – such as it is – is that France is certainly not isolated. Germany, for example, also saw a dip, but its Q1 2025 funding came in at $1.7 billion, relatively steady compared to $2.1 billion in Q1 2024. The Netherlands, while smaller in absolute terms, raised $501 million, down from $1.2 billion a year earlier.

Perhaps the other country currently getting spanked just as hard as France is the UK, which hit a peak quarterly funding of $12.5 billion in Q1 2022 but now has fallen to $3.5 billion in Q1 2025.

Spain, on the other hand, bucked the trend with a surprising uptick - raising $1.1 billion in Q1 2025, nearly triple its Q1 2024 figure of $385 million, and almost enough to knock France out of the third slot in Europe. Sweden also experienced a modest dip but maintained relatively strong levels at $728 million compared to $960 million in Q1 2024.

What's to be done? It's not clear. Perhaps this is another chill brought on by economic uncertainty created by a certain country's new leadership, which has introduced new political and economic chaos in the macroeconomic ether. Unfortunately, with France facing its own political upheaval and a heavy debt load, there likely isn't the political or financial will to launch a massive bailout of the nation's startups as was the case during the pandemic.

What is clear is that the nation faces a stress test that will likely reveal whether the French tech boom of the past decade was a fundamental shift – or an illusion.

Chris O'Brien

🚀 Tech Talk 🚀

🪦☹️ ...as if to emphasize the funding struggles... Talent.io, once Europe’s leading tech recruitment platform, filed for bankruptcy and was acquired by Davidson Consulting via commercial court proceedings in March 2025 - just after celebrating its 10th anniversary. Founded in 2015, Talent.io quickly rose to prominence, with 175 employees across 5 countries, matching up to 200 software engineers/month with jobs at its peak. It was part of a wave of platforms that disrupted traditional tech hiring.

However, cracks started showing in mid-2022, or as co-founder Jonathan Azoulay wrote: "Then we went through what some VCs call 'The God Damn Cycle.' " The post-COVID tech slowdown and VC funding freeze hit the sector hard. Revenue plunged 80% in 18 months. AI changed hiring priorities, reducing the need for traditional coding roles. Competitors like Hired.com, Triplebyte, Vettery, and Honeypot also shut down. LinkedIn's AI-enhanced dominance further marginalized niche recruitment platforms.

Talent.io entered judicial reorganization in Sept 2024. Azoulay had returned to the CEO role in 2023 to save the company, but market conditions made a turnaround impossible. Despite restructuring and downsizing, the plan for continuation wasn’t viable. In March 2025, Davidson Consulting took over, salvaging the freelance business but planning to wind down the permanent hiring division. Azoulay noted that the journey was filled with key decisions, including rejecting an €80M (yowch!) acquisition and a €40M fundraising round. | LinkedIn, Maddyness

💸🟢🔬Lest you think there is only reason to despair...Daphni has raised €200 million for a new fund focused on early-stage, science-based startups dedicated to climate transition and sustainability, with plans to reach €250 million by the end of the year. The fund aims to invest in 40 European startups across fields such as life sciences, biology, physics, chemistry, and mathematics, offering initial investments between €1 million and €8 million, with the possibility of follow-on investments up to €15 million per company. Daphni intends to source deals from Europe's top universities and research institutes, capitalizing on the growing trend of researchers transitioning from fundamental to applied research in entrepreneurship. | Sifted, Maddyness, LinkedIn

🙏🧑🚀 Then there is Founders Future, the venture capital firm founded in 2018 by Marc Menasé, which is accelerating despite the broader slowdown in the French tech ecosystem. The firm announced a new capital investment from CMA CGM, joining existing shareholders MACSF and the Dassault family, who together now hold 25% of the company. As part of its expansion, Founders Future is opening an office on the East Coast of the United States and launching a $250 million growth fund, targeting European investors to support its portfolio startups in scaling across the U.S. At the same time, Founders Future is broadening its investment scope beyond seed funding, with the goal of managing €1 billion in assets by 2030. Finally, the firm is launching a kind of “VC fund factory,” offering internal legal, finance, and compliance services to individuals looking to start their own funds—an initiative responding to regulatory challenges and gaps in the market. | Les Echos

🪙🏦 France hopes to take a major step forward in the crypto economy. State bank Bpifrance unveiled an ambitious plan to invest up to €25 million directly in digital assets, marking a pioneering move among global sovereign funds. This new strategy builds on nearly a decade of blockchain investment, with over €150 million already deployed into startups and crypto-focused funds. The aim is to support French innovation in areas such as DeFi, tokenization, identity, and blockchain infrastructure. On the same day, Fipto, a fintech specializing in stablecoin payments, became the first company in France to combine a Payment Institution license with crypto asset registration (PSAN and PSAV). This regulatory milestone allows Fipto to control the entire fiat-crypto payment chain, offering fast, compliant, and borderless payments to businesses. With the stablecoin market growing rapidly—over $7.6 trillion in annual volume—Fipto is positioning itself as a European leader in blockchain-based payments.

🤑 Speaking of the mighty hand of the government, Tibi 2: Electric Boogaloo was launched by Emmanuel Macron in June 2023. The goal was to mobilize €7 billion from institutional investors to support high-growth French tech startups, following the success of the first Tibi initiative. Midway through the sequel, which runs until the end of 2026, nearly half of the committed funds have already been deployed by 35 institutional players, including major insurers like AXA and Allianz. These funds have supported 19 unicorns and 60 top startups such as Mistral, Qonto, and Alan, although foreign—especially American—investors still play a dominant role in large fundraising rounds. | Journal du Net

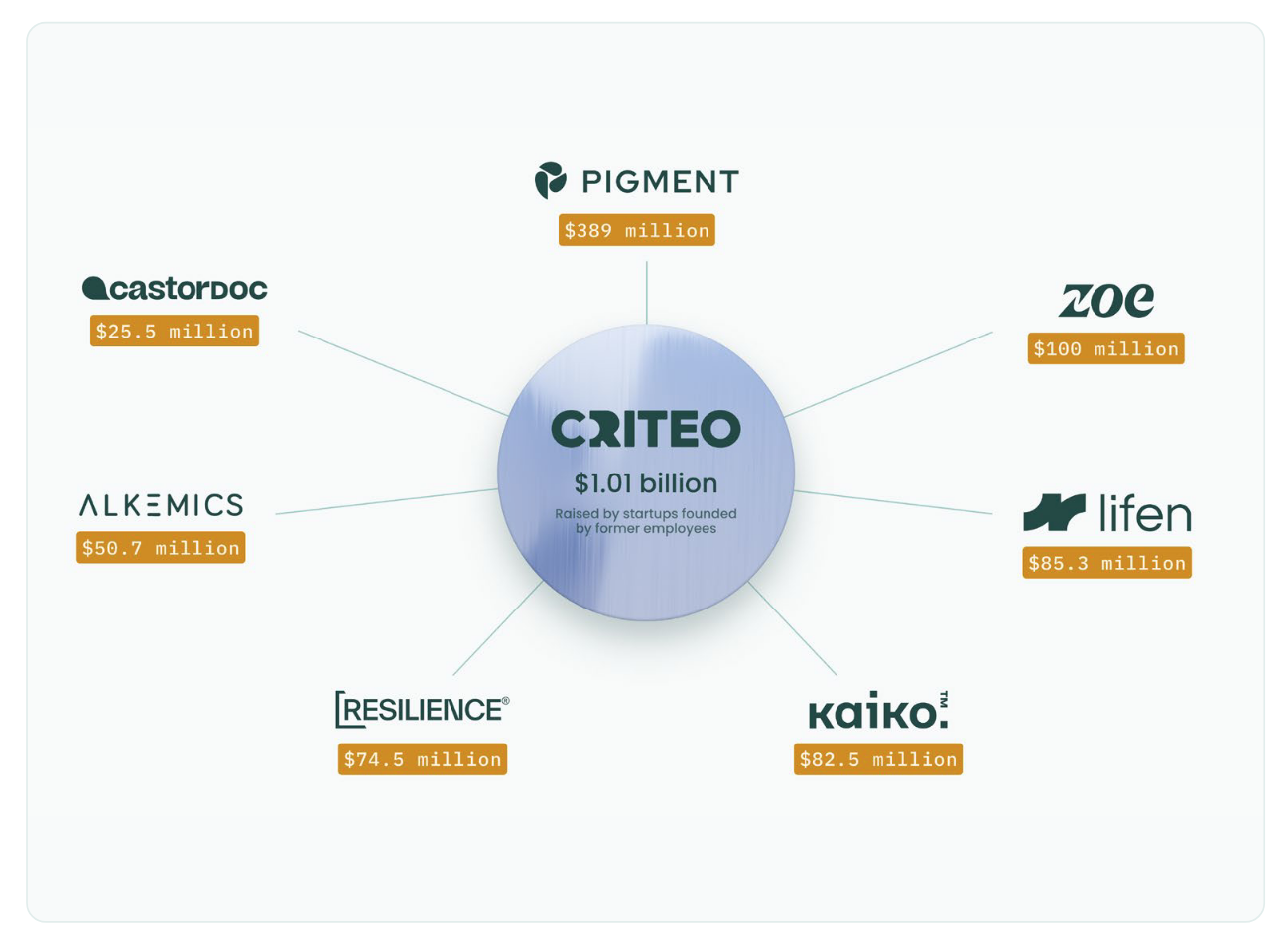

🏭 Accel and Dealroom are back with their Founder Factories 2025 report, and France ranks among the top countries in Europe for unicorn creation, with 39 venture-backed unicorns—behind only the UK, Germany, and Israel. These unicorns have had a significant “flywheel” effect, with 32 French unicorns fueling 270 new startups, primarily launched by their former employees. This places France in the top tier of “founder factory” nations. Paris is the clear epicenter of this activity: out of the 270 spinouts, 264 were founded in Paris, representing 98% of the total. Other cities like Montpellier, Orsay, and Toulouse contributed marginally. France’s founder factories are contributing to a thriving tech hub, with 69% of startups founded in the same city as their parent unicorns—showing strong local ecosystem effects, especially in Paris. Criteo stands as France's Top Dog when it comes to Founder Factories. | Accel x Dealroom

☎️ Iliad, the French telecom group that operates Free, surpassed €10 billion in revenue in 2024 and reached 50 million subscribers, placing it in the top 5 telecom operators in Europe. The company, led by CEO Thomas Reynaud, continues to grow across France, Italy, and Poland, adding 2 million subscribers and maintaining strong financial health, while aggressively pursuing both consumer and B2B markets, especially through AI and cloud infrastructure investments. Iliad is eyeing potential acquisitions, notably SFR in France and Telecom Italia, signaling ambitions to climb further in the European rankings, though Reynaud emphasizes a pragmatic approach to consolidation. The group sees AI not only as a tool for growth but also as a transformation lever, aiming to double its B2B revenue by 2028 while remaining cautious not to grow for growth’s sake. | Le Figaro

🎮 The French video game market experienced a significant downturn in 2024, with total sales declining by 5.8% to €5.67 billion. This drop was particularly evident in the console segment, where both hardware and software sales dropped by 19%. Factors contributing to this slump include a lack of major game releases and the market adjusting after the exceptional growth seen in 2023. Despite these challenges, industry professionals remain optimistic about a recovery in 2025. | Le Figaro

Deep Dive: MSInsight on Paving the Path towards Precision Oncology

When Angelina Jolie made her decision to undergo preventive surgery after learning she carried the BRCA1 gene mutation, it sparked a global conversation on the importance of genetic screening. A decade later, thanks to advances in bioinformatics, precision diagnostics are advancing, particularly in cancer care.

Enter MSInsight, a Paris-based startup focused on revolutionizing cancer diagnostics with its patented technology, MSIcare. This innovative screening tool detects Microsatellite Instability (MSI), a key biomarker that helps determine whether a tumor will respond to immunotherapy. Unlike traditional methods, which can miss MSI-positive cases, MSIcare achieves near-perfect accuracy, potentially transforming patient outcomes.

With €1.6 million in seed funding, MSInsight is setting its sights on market expansion and pushing the boundaries of cancer treatment, all while refining its approach through extensive data and real-time SaaS solutions.

As Dr. Arnaud Cutivet, MSInsight’s CEO, shares, “The potential of MSIcare is immense—it’s not just about diagnosing cancer, but helping predict treatment responses and improving outcomes for many patients.” Could this breakthrough technology hold the key to reshaping the future of oncology?

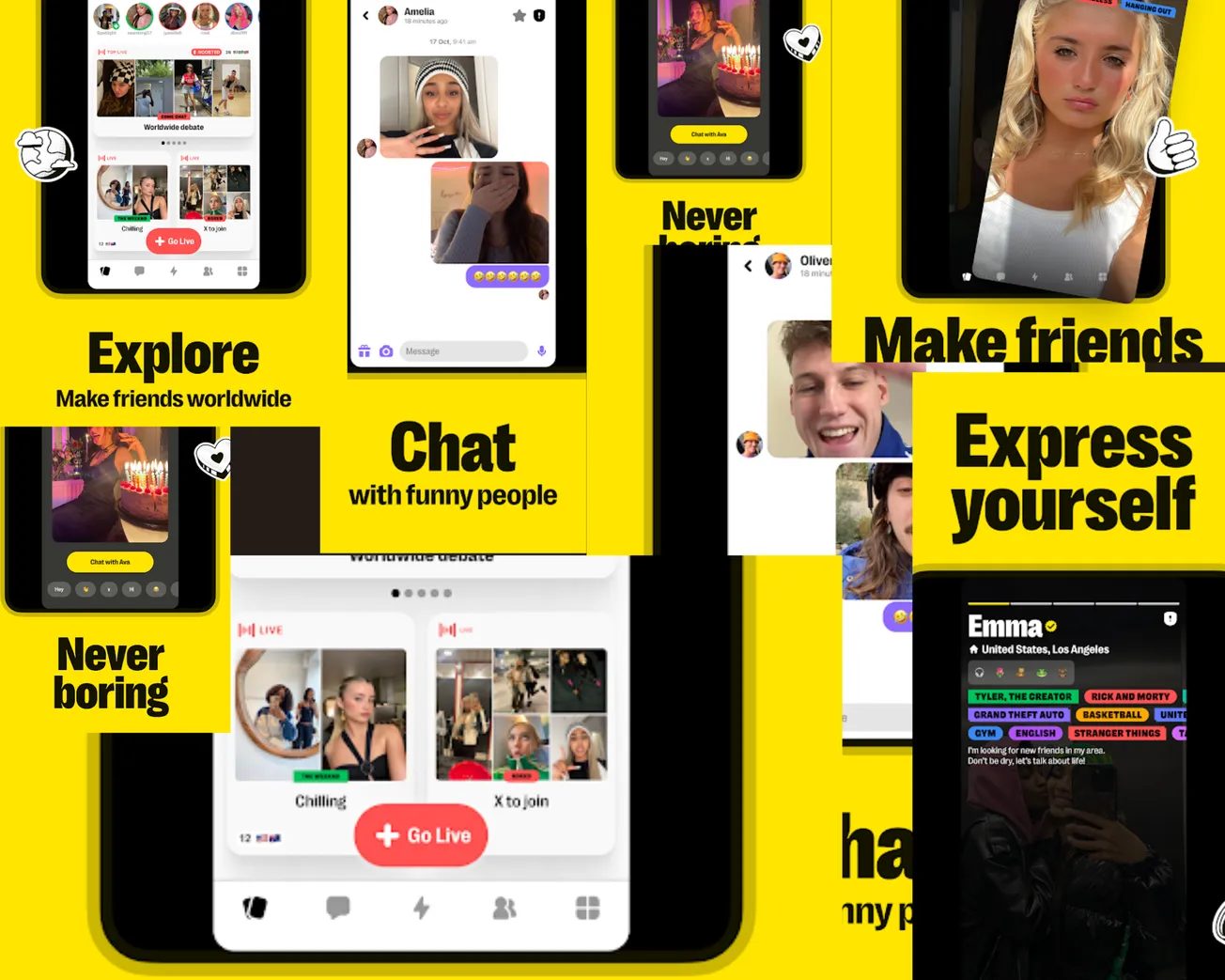

Deep Dive: How Yubo Achieved Profitability By Breaking Social Media's Ad Addiction

In a digital landscape dominated by social media giants fueled by advertising revenue, Yubo has charted a different course. The French startup announced in February 2025 that it had achieved profitability while recording over 80% annual growth, with annual revenue nearing €60 million.

Yubo CEO and co-founder Sacha Lazimi said getting the company in the black was the result of defining a different social media experience.

"We're a social discovery platform designed for Generation Z," said Lazimi. "The goal is to create authentic and meaningful new connections that are not based on followers or likes or comments. We chose a different business model than a classic social network, because our business model is not based on ads."

💸 Top Funding Deals 💸

📇 Company: GravitHy

🔍 Description: A Marseille-based company specializing in the production of low-carbon iron for the clean steel sector, aiming to decarbonize the steel industry through innovative processes.

💻 Website: https://gravithy.eu/

📍 HQ City: Marseille

🧗 Roun: Series A

💰 Amount Raised: €60 million

🏦 Investors: Japan Hydrogen Fund (advised by Advantage Partners); Marcegaglia; Ecolab (via Nalco Dutch Holding); Rio Tinto; Siemens; Engie New Ventures; InnEnergy

👨💼👩💼 Funders: José Noldin (CEO)

🗞️ News: EU Startups

📇 Company: RockFi

🔍 Description: French fintech redefining private wealth management by combining personalized service from independent private bankers with a proprietary digital platform offering comprehensive investment solutions and real-time asset reporting.

💻 Website: https://www.rockfi.fr

📍 HQ City: Paris, France

🧗 Round: Series A

💰 Amount Raised: €18 million

🏦 Investors: Partech (lead); Varsity; Arthur Waller and Félix Blossier (Pennylane); Mark Ransford (ex-Apax); BAs

👨💼👩💼 Founders: Pierre Marin, Marie Bedu, Maxime Durand; Stéphane Carles, Vincent Pagny

🗞️ News: Forbes

📇 Company: DeepIP

🔍 Description: A Franco-American AI startup revolutionizing the patent drafting process through an AI-powered platform designed to enhance, not replace, the work of intellectual property attorneys.

💻 Website: https://www.deepip.ai/

📍 HQ City: New York, USA & Paris, France

🧗 Round: Series A

💰 Amount Raised: $15 million

🏦 Investors: Resonance; Headline; Serena Capital; Balderton Capital

👨💼👩💼 Founders: François-Xavier Leduc; Edouard d'Archimbaud

🗞️ News: Business Insider

👋🏻 If you’re enjoying The French Tech Journal, support the project by forwarding it to friends and sharing it on your social networks. You can also comment on this post. And if you have ideas for stories, tips, or just want to harass us, shoot us an email: [email protected] / [email protected] 👋🏻